PERFORMANCE AND MARKET ENVIROMENT

Macroeconomic environment

Economy and the banking sector in 2015

| Key macroeconomic parameters | 2015 | Banking sector indicators | 2015 | |

| Real GDP growth rate (forecast) | 3.5% | Base interest rate | 1.5% | |

| Nominal GDP per capita (EUR) | 10,300* | Loan to Deposit ratio | 99.1% | |

| GDP per capita in PPS (EU-28=100) | 68%* | Non-performing loans ratio | 7.4% | |

| Average annual inflation rate | -0.7% | Total Capital Ratio (TCR) | 15.6%* | |

| Unemployment rate | 7.5% | Return on Assets (ROA) | 0,8% | |

| Population | 38 M | Return on Equity (ROE) | 6,8% |

Source: Eurostat, Polish Financial Supervision Authority

* Data as at December 31, 2015, or latest available

Summary of 2015

2015 was a year of changes. For the first time in 10 years, interest rates in the US were raised. At the same time, 2015 turned out well for the economy; however, in search of positive aspects one should go way beyond bald statistics of the national accounts because the GDP growth (according to estimates) was only slightly higher than the 2014 figure: 3.6% year on year compared with 3.3% in 2014. The change in growth composition and positive developments on the labour market are particularly worth highlighting.

In 2015, the growth was driven by consumption (3.2% compared with 2.6%) rather than investments (6.6% compared with 9.8% in 2014); consumption was based mainly on domestic resources, which reduced growth in import, while growth in export came only slightly below the 2014 figure, which improved the GDP growth statistics owing to a positive contribution to net export growth (2015 was a record-breaking year in terms for the combined trade surplus in goods and services).

Higher growth in consumption was a direct consequence of changes on the labour market: higher growth in salaries (in real terms: 4.6% compared with 3.2% in 2014) and continued decrease in unemployment rate, which slid below 10% in 2015, coupled with a major rise in the number of available job vacancies on the labour market: by the end of 2015 the number of job vacancies per one unemployed reached a historic high. Additionally, low level of activity was also overcome in the employment statistics. Q4, which saw the number of new jobs created in the corporate sector reach 32 thousand, was the best quarter since 2007.

Although the national accounts and the processes observed on the labour market painted a positive picture of the Polish economy, high frequency data (production, sales, construction) turned out to be a source of many negative surprises, especially in the first half of the year, which were seen as signs of an economic downturn. Amid an upward pressure on the Polish zloty observed in Q1 and deflation growing quickly, the Monetary Policy Council (MPC) decided to cut interest rates in March by 50 basis points in one move, bringing the reference rate down to 1.50%. Until the end of the year interest rates remained stable, while the RPP’s rhetoric drifted towards a stabilisation of monetary policy parameters.

After hitting the lowest level in April (3.9650), the Polish zloty continued its depreciation trend until the year’s end amid expectations of a more relaxed monetary policy in the Eurozone, to reach 4.2580 against the Euro at the end of 2015. The depreciation was caused by global factors (weaker sentiment towards emerging markets related to high FX debt burden at a number of developing countries and upcoming increase in interest rates in the United States and weakening global growth) as well as local and political factors connected not only with the uncertainty about a possible change in power (presidential and parliamentary elections) and the economic programme of the new government (banking tax, a rather unfavourable stance on Open-end Pension Funds), but also the previous proposals of converting CHF denominated mortgage loans formulated across the political spectrum during the election campaign.

The yields on 10-year T-bonds hit their lowest level on January 29 (1.939) only to lose value by June, reaching 3.40% (maximum reported on June 16). Although a part of the decline was compensated for over the following months (2.94% at the end of 2015), the performance of the debt instruments with long maturities became more variable and prone to global factors and sell-offs (these factors include a rise in the Fed’s interest rates, fears surrounding China); Polish bonds displayed greater correlation with emerging market countries, whose economies are structured differently than the Polish economy (Russia, Republic of South Africa, Turkey), which could be a sign that foreign investors place Polish debt in one basket with that of emerging market countries. At the same time, 5-year bonds performed similarly. The difference was particularly visible in the case of 2-year bonds whose yields, supported by the expected easing of the monetary policy, continued their downward trend. Apart from Fed’s interest rates hike and the negative surprise from the European Central Bank, the sell-off in December, just like in the case of 5-year bonds, was also caused by the plans (ultimately not realised) to impose tax on T-bonds being a component of banks’ assets, which previously were fairly popular among banks as a security for credit portfolios and a liquidity management tool.

What will 2016 be like for the Polish economy?

In 2016, the GDP growth rate is expected to stabilise around ca. 3.5%. The structure of growth will still be based on consumption and export, while investments will recede into the background; however in the case of investments 2016 is expected to be a transition period.

Poland, being a country with high value added in export (which means that a major part of export is generated in Poland) takes full advantage of the weakening foreign exchange rate. Supported by strong labour market (which is close to becoming an employee’s market, continuation of processes started in 2015) and the expected launch of the government’s 500+ programme, consumption may grow by nearly 4% annually.

In 2016, public investments will be curbed (in fact, only road construction expenditures will be rising; traditionally, the period between EU perspectives entails railways’ problems with using funds, suspension of investment plans in the energy industry and restrictions at the local government level). The beginning of the year will also be unfavourable to private investments due to political uncertainty (as shown by a study of the National Bank of Poland). However, if the economy remains on an upward trajectory, it will help to resume private investment programmes in the face of extensive use of production capacity.

Poland will face the deflation until autumn when a considerable rise in prices is expected (helped by: statistical base effect, slow growth in prices of food and raw materials, pressure on prices of services connected with pay rises, tax on supermarkets). Since RPP takes an opportunistic view on interest rate cuts, there is little chance of any reductions at the beginning of the year, which means that a decrease in the exchange rate volatility should rather be expected.

Złoty and Polish bonds

Polish assets have started to show more features typical of emerging markets. Over the next few months it will remain unknown whether we will be facing an escalation of internal risks or rather a normalisation; however, the economic parameters such as current account surplus, GDP growth, low USD debt, and inflow of EU funds suggest that the złoty is presently undervalued. In addition, the złoty should benefit from a more expansive policy of the main central banks. However, the room for appreciation of the zloty is smaller than the fundamental models would suggest. In Q1, the deflationary pressure will continue.

Compared with the previous years, there are fewer arguments in favour of a convergence between Polish long-term interest rates and European rates. The pursued strategy of lowering dependence on foreign investors (which involves greater use of domestic capital, including banks’ capital, to finance the budget deficit) is expected to reduce the steepness of the yield curve (up to 5 years) in the coming months. Consequently, in the next few months the yields on Polish bonds may even go down. In the following months, the trend on the base markets may become less favourable for bonds. At this point, we would like to point out the historically strong correlation between bond yields and inflation. The latter will pick up in H2 2016.

Banking sector and monetary aggregates

As a result of increasing interest rates (loan margins had been rising even before the introduction of the banking tax), stricter requirements concerning the LtV ratio and relatively low attractiveness of mortgage loans caused by additional burdens imposed on banks, the growth in mortgage loans will slow down. This will be offset by faster growth in consumer loans (driven, among others, by the positive impact of the government’s 500+ programme on creditworthiness) as well as the dynamic growth in corporate loans where the banking tax should initiate limited restructuring and consolidation.

Although a significant decline in interest on deposits may be expected (another effect of the banking tax and the restructuring of balance sheet size), it should not have a major impact on the growth in household deposits. At present, investment alternatives are unattractive, while higher nominal income (driven by both higher salaries and social benefits) translate into more deposits in the banking sector.

