DANE FINANSOWE

Key projects and innovations of mBank Group in 2016

Cooperation with Orange

[G4-4] It has already been two years since the joint-venture of mBank and Orange, Poland’s leading landline telephone, mobile, Internet and data transfer provider, called Orange Finanse, was launched.

At the end of 2016, the number of Orange Finanse accounts reached 330 thousand, including approximately 100 thousand opened in 2016 alone. Orange Finanse became one of mBank’s key acquisition channels.

2016 was a period of changes in the product offer supported by marketing campaigns promoting the Orange Finanse brand among the existing and prospective clients of Orange. The key component of the new offer is the option for active users of the Bank’s services to lower their monthly phone bills in a period of up to 24 months and to open a free account (under no extra conditions) with a payment card, bank transfers and withdrawals from all ATMs free of charge in Poland. The offer is addressed to Orange subscribers, and since November 2016 it has also been available to those who buy Orange prepaid top-ups.

In 2016, Orange Finanse was enhanced with new interesting functionalities in the mobile application and online banking. A dedicated version of Orange Finanse for Windows Phone was released. iOS users can now log into the application with a fingerprint. By clicking a dedicated button in the mobile application, the users of all platforms can now quickly get in touch with the Bank’s contact centre, a one-of-a-kind solution on the market. It is also worth mentioning that new deposits for new funds and the option to pay bills using the Direct Debit in on-line banking were introduced. Orange Finanse clients were also given the opportunity to apply for child benefits under the Family 500+ Programme and to make transfers using telephone numbers within the BLIK system. The offer was also expanded with the Payment Assistant, which is a unique solution on the Polish market, sending text messages reminding clients of upcoming transfers, and with 3D secure, a service ensuring security of online payments. Moreover, the website www.orangefinanse.pl now offers account comparison tools, which allow visitors to compare accounts offered by various banks, and a calculator of exact costs of a cash loan in Orange Finanse.

A new, more comprehensive credit offer was introduced in 2016, as well. The existing clients of Orange Finanse can now take out cash loans of up to PLN 150 thousand in all Orange stores. In addition, the loans are also available to clients who do not want to open personal accounts. In June, a new special offer was launched in Orange stores. New clients were given the option to buy holiday gadgets for PLN 1 with contactless payments or BLIK.

H2 2016 was marked with further efforts to enhance selling competences of Orange stores’ employees. Tests of new selling scenarios and client communication methods were conducted and a series of training sessions was implemented to broaden the knowledge on Orange Finanse products. In order to optimise campaigns addressed to new and existing clients of Orange Finanse, a number of measures were taken in 2016, i.a. new educational campaigns on online banking and mobile application were implemented, a regular e-mail newsletter was launched and effectiveness of acquisition activities was increased.

Plans for the future aim at developing the deposit and credit offer. This includes addressing the Orange Finanse offer to clients of Orange fixed-line services. Moreover, constant efforts are taken to make the latest technology of mobile payments based on Android Pay available to clients. Further measures aimed at improving selling competences of Orange Polska stores’ employees are to be taken as well.

In September, Orange Finanse ranked second in the mobile banking category of the Newsweek’s Friendly Bank ranking (mBank ranked first). This means advantage over competition in terms of easy navigation in mobile application, effective channels of communication with the Bank and services and functionalities available in the application.

Program ALM (Asset and Liability Management)

At the beginning of February 2015, the Bank launched the ALM Project. Its aim is to consolidate the systems of interest rate risk, market risk and liquidity risk, the funds transfer pricing system and the Bank’s Treasury system into an integrated ALM System. As a result, the Bank will improve the quality and effectiveness of balance sheet and net interest income management processes. Through working on the implementation of the ALM System, the Bank strives to eliminate redundant systems and processes for collecting and processing data, reporting processes and analytical tools, which will translate into the improvement of the Bank's cost-efficiency. In addition to the above objectives, the system is meant to automate the processes of management of Treasury and Risk areas, assets and liabilities, controlling and finance by collecting and storing complete input data processed by a complex calculation engine. It will make it possible to create consistent simulations, analyses and reports to be distributed to various stakeholders.

In 2016, an integrated data layer together with a module supporting the liquidity risk management process was made available within the project. The following project priorities are planned for the next year: construction of further modules, including the FTP module and a module supporting the interest rate management process.

Integration of Dom Maklerski mBanku and mWealth Management within the Group’s structure

[G4-13] In Q4 2015, the management boards of mBank and Dom Maklerski mBanku and mWealth Management signed the division plans marking the first stage of the planned integration of the companies within the Group’s structure.

In May 2016 the integration of the brokerage operations into an expanded brokerage bureau of mBank was completed. For the purpose of the integration process, the subsidiaries mDM and mWM were divided.

The division of mDM was effected under Article 529 para.1 item 1 of the Code of Commercial Partnerships and Companies and included a transfer of the organised part of mDM’s enterprise connected with the provision of brokerage services to mBank and a transfer of the organised part of mDM’s enterprise connected with servicing and rendering of human resources and payroll services to mCentrum Operacji Sp. z o.o. The division of mWM was effected under Article 529 para.1 item 1 of the Code of Commercial Partnerships and Companies and included a transfer of the organised part of mWM’s enterprise connected with the provision of brokerage services and the remaining operations not constituting the operations of the Real Estate Market and Alternative Investments Bureau to mBank and a transfer of the organised part of mWM’s enterprise connected with advisory and agency services in the scope of purchasing and investing in real estate and other alternative investments for the benefit of natural persons and real estate market analyses to BRE Property Partner Sp. z o.o. (non-consolidated subsidiary). On May 20, 2016 mDM and mWM were struck off the National Court Register.

The division ultimately resulted in integration of the brokerage operations of mBank, Dom Maklerski mBanku and mWealth Management in an expanded brokerage bureau of mBank. By bringing the brokerage operations under one roof, mBank Group is able to offer an optimum portfolio of brokerage services to all its client groups, both individuals and institutions. Integration will allow the Bank to better use its resources and potential, thus giving the brokerage services of mBank Group a greater competitive advantage.

Changes in the Group’s funding structure

Issue of covered bonds

mBank in cooperation with mBank Hipoteczny pursues a strategy designed to issue covered bonds secured with liabilities backed by mortgage loans, allowing for the narrowing of the maturity gap between assets and liabilities and cutting the cost of new funding.

In 2016 mBank Hipoteczny issued covered bonds worth in total PLN 850 million and EUR 168 million, with maturities ranging from 4 to 10 years. The issues in zloty placed in April and May 2016 were