Changes in recommendations of the Polish Financial Supervision Authority (KNF), legal acts concerning banks in Poland

Changes in recommendations of the Polish Financial Supervision Authority (KNF) and legal acts concerning banks in Poland are presented in the table below:

| A legal act / Recommendation | Date of entry into force and a summary of new challenges | Influence on the main areas of the Bank | ||

| YES – the regulation has an impact on a given area NO – the regulation has no impact on a given area, or has a limited impact on a given area |

||||

| Basel III (CRD IV/CRR regulatory package) | 2015 | |||

| 01.01.2014 ->2019 | Defines requirements concerning, among others, capital base, liquidity, leverage ratio, corporate governance and remuneration policy. Transposition of provisions into Polish legislation has been carried out mainly by Act on macroprudential supervision, amending the Banking Law, but accompanying standards and documents are systematically being issued. |

|

YES | |

|

NO | |||

|

YES | |||

|

YES | |||

| Banking Recovery and Resolution Directive (BRRD) | 01.01.2015 |

The directive introduces framework for managing recovery and resolution of banks. It imposes the need to prepare respective plans (recovery – by banks, resolution – by resolution authority, in Poland – BFG) and establishes a resolution fund to provide for assistance in managing bank’s failure. It also constitutes minimum requirement for own funds and eligible liabilities allowing for effective bail-in of sufficient amount of liabilities and avoiding contagion or a bank run (MREL, binding since beginning of 2016, but delay in implementation on both European and domestic level is observed). |

|

YES |

|

NO | |||

|

YES | |||

|

NO | |||

| Act on Foreign Account Compliance Act (FATCA) agreement | 01.12.2015 |

The adopted Act constitutes a legal framework for implementing FATCA provisions, obliging Polish banks to identify, collect, process and transmit information about US citizens and residents’ accounts to America’s Tax Office. An automatic information exchange will be performed on the basis of reciprocity. |

|

NO |

|

YES | |||

|

NO | |||

|

YES | |||

| Act on macroprudential supervision over the financial system and crisis management | Q4 2015/01.01.2016 |

The Act introduces additional capital buffers described in CRD IV to Polish legal framework. It implements also provisions concerning corporate governance, disclosure framework and crisis management principles, establishing the BFG as a resolution authority in Poland equipped with the resolution tools (BRRD partial implementation). The Act influences dividend policy of the banks by setting maximum distributable amount of dividend depending on the joint buffer requirement fulfilment. |

|

YES |

|

NO | |||

|

NO | |||

|

NO | |||

| Recommendation P | 31.12.2015 |

Recommendation P issued by KNF aims at updating the standards of liquidity risk management in line with market practice (and EBA guidelines). It provides for defining the acceptable liquidity risk, liquidity measurement and management, especially versus other types of risk, intraday liquidity measurement, stress-testing and disclosures. Additionally, it contains requirements towards liquidity cost allocation within a fund transfer pricing system. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Banking Law and other Acts | 27.11.2015 |

An amendment to banking law and other acts concerns mainly liquidation of banking enforcement title, which served debt collection process, and regulating procedure of managing accounts of deceased and their takeover by the heirs. |

|

NO |

|

NO | |||

|

NO | |||

|

YES | |||

| Recommendation on Internet payments security | December 2015 |

KNF Recommendation aims at setting uniform minimum requirements concerning security of payment transactions performed via Internet. Its provisions address i.e. process management, control and risk assessment as well as education of customers with this respect. |

|

NO |

|

YES | |||

|

NO | |||

|

YES | |||

| Act on payment services |

01.02.2015/17.11.2015 |

Amendment to the Act introduces the cap on maximum level of interchange fee of 0.2% for debit cards and 0.3% for credit cards, beginning from February 1, 2015. In Q4 2015, change concerning transitional period until December 8, 2018 for the small (max 3% market share), eligible payment services was made in order to promote development of Polish payment services companies. |

|

NO |

|

YES | |||

|

YES | |||

|

YES | |||

| European Market Infrastructure Regulation (EMIR) |

2016 | |||

| nagation of some nrovisions/ | Addresses financial markets functioning, in particular risk mitigator. It requires transactions to be cleared centrally through Central Counterparty and sets margining requirements. |

|

NO | |

|

YES | |||

|

NO | |||

|

YES | |||

| Act on Bank Guarantee Fund, the deposit guarantee scheme and resolution |

2016 |

An amendment to an Act is going to implement the EU Directives: on Deposit Guarantee Scheme (DGS) and the BRRD (in respect to recovery plans, MREL, BRR fund). Main differences compared to these documents concern increased target levels for DGS fund (2.8% instead of 0.8%) and Resolution fund (1.4% instead of 1.0%). Collection period for the target volume of funds is set at 2024. Banks’ contributions are going to depend on their market share in the respective calculation and the risk profile of an institution. Under the currently binding regime, the annual contribution rate for 2015 (to be paid in 2016) was set at the level of 0.167% of total risk exposure amount (TREA) (0.189% in 2014) and prudential fee rate at 0.079% of TREA (0.05% in 2014). |

|

NO |

|

NO | |||

|

YES | |||

|

YES | |||

| Act on assistance to borrowers in difficult financial situation |

19.02.2016 |

The Act aims at providing financial support to indebted individuals, fulfilling certain requirements who ran into financial difficulties and are not able to repay mortgage on their own. Financial help will be provided from the ‘assistance fund’, financed by the banks (initial value of PLN 600 million) proportionally to volumes of their portfolios of mortgage loans to households, for which the delay in repayment exceeds 90 days. |

|

NO |

|

NO | |||

|

YES | |||

|

NO | |||

| Recommendation W | 30.06.2016 |

Recommendation W, on model risk management was issued by the KNF in July, 2015. It aims at setting the standards of the model risk management process as well as framework for building models and assessing their quality with the aim to ensure appropriate corporate governance. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Recommendation Z | 01.11.2016 |

The draft of Recommendation Z on corporate Governance was submitted to public consultation by the KNF on December 23, 2015. It covers the elements of corporate governance resulting from other regulations, such as Banking Law (implementing majority of CRD IV provisions of corporate governance in banks) in a detailed way, also based on the KNF’s observations and BION assessment results. The recommendation is expected to become binding from November 1, 2016. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Act on tax on financial institutions |

01.02.2016 |

The Act imposes monthly tax of 0.0366% (0.44% annually) from selected financial institutions, including banks. Tax will be calculated based on the assets volume subject to several deductions, including own funds and treasury bonds. |

|

NO |

|

NO | |||

|

YES | |||

|

YES | |||

| MIFID II i MIFIR | 2018 | |||

| 2018 |

The set of ESMA technical standards on transparency requirements for trading venues and investment firms and on the obligation for investment firms to execute transactions in certain shares on a trading venue or a systematic internaliser has been published in 2015. The implementation date is set for January 1, 2018. |

|

NO | |

|

YES | |||

|

NO | |||

|

NO | |||

Impact of the appreciation of the Swiss franc on the position of borrowers, the banking sector, and mBank

The Polish Banks Association’s proposal

Several days after the Swiss franc’s abrupt surge in mid-January 2015 the Polish Banks Association (ZBP) proposed solutions to help CHF borrowers repay inflated credit instalments.

The package of solutions included:

- Taking into account the negative CHF LIBOR

- Narrowing the currency spread for 6 months

- Extending the repayment period at the client’s request

- Not requesting new collateral or loan insurance from the borrowers who repay their instalments on time

- Converting the loans using the fixing rate of the National Bank of Poland (NBP)

- Introducing more flexible rules for restructuring mortgage loans applicable to clients.

In May 2015, the ZBP followed up with new measures. Banks declared financial and organisational involvement in the introduction of additional support for clients who took out housing loans, especially loans in foreign currencies. These measures include:

- Extending the applicability period of the first ZBP package by the end of 2015 with an option to extend the applicability of certain solutions even further

- Setting up internal stabilization funds dedicated solely to CHF borrowers

- Allocating PLN 125 million from banks’ own resources to the Mortgage Loans Restructuring Support Fund whose creation by way of an act is requested by the banks declaring financial support

- Making it possible for the borrowers who took out mortgage loans in foreign currencies to meet their own housing needs to transfer mortgage collateral in order to facilitate the sale or exchange of flats.

The subsidies from internal stabilization funds would be granted if the exchange rate of the Swiss franc exceeded a pre-defined threshold. This solution would be available to the borrowers who are ready to undertake to convert their loans at a specified exchange rate and meet the specific income criteria. The support would be addressed to the borrowers whose income at the time of requesting for an amending annex is below the average monthly income in the national economy and whose flat or house is not bigger than 75 or 100 square metres respectively. Another condition is regular repayment. In accordance with the declaration signed by banks, the subsidies would be granted when the CHF exchange rate exceeded PLN 5, yet the amount of the subsidy cannot be higher than PLN 0.33 per 1 CHF. According to ZBP’s estimations, in 10 years the amount of subsidies paid by banks from the stabilization funds would reach approx. PLN 3.5 billion. Certain aspects of the ZBP proposals were later incorporated into the Presidential Bill on the Borrowers Support Fund.

The Mortgage Loan Restructuring Support Fund aims at helping mortgage borrowers regardless of the loan currency who found themselves in financial straits due to an adverse event such as unemployment or illness. The support would account for up to 100% of the principal and interest instalment over 12 months, but no more than PLN 1,500 monthly. Except for special cases, the support would be reimbursable. (for more information see table 4.2)

Presidential proposal on restructuring of FX loans

On January 15, 2016 the President’s Office published his proposal for FX mortgage loans bill proposing the conversion of Swiss franc denominated mortgage loans held by individuals (other than entrepreneurs using loan’s interest as a tax shield) into PLN and ways of compensating borrowers for excessive FX spreads. The proposal includes three mechanisms of loan restructuring. The first two solutions are based on conversion of FX mortgage loan at “fair” rate of exchange, which is calculated by comparison of FX rate at origination, corrected by the accumulated difference in servicing costs of FX mortgage loan in comparison to a similar PLN denominated mortgage loan. Loan restructuring solutions are as follows:

- Voluntary conversion, based on terms agreed between a client and a bank. The loan is converted into PLN and switched to WIBOR.

- Forced conversion of FX mortgage loan at “fair rate”. A loan will stay on bank’s balance sheet in FX, it will be repaid at fixed fair rate of exchange (calculated individually for each loan by a bank, according to the formula described in the bill) and monthly instalments will be based on LIBOR. “Fair” rate exchange cannot be lower than historical rate at which borrower has drawn the obligation, and higher than current exchange rate. The conversion to PLN will be gradual, until the maturity of the loan, but always at the “fair” FX rate. The intention of the President’s Office is to spread the losses of conversion over time, rather than incurring them at once. mBank’s Management Board agrees with the views of various professionals working in the Accounting and Audit industry, namely that under the applicable International Financial Reporting Standards rules the impact caused by this solution would have to be recognized up front.

- Transfer of the property to the bank, and release of the debtor from the debt only if “voluntary” or “forced” conversion would not have taken place. The borrower, in order to be eligible to transfer the mortgaged property, must meet the following criteria: the amount of loan must be higher than 130% of the loan amount at origination, and monthly instalment needs to exceed 20% of customer’s monthly income. It cannot be applied to individuals:

a. who over the last 12 months had an average income denominated in the currency of the FX loan in the amount sufficient to pay monthly instalments

b. whose 12-month average monthly instalment is lower than 20% of 12-month average income.

Moreover, banks will be obliged to return FX spreads charged on the clients in the past and pay interest for delayed payment on FX spreads by deducting the amount from the value of outstanding debt. The bill also allows partial deduction of losses connected to the restructuring from the banking tax up to 20% of the monthly tax amount. The unused part of the deduction is cumulated for the future reduction in the banking tax.

If a proposal concerning Swiss francs loan conversion is adopted, it might require banks to reflect large write-offs in the financial statements. The costs of conversion are being calculated by Polish Financial Supervision Authority (KNF) before presenting the bill in the Parliament.

mBank Group and the Polish banking sector performance in 2015

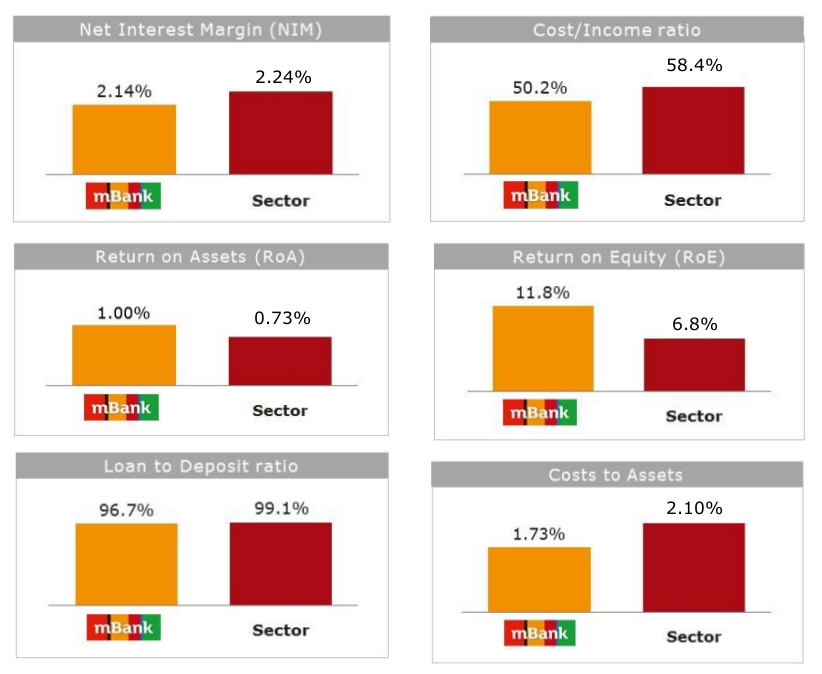

mBank’s performance relative to the overall banking sector in 2015 was very strong, as presented in the comparisons of key efficiency and profitability ratios in the following graphs:

Source: Own calculations, based on statistics published by the Polish Financial Supervision Authority (data as of December 31, 2015)

Demographic profile of mBank Group clients

mBank stands out with its favourable demographic profile of clients. As a Bank actively using new technologies, mBank has always had a special appeal for younger people, who have been surrounded by technological innovations from a relatively early age. The charts below present the demographic structure of mBank’s clients and the Polish society in 2014:

The majority of mBank’s clients represent the working age population aged 25-44 (62%), while in Poland this age group accounts for 31%. The second largest group of mBank's clients are people aged 19-24, who at the same time are the least numerous age group in Poland (7%).

Among mBank’s clients there are also children and young people aged below 19, as well as middle-aged people and seniors, i.e. people aged 55+, yet these groups are relatively small (2% and 12% respectively), especially in view of the demographic situation. This is due to the fact that, despite rising popularity of accounts dedicated to young clients, many parents are still reluctant to open accounts for their children.

In turn, clients aged 55+ typically take a conservative approach to finances and technological innovations, which prevents those who do not have an account from opening one or those who already have a relationship with one bank from switching to a different bank, even if another financial institution offers more attractive products and services.

According to demographic forecasts, the Polish society is aging. Therefore, it is particularly important for mBank to enhance interest in its offer among young people and working age population, who in several dozen years, being seniors, will be the largest demographic group in Poland’s demographic structure. It is worthy to note that by 2050 people over the age of 60 will be a completely different, new generation of seniors for whom the Internet and modern technologies hold no mystery.

Housing market

The situation on the property market in Poland in 2015 was driven, similarly to 2014, by a slow but steady economic growth, as well as the relatively low interest rates maintained by the Monetary Policy Council (MPC). Consequently, banks relaxed their credit policies, as mirrored by the mortgage loan offer becoming more attractive.

The Polish mortgage lending market saw no revolution in 2015 despite the regulatory changes introduced a year earlier. Although the Recommendation S of the Polish Financial Supervision Authority (KNF) changed the rules applicable to lending in Poland, no major change on the property market or, consequently, the mortgage lending market, has been observed since the Recommendation was issued.

In 2015, MPC stabilised interest rates at a record low level. The reference rate was set at 1.5%, while WIBOR 3M stood at 1.65% in March 2015 and then remained at a stable level of 1.73-1.74% until the end of the year. As a result, new loans (including mortgage loans) offered very low costs to borrowers; due to low interest rates and a more attractive credit offer, their creditworthiness was stronger.

The introduction of reverse mortgage in December 2014 did not affect the property market in 2015. Reverse mortgage is a loan for persons who have a legal title to a property, secured by a mortgage on the property. However, no bank in Poland has launched reverse mortgage products to date.

Situation on the private property market (in six major Polish cities)

The situation on the private property market was stable throughout 2015. Transaction prices of apartments on the primary and secondary market in the largest Polish cities changed only slightly. In the analysed cities, the transaction price per square meter on the primary market changed by approx. 2.2% year on year, while the prices on the secondary market remained stable.

From January to September 2015 banks signed 132.6 thousand credit agreements worth PLN 28.7 billion in total, compared with about 131.1 thousand loans worth PLN 27.6 billion granted in the same period of 2014. Therefore, new lending in the entire 2015 is likely to be a little higher than in 2014.

Housing demand was boosted by low interest rates, cash purchases of apartments, improvement on the labour market, rising households’ income, higher limits and changes in the government’s programme Mieszkanie dla Młodych (Apartments for the Young). The biggest change in the programme was the inclusion of transactions on the secondary market. Moreover, the programme became more family-friendly with subsidised own contributions and an option for any person to accede to the credit agreement together with the borrower. Consequently, about 43% of applications were related to second-hand apartments and about 57% with primary market apartments. Additionally, in view of a risk that the funds allotted to the programme in 2016-2018 will turn out insufficient, many people may be encouraged to hasten their decision to buy an apartment.

The housing construction market indices in 2015 reflect heightened activity of investors. According to preliminary data released by the Central Statistical Office (GUS), the number of completed apartments rose by about 3.2% year on year, the number of apartments whose construction has begun grew by about 13.7%, while the number of apartments with building permits issued went up by about 20.5% year on year. Over the 12 months ended in November 2015, developers started the construction of more than 83.7 thousand apartments, thus establishing a new record for the number of agreements (which breaks the previous record set in June 2008 - 82.3 thousand agreements).

2015 was a successful year for real property developers. The total number of transactions on the six analysed markets reached a record level of nearly 13.2 thousand apartments in Q3 2015. Over the last four quarters, almost 48.6 thousand apartments were sold on the primary market, which represents an increase by nearly 13% compared with the record-breaking 2014 when the figure stood at 43 thousand. In Q3 2015, nearly 15.9 thousand apartments were offered for sale (up by about 20% quarter on quarter). Until then, the only quarter that had seen a higher number of apartments put up for sale was Q4 2007, which was the peak of the housing market boom.

The chart below presents situation on the private property market in Poland:

In total, over the last four quarters there were about 50.8 thousand apartments offered for sale. Despite strong sales, the number of apartments offered on the primary market rose by about 3 thousand to reach 51.4 thousand at the end of Q3 2015. The biggest rise was reported in Warsaw (approx. 11% quarter on quarter), Wrocław (approx. 9% quarter on quarter) and Kraków (approx. 6% quarter on quarter). In Poznań and Łódź the number of apartments on offer remained unchanged, while in Tricity (Trójmiasto) it fell by about 5% quarter on quarter.

High sales materially affected the structure of offer on the primary housing market, especially as far as the sale of ready-for-sale apartments is concerned. At the end of Q3 2015, apartments completed in 2014 and before accounted for merely about 10% of all apartments offered by real property developers, apartments scheduled for completion in 2015 accounted for about 17%, while those scheduled for completion in 2016 and later accounted for 44% and 29% respectively.

In the majority of analysed cities, the time needed to sell all apartments on offer at the current rate of sales was stable and ranged from 4 to 5 quarters. Tricity, where demand clearly outweighs supply and the average selling time is 3.2 quarter, was an exception. Therefore, the above data show that the supply of apartments is at a safe level, assuming that the current rate of sales is maintained.

Over the next few quarters the upward trend in prices may be mildly reinforced. On the other hand, a rise in demand is driven by low interest rates, alternative sources of funding the purchase of apartments, improvement on the labour market, rising households’ income, and changes in the programme Mieszkanie dla Młodych. The main threat looming over the property market (and causing a shift in price trends) is the uncertainty about the regulatory environment (prospective regulations resulting in higher costs of banks’ operation) and the external environment. In the long-term perspective, demographic developments are the fundamental factor affecting housing demand. The decline in population and ageing of the society forecast by the Central Statistical Office (GUS) will contribute to a slowdown in demand for apartments.

Situation on the commercial property market

The volume of investment transactions on the Polish property market exceeded EUR 4 billion in 2015. It was the second best year in the history of the Polish property market (EUR 4.7 billion in 2006). The record-breaking result was helped mainly by two major transactions involving the purchase of shares in Echo Investment SA by Oaktree and PIMCO funds, and the partial takeover of Trigranit special purpose vehicles by TPG Real Estate. The markets saw a decline in capitalisation rates for the best assets. The rates for “prime” properties on the office space market stood at 6.0-6.5%, approximately 6% on the commercial property market, and approximately 7% on the warehouse space market.

The volume of transactions on the commercial properties market increased by about 285% compared with 2014, reaching a record high level of EUR 2.2 billion. Investment transactions accounted for 55% of the total volume, which represents a rise by 37 percentage points year on year. Such a surge in transaction volume was driven predominantly by heightened investors’ activity in Q4 2015.

The trend towards changing of the business model, re-commercialising, and upgrading older commercial properties so that they meet present market standards continues. The extension of gastronomic areas is a special trend connected with adjusting older commercial properties to the latest solutions. Such an upgrade results, among others, from changing life styles and growing purchasing power of the society. Moreover, bigger space earmarked for gastronomic services may encourage international brands which so far have not been present on the Polish market to expand into Poland.

In the past months there has been no considerable change in rents for commercial space. Warsaw, where the monthly “prime” rents for the best premises of up to 100 square metres in the most prestigious shopping malls exceed EUR 100 per square metre, still remains the most expensive location.

The vacancy rate in commercial properties located in the largest Polish cities is still relatively low (from 1.5% to 4.5%).

The volume of transactions on the office space market in seven major cities in Poland (with an approx. 32% share in the total value of transactions) fell by about 27% year on year. As before, Warsaw remains the largest office space market in Poland. High supply of new space under construction and pressure on rents contributed to suspending new investments in the capital city and shifting investors’ interest to regional cities. Transactions on regional markets accounted for more than half of previous year’s volume in the office space sector.

The asking price for space to lease remained stable. Developers are still highly flexible as far as negotiations of lease terms other than rent are concerned, such as participation in refurbishment costs or rent-free periods.

High level of new space under construction (approx. 1.2 million square metres in the main cities of Poland) may trigger a growth in vacancy rate in 2016. In particular, older office buildings (B-class) and ones with less convenient location are threatened by higher vacancy rate.

Investment activity on the warehouse space market in seven major regions in 2015 was slightly below the level reported in the record-breaking 2014 and reached EUR 470 million in volume. Investors are still deeply interested in the warehouse space market, while the fall in volume was caused by the absence of projects for sale matching their expectations.

The activity of developers on the warehouse space market is still high. The share of speculative projects in new projects, currently at 42.3% of supply in construction, is on the rise.

Despite record low vacancy rate (approx. 6%), effective rates in new warehouse projects in the area of Poznań, Warszawa, and Upper Silesia follow a downward trend. In addition, the gap between offered and effective rents is widening. The highest rates are still charged in the urban area of Warsaw and the lowest ones in central Poland and on the outskirts of Warsaw.

In 2016, the volume of transactions is expected to be similar to that reported in 2015. At the same time, a modest rise in the share of the office space sector in the total volume of transactions should be expected, mainly due to big transactions expected in Warsaw and on regional markets.

Financial position of mBank Group in 2015

Profit and loss account of mBank Group

mBank Group reported a profit before tax of PLN 1,617.9 million in 2015, compared with PLN 1,652.7 million in 2014 (-PLN 34.8 million, i.e. -2.1%). The net profit attributable to the shareholders of mBank reached PLN 1,301.2 million, compared with PLN 1,286.7 million in 2014 (+ PLN 14.5 million, i.e. +1.1%).

Summary of financial results of mBank Group

| PLN M | 2014 | 2015 | Change in PLN M | Change in % |

| Total income | 3,939.2 | 4,093.3 | 154.1 | 3.9% |

| Net impairment losses on loans and advances |

-515.9 | -421.2 | 94.7 | -18.4% |

| Overhead costs and amortization | -1,770.6 | -2,054.2 | -283.6 | 16.0% |

| Profit before income tax | 1,652.7 | 1,617.9 | -34.8 | -2.1% |

| Net profit attributable to: | 1,286.7 | 1,301.2 | 14.5 | 1.1% |

| ROA net | 1.1% | 1.0% | ||

| ROE gross | 16.9% | 14.7% | ||

| ROE net | 13.1% | 11.8% | ||

| Cost / Income ratio | 44.9% | 50.2% | ||

| Net interest margin | 2.3% | 2.1% | ||

| Common Equity Tier 1 ratio | 12.2% | 14.3% | ||

| Total capital ratio | 14.7% | 17.3% |

The main drivers of the financial results of mBank Group in 2015 included:

- Increase in total income which stood at PLN 4,093.3 million. The increase was recorded in net interest income, gains less losses from investment securities, investments in subsidiaries and associates. In 2015, mBank Group reported gains on the sale of BRE Ubezpieczenia TUiR and signing of agreements accompanying the sale with AXA Group companies and on the sale of 4,731,170 PZU shares.

- Increase in operating expenses (including amortisation) to PLN 2,054.2 million compared with 2014. In 2015, mBank Group reported one-off costs related to payments of guaranteed funds to the deposit holders of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin and contribution to the Borrowers Support Fund.

- Decrease in efficiency as measured by the cost/income ratio which stood at 50.2% at the end of 2015 compared with 44.9% at the end of 2014. Excluding the one-off costs and the gains on the sale of shares of BRE Ubezpieczenia TUiR and PZU the cost/income ratio stood at 49.3% in 2015.

- Lower costs of risk at 54 bps, compared with 72 bps in 2014.

- Continued organic growth and business expansion as demonstrated by:

- Increase in the individual client base in Poland, the Czech Republic and Slovakia, and clients of Orange Finance, to 4,947 thousand (+396 thousand clients compared with the end of 2014). Due to the migration of former Multibank and Private Banking clients to mBank transactional platform in Q4 2015 and differences in methods of identifying each customer before and after the migration, the number of clients dropped thereafter with preserved high-growth dynamics.

- Increase in the number of corporate clients to 19,562 clients (+1,775 clients compared with the end of 2014).

Gross loans and advances increased by 5.2% year on year while customer deposits increased by 12.0%. Consequently, the loan to deposit ratio decreased from 103.0% at the end of 2014 to 96.7%.

The changes in the Group’s results translated into the following profitability ratios:

- Gross ROE of 14.7% (16.9% at the end of 2014).

- Net ROE of 11.8% (13.1% at the end of 2014).

mBank Group’s capital ratios remained high. Total Capital Ratio stood at 17.3% at the end of December 2015, compared with 14.7% in 2014. Common Equity Tier 1 capital ratio reached 14.3%, compared with 12.2% at the end of 2014.

Income of mBank Group

Total income generated by mBank Group was PLN 4,093.3 million in 2015, compared with PLN 3,939.2 million in 2014, representing an increase by PLN 154.1 million, i.e. 3.9%. The increase was mainly driven by improved net interest income, gains less losses from investment securities and investments in subsidiaries and associates.

| PLN M | 2014 | 2015 | Change in PLN M | Change in % |

| Interest income | 3,956.3 | 3,660.5 | -295.8 | -7.5% |

| Interest expense | -1,.465.6 | -1,149.1 | 316.5 | -21.6% |

| Net interest income | 2,490.7 | 2,511.4 | 20.7 | 0.8% |

| Fee and commission income | 1,399.6 | 1,434.0 | 34.4 | 2.5% |

| Fee and commission expense | -497.9 | -536.8 | -38.9 | 7.8% |

| Net fee and commission income | 901.7 | 897.2 | -4.5 | -0.5% |

| Dividend income | 20.0 | 17.5 | -2.5 | -12.5% |

| Net trading income | 369.2 | 292.9 | -76.3 | -20.7% |

| Gains less losses from investment securities. investments in subsidiaries and associates | 51.9 | 314.4 | 262.5 | 505.8% |

| The share in profits (losses) of investments in joint ventures | 0.0 | -0.1 | -0.1 | - |

| Other operating income | 346.9 | 245.9 | -101.0 | -29.1% |

| Other operating expenses | -241.2 | -185.9 | 55.3 | -22.9% |

| Total income | 3,939.2 | 4,093.3 | 154.1 | 3.9% |

Similar to 2014, net interest income remained mBank Group’s largest revenue source in 2015. It stood at PLN 2,511.4 million, compared with PLN 2,490.7 million in 2014 (+0.8%). Stable net interest income resulted mainly from a decrease in interest expense and a drop in interest income triggered by low interest rates maintained by the Monetary Policy Council.

Net interest margin, calculated as a relation between net interest income and average interest-earning assets, stood at 2.1% compared with 2.3% in 2014.

The average interest rate of mBank’s deposits and loans is presented in the table below:

| Average interest rate at mBank | ||||||||||

| Retail Banking (Poland and foreign branches) | Corporate and Investment Banking |

mBank total | ||||||||

| 2013 | 2014 | 2015 | 2013 | 2014 | 2015 | 2013 | 2014 | 2015 | ||

| Deposits | PLN | 2.5% | 1.6% | 1.1% | 2.4% | 1.9% | 1.3% | 2.5% | 1.7% | 1.2% |

| FX | 0.9% | 0.5% | 0.3% | 0.2% | 0.2% | 0.1% | 0.6% | 0.4% | 0.2% | |

| Total loans | PLN | 8.8% | 8.1% | 6.6% | 4.5% | 3.9% | 3.3% | 6.3% | 5.8% | 5.0% |

| FX | 2.0% | 2.1% | 1.4% | 2.3% | 2.3% | 2.4% | 2.1% | 2.1% | 1.6% | |

| Mortgage loans | PLN | 4.6% | 4.3% | 3.6% | ||||||

| FX | 2.0% | 1.9% | 1.3% | |||||||

Similar to 2014, loans and advances to customers remained the main source of the Group’s interest income (70.6%). Due to lower annual average market interest rates in 2015, total interest income decreased year on year and stood at PLN 3,660.5 million. Interest income from investment securities decreased by PLN 85.9 million, i.e. 10.3% in 2015 due to lower average Treasury bond yields in 2015. Interest income from debt securities held for trading increased by PLN 3.2 million, i.e. 6.7%, Interest income on derivatives concluded under the fair value hedge increased by 153.3%, compared with 2014, to PLN 46.6 million due to an increase in the volume of such transactions. Interest income from cash and short-term deposits decreased in 2015 (-PLN 23.4 million, i.e. 31.9%).

| PLN M | 2014 | 2015 | Change in PLN M |

Change in % |

| Loans and advances including the unwind of the impairment provision discount | 2 833.2 | 2 584.6 | -248.6 | -8.8% |

| Investment securities | 836.6 | 750.7 | -85.9 | -10.3% |

| Cash and short-term placements | 73.3 | 49.9 | -23.4 | -31.9% |

| Trading debt securities | 47.9 | 51.1 | 3.2 | 6.7% |

| Interest income on derivatives classified into banking book | 138.1 | 157.5 | 19.4 | 14.0% |

| Interest income on derivatives concluded under the fair value hedge | 18.4 | 46.6 | 28.2 | 153.3% |

| Interest income on derivatives concluded under the cash flow hedge | 1.4 | 14.1 | 12.7 | 907.1% |

| Other | 7.4 | 6.0 | -1.4 | -18.9% |

| Total interest income | 3,956.3 | 3,660.5 | -295.8 | -7.5% |

The decrease in interest expenses in 2015 was mainly driven by lower costs of settlements with clients (a decrease by PLN 196.1 million, i.e. 22.0%) due to lower interest rates on deposits resulting from a decrease in average annual market interest rates and the consequent changes in the prices of deposit products. Interest expenses paid to banks decreased by PLN 95.3 million, i.e. 50.0% mainly due to the repayment of some of mBank’s loans granted by Commerzbank Group for the total amount of CHF 850 million and lower average market interest rates, in particular lower CHF LIBOR. Interest expenses on issued debt securities increased by PLN 35.7 million, i.e. 15.6% in 2015, mainly driven by diversification of funding sources and increased activity on the covered bond market. Interest expenses on subordinated debt remained almost unchanged compared with the level reported in 2014 (an increase by PLN 1.7 million, i.e. 2.2%).

Net fee and commission income, accounting for 21.9% of mBank Group’s total income, dropped slightly year on year. In the discussed period it stood at PLN 897.2 million, which represents a drop by PLN 4.5 million, i.e. 0.5%.

| PLN M | 2014 | 2015 | Change in PLN M |

Change in % |

| Payment cards-related fees | 413.6 | 342.3 | -71.3 | -17.2% |

| Credit-related fees and commissions | 254.3 | 287.3 | 33.0 | 13.0% |

| Commissions for agency service regarding sale of products of external financial entities | 116.7 | 149.7 | 33.0 | 28.3% |

| Commissions for brokerage services and for organising issues | 119.5 | 123.0 | 3.5 | 2.9% |

| Commissions from bank accounts | 157.5 | 165.8 | 8.3 | 5.3% |

| Commissions from money transfers | 97.7 | 102.8 | 5.1 | 5.2% |

| Commissions due to guarantees granted and trade finance commissions | 46.6 | 49.0 | 2.4 | 5.2% |

| Commissions for agency service regarding sale of products of external financial entities | 88.3 | 114.0 | 25.7 | 29.1% |

| Commissions on trust and fiduciary activities | 21.1 | 22.3 | 1.2 | 5.7% |

| Fees from portfolio management services and other management-related fees | 13.4 | 14.9 | 1.5 | 11.2% |

| Fees from cash services | 38.6 | 39.7 | 1.1 | 2.8% |

| Other | 32.3 | 23.1 | -9.2 | -28.5% |

| Total fee and commission income | 1,399.6 | 1,433.9 | 34,3 | 2.5% |

Commission income increased by PLN 34.3 million, i.e. 2.5% year on year. Payment card-related commission income decreased by PLN 71.3 million, i.e. 17.2% year on year. The decrease was driven by two reductions in interchange fees: on July 1, 2014 and January 29, 2015. Fees and commissions on loans increased by PLN 33.0 million, i.e. 13.0% mainly due to bigger sales of mortgage loans. In 2015, commissions from insurance activity increased by 28.3% year on year (an increase of PLN 33.0 million). Commissions from Bank accounts increased (by PLN 8.3 million, i.e. 5.3%) driven by a growing client base. Development of transactional banking and a higher number of transactions translated into an increase in commissions from money transfers (+5.2%). Commissions for agency service regarding sale of products of external financial entities increased by 29.1%, in connection with the growth in the number and value of sold financial products. In 2015, commission income from the brokerage business and debt securities issues increased (an increase by PLN 3.5 million, i.e. 2.9%). It was mainly driven by a growth in commission income generated by Dom Maklerski mBanku and the Bank’s activity in the scope of issuing Non-Treasury debt securities for corporate customers.

Dividend income amounted to PLN 17.5 million in 2015, compared with PLN 20.0 million in 2014. The decrease was due to lower dividend payments received from PZU.

Net trading income amounted to PLN 292.9 million in 2015 and was lower by PLN 76.3 million, i.e. 20.7% compared with 2014. The decrease was caused by a drop in other trading income and net income on hedge accounting (PLN 4.2 million compared with PLN 136.1 million in 2014). It was mainly driven by the valuation of interest rate derivatives.

Gains less losses on investment securities in 2015 amounted to PLN 314.4 million (PLN 51.9 million in 2014). In 2015, mBank Group reported gains on the sale of BRE Ubezpieczenia TUiR and signing of agreements accompanying the sale with AXA Group companies amounting to PLN 194.3 million and on the sale of PZU shares totalling PLN 125.0 million. The result also covers gains on the sale of minority interests in two companies listed on the Warsaw Stock Exchange, which was related to the Bank’s management of its non-strategic assets.

Other operating result (other operating income net of other operating expenses) amounted to PLN 60.0 million in 2015, representing a decrease by PLN 45.7 million, i.e. 43.2% year on year. In 2015, mBank Group reported lower income from insurance activity compared with 2014, generated until the sale of BRE Ubezpieczenia TUiR (i.e. only in Q1 2015), and lower income from the sale of apartments by mLocum.

Net impairment losses on loans and advances

Net impairment losses on loans and advances in mBank Group amounted to PLN 421.2 million in 2015, compared with PLN 515.9 million in 2014, which represents a decrease by PLN 94.7 million, i.e. 18.4%. The cost of risk in 2015 was 54 basis points in 2015, compared with 72 basis points in 2014.

Net impairment losses on loans and advances in Corporates and Financial Markets stood at PLN 178.5 million in 2015, compared with PLN 212.6 million in 2014. The drop in provisions reported in 2015 was caused by a release of credit risk provisions in K1 segment. On the other hand, provisions in K3 and K2 segments, mFactoring and mLeasing rose in the analysed period.

Net impairment losses on loans and advances in Retail Banking stood at PLN 224.3 million in 2015, compared with PLN 303.3 million in 2014. The coverage ratio increased slightly in the reporting period.

Costs of mBank Group

Total overhead costs of mBank Group (including amortisation) stood at PLN 2,054.2 million, representing an increase by 16.0% year on year. The increase was driven predominantly by one-off costs related to a PLN 141.7 million payment of guaranteed funds to the deposit holders of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin and by a PLN 52.1 million contribution to the Borrowers Support Fund.

| PLN M | 2014 | 2015 | Change in PLN M |

Change in % |

| Staff-related expenses | 844.1 | 854.8 | 10.7 | 1.3% |

| Material costs | 627.6 | 633.9 | 6.3 | 1.0% |

| Taxes and fees | 29.8 | 28.3 | -1.5 | -5.0% |

| Contributions and transfers to the Bank Guarantee Fund | 70.8 | 278.2 | 207.4 | 292.9% |

| Contributions to the Borrowers Support Fund | 0.0 | 52.1 | 52.1 | - |

| Contributions to the Social Benefits Fund | 7.0 | 7.2 | 0.2 | 2.9% |

| Other | 1.3 | 0.0 | -1.3 | -100.0% |

| Amortization | 190.0 | 199.7 | 9.7 | 5.1% |

| Total overhead costs and amortization | 1,770.6 | 2,054.2 | 283.6 | 16.0% |

| Cost / Income ratio | 44.9% | 50.2% | - | - |

| Employment (FTE) | 6 318 | 6 540 | 222 | 3.5% |

Personnel costs increased by PLN 10.7 million, i.e. 1.3% in 2015. The change was driven by higher remuneration costs as a consequence of an increased headcount of mBank Group, which increased from 6,318 as at the end of 2014 to 6,540 as at the end of 2015. The increase took place mainly in the area of Retail Banking, due to the implementation of new strategy in foreign branches as well as in call center and IT area.

Material costs remained relatively stable and increased by PLN 6.3 million, i.e. 1.0% in the period under review. mBank Group reported higher material costs in the IT area in 2015, among others due to the implementation of innovative mobile banking solutions.

The contribution to the Bank Guarantee Fund (BFG) paid by mBank Group increased from PLN 70.8 million in 2014 to PLN 278.2 million in 2015. The rise was driven by higher annual premium and prudential levy paid in 2015 and one-off obligatory payment related to bankruptcy of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin.

Amortisation charges increased in 2015 due to higher amortisation of intangible assets.

Changes to the income and costs of mBank Group contributed to an increase in the cost/income ratio which stood at 50.2% at the end of 2015, compared with 44.9% in 2014. Excluding the one-off costs in 2015 and gains on the sale of shares in BRE TUiR Ubezpieczenia and PZU, the cost/income ratio stood at 49.3%.

Contribution of business lines and segments to the financial results

Data based on internal management information of mBank Group.

Financial results of mBank Group’s business lines

The Retail Banking segment made the highest contribution to the profit before tax of mBank Group at 65.6%, compared with 38.2% for the Corporates and Financial Markets segment including Corporate and Investment Banking (33.2%) and Financial Markets (5.0%).

The charts below present gross profit contribution by business segments:

Changes in the consolidated statement of financial position

Changes in assets of mBank Group

The assets of mBank Group increased by PLN 5,537.2 million, i.e. 4.7% in 2015. Total assets stood at PLN 123,523.0 million as at December 31, 2015.

The table below presents the year-on-year change in the asset lines of mBank Group.

| PLN M | 2014 | 2015 | Change in PLN M |

change in % |

| Cash and balances with Central Bank | 3,054.5 | 5,938.1 | 2,883.6 | 94.4% |

| Loans and advances to banks | 3,751.4 | 1,897.3 | -1,854.1 | -49.4% |

| Trading securities | 1,163.9 | 557.5 | -606.4 | -52.1% |

| Derivative financial instruments | 4,865.5 | 3,349.3 | -1,516.2 | -31.2% |

| Net loans and advances to customers | 74,582.4 | 78,433.5 | 3,851.1 | 5.2% |

| Investment securities | 27,678.6 | 30,736.9 | 3,058.3 | 11.0% |

| Intangible assets | 465.6 | 519.0 | 53.4 | 11.5% |

| Tangible fixed assets | 717.4 | 744.5 | 27.1 | 3.8% |

| Other assets | 1,706.5 | 1,346.9 | -359.6 | -21.1% |

| Total assets | 117,985.8 | 123,523.0 | 5,537.2 | 4.7% |

Loans and advances to customers retained the largest share in the balance sheet of the Group at the end of 2015. They represented 63.5% of total assets at December 31, 2015, compared with 63.2% at the end of 2014.

| PLN M | 2014 | 2015 | Change in PLN M |

Change in % |

| Loans and advances to individuals | 41,560.5 | 46,258.7 | 4,698.2 | 11.3% |

| Loans and advances to corporate entities | 32,841.0 | 33,446.6 | 605.6 | 1.8% |

| Loans and advances to public sector | 1,924.4 | 1,520.7 | -403.7 | -21.0% |

| Other receivables | 1,047.3 | 183.4 | -863.9 | -82.5% |

| Total (gross) loans and advances to customers | 77,373.2 | 81,409.4 | 4,036.2 | 5.2% |

| Provisions for loans and advances to customers (negative amount) | -2,790.8 | -2,975.9 | -185.1 | 6.6% |

| Total (net) loans and advances to customers | 74 582.4 | 78 433.5 | 3,851.1 | 5.2% |

The net volume of loans and advances to customers increased by PLN 3,851.1 million, i.e. 5.2% year on year.

Gross loans and advances to retail customers increased by PLN 4,698.2 million, i.e. 11.3%. The volume of mortgage and housing loans increased by PLN 3,673.7 million, i.e. 12.0% year on year, mainly due to active sales of new loans. In 2015, mBank Group sold PLN 4,503.0 million of mortgage loans, which implies an increase in the volume of sales by 41.8% compared with 2014. mBank Group continued its strategic support for mBank Hipoteczny and the development of Poland’s covered bond market in 2015 as it increased sales of mortgage loans directly by mBank Hipoteczny. In 2015, mBank Hipoteczny sold PLN 1,457.0 million of mortgage loans. In addition, the Group granted PLN 4,866.5 million of non-mortgage loans, representing an 8.5% increase in sales. Net of the FX effect, loans and advances to retail customers grew by ca. 6.3%.

At the same time, gross loans and advances to corporate customers increased by PLN 605.6 million, i.e. 1.8%. Net of reverse repo/buy sell back transactions and the FX effect, loans and advances to corporate customers increased by ca. 11.2% year on year. The volume of gross loans and advances to the public sector decreased by PLN 403.7 million, i.e. 21.0%.

Investment securities constituted mBank Group’s second largest asset category (24.9%). In 2015, their value increased by PLN 3,058.3 million, i.e. 11.0%. The government bond portfolio decreased by 1.5% year on year while the portfolio of debt instruments issued by the central bank increased by 66.1%.

The other asset lines on mBank Group’s balance sheet represented 11.6% of total assets in aggregate.

Changes in liabilities and equity of mBank Group

The table below presents changes in liabilities and equity of the Group in 2015.

| PLN M | 2014 | 2015 | Change in PLN M |

Change in % |

| Amounts due to other banks | 13,383.8 | 12,019.3 | -1,364.5 | -10.2% |

| Derivative financial instruments and other trading liabilities | 4,719.1 | 3,173.6 | -1,545.5 | -32.7% |

| Amounts due to customers | 72,422.5 | 81,140.9 | 8,718.4 | 12.0% |

| Debt securities in issue | 10,341.7 | 8,946.2 | -1,395.5 | -13.5% |

| Subordinated liabilities | 4,127.7 | 3,827.3 | -300.4 | -7.3% |

| Other liabilities | 1,918.0 | 2,140.7 | 222.7 | 11.6% |

| Total Liabilities | 106,912.8 | 111,248.0 | 4,335.2 | 4.1% |

| Total Equity | 11,073.0 | 12,275.0 | 1,202.0 | 10.9% |

| Total liabilities and equity of mBank Group | 117,985.8 | 123 523.0 | 5 537.2 | 4.7% |

Amounts due to customers remained the dominant funding source of mBank Group. They accounted for 65.7% of liabilities and equity at the end of 2015, compared with 61.4% at the end of 2014.

Amounts due to customers increased by PLN 8,718.4 million, i.e. 12.0% to PLN 81,140.9 million in 2015. The change was driven by an increase of amounts due to both retail and corporate customers.

Amounts due to retail customers rose by PLN 6,832.3 million, i.e. 17.4%. Current accounts increased by 16.1%. Term deposits of retail customers increased by 21.4% year on year.

Amounts due to corporate customers increased by PLN 2,186.8 million, i.e. 6.8%.

Amounts due to other banks decreased by PLN 1,364.5 million, i.e. 10.2% year on year to PLN 12,019.3 million at the end of 2015. The change was mainly driven by the repayment of CHF 850 million of loans granted by Commerzbank Group.

The share of debt securities in issue in mBank Group’s total liabilities and equity decreased from 8.8% at the end of 2014 to 7.2% at the end of 2015. The change was driven mainly by the lack of euro note issues in 2015 compared with 2014 and reduction of EUR 500 million eurobonds.

At the end of 2015, the share of equity in liabilities and equity of mBank Group was 9.9% compared with 9.4% at the end of December 2014 due to full retention of 2014 earnings.

Prudential consolidation

According to the Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (“CRR Regulation”), mBank (“the Bank”) is a significant subsidiary of EU parent institution, responsible for the preparation of the consolidated prudentially financial data to fulfil the requirement of disclosures described in IAS 1.135 Presentation of Financial Statements.

Financial information presented below does not represent IFRS measures as defined by the standards.

mBank S.A. Group (“the Group”) consists of entities defined in accordance with the rules of prudential consolidation, specified by the CRR Regulation.

Basis of the preparation of the consolidated financial data

mBank S.A. Group consolidated financial data based on the rules of prudential consolidation specified by the CRR Regulation (“Consolidated prudentially financial data”) have been prepared for the 12-month period ended December 31, 2015 and for the 12-month period ended December 31, 2014.

The consolidated profit presented in the consolidated prudentially financial data may be included in consolidated Common Equity Tier 1 for the purpose of the calculation of consolidated Common Equity Tier 1 capital ratio, consolidated Tier 1 capital ratio and consolidated total capital ratio with the prior permission of the Polish Financial Supervisory Authority or after approval by the General Meeting of shareholders.

The accounting policies applied for the preparation of the Group consolidated prudentially financial data are identical to those, which have been applied to the mBank S.A Group consolidated financial data for the year 2015, prepared in compliance with International Financial Reporting Standard (“IFRS”), except for the consolidation standards presented below.

Consolidation

The consolidated prudentially financial data includes the Bank and the following entities:

-

| 31.12.2015 | 31.12.2014 | |||

| Company | Share in voting rights (directly and indirectly) | Consolidation rights | Share in voting Consolidation rights (directly and method indirectly) | Consolidation method |

| Aspiro S.A | 100% | full | - | - |

| Dom Maklerski mBanku S.A. | 100% | full | 100% | full |

| mBank Hipoteczny S.A. | 100% | full | 100% | full |

| mCentrum Operacji Sp. z o.o. | 100% | full | 100% | full |

| mFaktoring S.A. | 100% | full | 100% | full |

| mLeasing Sp. z o.o. | 100% | full | 100% | full |

| MLV 45 Sp. z o.o. spółka komandytowa | - | - | 100% | full |

| mWealth Management S.A. | 100% | full | - | - |

| Tele-Tech Investment Sp. z o.o. | 100% | full | - | - |

| Transfinance a.s. | - | - | 100% | full |

| mFinance France S.A. | 99.998% | full | 99.98% | full |

Entities included in the scope of prudential consolidation are defined in the Regulation CRR – institutions, financial institutions or ancillary services undertakings, which are subsidiaries or undertakings in which a participation is held, except for entities in which the total amount of assets and off-balance sheet items of the undertaking concerned is less than the smaller of the following two amounts:

- EUR 10 million;

- 1% of the total amount of assets and off-balance sheet items of the parent undertaking or the undertaking that holds the participation.

The consolidated financial data combine items of assets, liabilities, equity, income and expenses of the parent with those of its subsidiaries eliminating the carrying amount of the parent’s investment in each subsidiary and the parent’s portion of equity of each subsidiary. Thus arises goodwill. If goodwill has negative value, it is recognised directly in the income statement. The profit or loss and each component of other comprehensive income is attributed to the Group’s owners and to the non-controlling interests even if this results in the non-controlling interests having a deficit balance. If the Group loses control of a subsidiary, it shall account for all amounts previously recognised in other comprehensive income in relation to that subsidiary on the same basis as would be required if the Group had directly disposed of the related assets or liabilities

Intra-group transactions, balances and unrealised gains on transactions between companies of the Group are eliminated. Unrealised losses are also eliminated unless the transaction provides evidence of impairment of the asset transferred. Accounting policies of subsidiaries have been changed where necessary to ensure consistency with the policies adopted by the Group.

In 2015 the income of the Group, calculated as the sum of net interest income, net fee and commission income, dividend income, net trading income, gains less losses from investment securities, investments in subsidiaries and associates, other operating income and other operating expenses, amounted to PLN 4,086,739 thousand (2014 – PLN 3,759,919 thousand). This income relates in whole to the activity conducted within the European Union.

In 2015, the rate of return on assets of the Group, calculated as net profit divided by the average total assets, amounted to 1.07%.

In 2015, the Group did not received any public subsidies, in particular on the basis of the Act on the Government support for the financial institutions dated February 12, 2009 (Journal of Laws of 2014, No 158).

As at December 31, 2015 the employment in the Group was 6,483 FTEs and 8,529 persons (December 31, 2014 respectively: 6,043 FTEs and 7,284 persons).

Consolidated prudentially income statement

| Period from 01.01.2015 to 31.12.2015 |

Period from 01.01.2014 to 31.12.2014 |

|

| Interest income | 3,655,896 | 3,930,574 |

| Interest expense | (1,149,114) | (1,468,315) |

| Net interest income | 2,506,782 | 2,462,259 |

| Fee and commission income | 1,448,741 | 1,358,468 |

| Fee and commission expense | (535,835) | (482,126) |

| Net fee and commission income | 912,906 | 876,342 |

| Dividend income | 17,540 | 30,133 |

| Net trading income, including: | 292,020 | 366,232 |

| Foreign exchange result | 288,558 | 233,341 |

| Other net trading income and result on hedge accounting | 3,462 | 132,891 |

| Gains less losses from investment securities, investments in subsidiaries and associates, including: | 348,898 | 29,205 |

| Gains less losses from investment securities | 133,213 | 55,373 |

| Gains less losses from investments in subsidiaries and associates | 215,685 | (26,168) |

| Other operating income | 107,338 | 137,734 |

| Net impairment losses on loans and advances | (421,222) | (515,903) |

| Overhead costs | (1,837,816) | (1,500,946) |

| Amortisation | (199,146) | (186,251) |

| Other operating expenses | (99,105) | (141,986) |

| Operating profit | 1,628,195 | 1,556,819 |

| Profit before income tax | 1,628,195 | 1,556,819 |

| Income tax expense | (307,887) | (333,587) |

| Net profit | 1,320,308 | 1,223,232 |

| Net profit attributable to: | ||

| - Owners of mBank S.A. | 1,320,308 | 1,223,232 |

Consolidated prudentially statement of financial position

| ASSETS | 31.12.2015 | 31.12.2014 |

| Cash and balances with the Central Bank | 5,938,132 | 3,054,548 |

| Loans and advances to banks | 1,897,233 | 3,727,309 |

| Trading securities | 557,541 | 1,156,450 |

| Derivative financial instruments | 3,349,328 | 4,865,517 |

| Loans and advances to customers | 78,464,673 | 74,697,423 |

| Hedge accounting adjustments related to fair value of hedged items | 130 | 461 |

| Investment securities | 30,980,449 | 27,906,260 |

| Non-current assets held for sale | - | 291,829 |

| Intangible assets, including: | 519,049 | 456,522 |

| - goodwill | 3,532 | - |

| Tangible assets | 739,978 | 708,103 |

| Current income tax assets | 1,721 | 61,336 |

| Deferred income tax assets | 357,207 | 238,980 |

| Other assets | 702,967 | 509,114 |

| Total assets | 123,508,408 | 117,673,852 |

| LIABILITIES AND EQUITY | ||

| L i a b i l i t i e s | ||

| Amounts due to the Central Bank | - | - |

| Amounts due to other banks | 12,019,331 | 13,383,829 |

| Derivative financial instruments | 3,173,638 | 4,719,056 |

| Amounts due to customers | 81,185,025 | 72,615,316 |

| Debt securities in issue | 8,946,195 | 10,341,742 |

| Hedge accounting adjustments related to fair value of hedged items | 100,098 | 103,382 |

| Liabilities held for sale | - | 91,793 |

| Other liabilities | 1,708,139 | 1,301,051 |

| Current income tax liabilities | 50,126 | 1,441 |

| Provisions for deferred income tax | 981 | 1,980 |

| Provisions | 225,416 | 176,881 |

| Subordinated liabilities | 3,827,315 | 4,127,724 |

| T o t a l l i a b i l i t i e s | 111,236,264 | 106,864,195 |

| E q u i t y | ||

| Equity attributable to Owners of mBank S.A. | 12,272,144 | 10,809,655 |

| Share capital: | 3,535,758 | 3,523,903 |

| - Registered share capital | 168,956 | 168,840 |

| - Share premium | 3,366,802 | 3,355,063 |

| Retained earnings: | 8,303,580 | 6,736,229 |

| - Profit from the previous years | 6,983,272 | 5,512,997 |

| - Profit for the current year | 1,320,308 | 1,223,232 |

| Other components of equity | 432,806 | 549,523 |

| Non-controlling interests | - | 2 |

| T o t a l e q u i t y | 12,272,144 | 10,809,657 |

| T o t a l l i a b i l i t i e s a n d e q u i t y | 123,508,408 | 117,673,852 |

mBank Group capital and funding

mBank Group capital base

Structure of own funds including CET 1 and Tier 2 capita

The amount of capital maintained by mBank Group meets the regulatory requirements and allows for the planned business expansion at a defined risk appetite level. This is reflected in the Common Equity Tier 1 (CET 1) capital ratio (14.29% at the end of 2015) and the Total Capital Ratio (TCR, 17.25% at the end of 2015), which are safely above the levels recommended in 2015 by the Polish Financial Supervision Authority (KNF), According to general the KNF requirements in 2015 banks’ CET 1 Ratio shouldn’t be below 9% and TCR shouldn’t be below 12%. Since January 1, 2016, the KNF increased abovementioned requirements by 1.25 percentage point due to introduction of the conservation buffer. Accordingly, a minimal level for CET 1 and TCR should stand at 10.25% for and 13.25%, respectively.

Moreover, in October 2015, the KNF introduced for 14 banks additional capital requirements, resulting from risk related to foreign exchange mortgage loans. mBank Group was recommended to maintain own funds to cover the additional capital requirement at the level of 4.39 percentage points, in order to secure the risk resulting from foreign exchange mortgage loans for households, which should include at least 75% of Tier I equity (which corresponds to 3.29 percentage points).

In February 2016, the KNF explained, that recommended levels regarding capital ratios (addressed to the whole banking sector and those addressed to the selected banks in October 2015 concerning risk resulting from foreign exchange mortgage loans for households) should be applied both on an individual and consolidated basis.

Taking into account the above described additional capital requirement as well as the conservation buffer of 1.25% enforced on January 1, 2016 on the basis of the Act on Macro-prudential Supervision over the Financial System and Crisis Management in the Financial System, starting from January 1, 2016 the Bank as well as mBank Group should maintain, on the stand alone and consolidated level respectively, the Common Equity Tier 1 ratio on the level not lower than 13.54% and the total capital ratio on the level not lower than 17.64%, which compares against 14.29% and 17.25% respectively reported by mBank Group as of December 31, 2015. As of January 31, 2016 on consolidated level the reported total capital ratio was below the afore-mentioned target ratio of 17.64%, whereas consolidated Common Equity Tier 1 ratio remained to well exceed the new target ratio, similar to the respective ratios on mBank stand alone level. The Management Board of mBank believes that with the decisions to be made by the upcoming mBank Ordinary General Meeting (planned on March 24, 2016) the Group will exceed the total capital ratio target level of 17.64%.

mBank Group has a strong capital base, as reflected in its capital structure. Own funds stood at PLN 12.0 billion at the end of 2015, of which PLN 9.9 billion (83%) constituted CET 1 capital. The main components of CET 1 capital include: share premium, other reserve capital and general risk fund. Tier 1 capital is strengthened mainly through retained earnings.

Tier 2 capital stood at PLN 2.1 billion at the end of 2015, which represents an increase year on year. The rise in Tier II capital was caused mainly by the inclusion of funds raised in a new issue. On December 17, 2014 mBank successfully completed an issue of subordinated bonds in the nominal amount of PLN 750 million maturing on January 17, 2025. Following KNF’s approval granted on January 8, 2015, the amount was added to the supplementary capital of mBank.

A decrease in Tier 2 capital denominated in CHF was driven by an early repayment of a subordinated debt with a limited capital credit and a gradual withdrawal of bonds without a fixed maturity in accordance with CRR.

On June 18, 2015, the Bank made an early repayment of a subordinated debt issue amounting to CHF 70 million. As a result of the early repayment, the instrument with nil capital credit was redeemed in whole. Moreover, on June 24, 2015 the Bank made an early repayment of a subordinated debt issue with a limited capital credit of CHF 90 million.

The Bank plans to successively increase the share of instruments denominated in PLN in the structure of Tier 2 instruments. In 2016-2018 the Bank plans additional issues of subordinated debt in PLN.

The table below presents the balances of mBank Group’s subordinated debt as at December 31, 2015:

Subordinated debt with a fixed maturity included in own funds is subject to amortisation on a daily basis over five years prior to final maturity. In addition, subordinated debt without a fixed maturity in the table above is being gradually withdrawn starting from 2014 and is included in own funds according to the percentage rate set by the Polish Financial Supervision Authority (KNF) for each year until the end of 2021. The percentage was 70% in 2015 and is set at 60% in 2016.

The current structure of the Bank’s capital base derives from prior decisions regarding retained earnings and additional capital increases. Between 2002 and 2011 mBank retained all of its earnings by decision of the General Shareholders’ Meeting, while the 2012 dividend constituted 35% of mBank’s net profit followed by a 67% dividend payment in 2013. The profit for 2014 was included in whole in the Bank’s own funds.

Capital and liquidity norms under Basel 3 and EU regulations

The recommendations of the Basel Committee put forward in the new capital accord Basel 3 form the basis for strengthening the capital base, tightening liquidity requirements, and maintaining the acceptable level of leverage in financial institutions. The primary objective of Basel 3 is to ensure such levels of own funds as are necessary to effectively manage an institution, even in financial distress, without the need for a bailout with taxpayers’ money.

The recommendations of Basel 3 have been introduced into the European Union legislation in the CRD IV / CRR package, which took effect on January 1, 2014, subject to respective transitional periods. Moreover, the European Banking Authority (EBA) gradually issues technical standards for CRD IV and CRR, i.e. detailed descriptions of procedures, instruments, indicators, rules, and their calibration, making it possible for financial institutions to fully implement the requirements imposed on their capital, liquidity, as well as corporate governance and management standards. As a regulation, CRR directly applicable in the EU member states without the need to implement legislative amendments in their jurisdictions. CRD IV was transposed into Polish law in 2015 by the Act on Macro-prudential Supervision on the Financial System and Crisis Management in the Financial System whereby the regulations applicable so far were amended accordingly. One of the most important requirements laid down in the Act concerns capital buffers which can be imposed on banks in Poland. These include:

- Capital conservation buffer – designed to ensure that banks build up capital buffers outside periods of stress which can be drawn down as losses are incurred. Target for this buffer is set at the level of 1.25% of total risk exposure amount (TREA) starting from January 1, 2016, rising to 1.875% from 2017 and finally reaching CRD IV level of 2.5% by 2019.

- Buffer for Globally Systematically Important Institution (G-SII) or Other Systematically Important Institution (O-SII) – kept by institutions characterized by particular scale of activities and institution's contribution to systemic risk. Basel III indicates on maximum level of 2% for O-SII buffer and maximum limit for G-SII set at the level of 3.5%.

- Systemic risk buffer – set out in order to prevent and limit long-term non-cyclical systemic or macroprudential risk. Buffer can be set at the level up to 5% by means of Resolution of Minister of Finance.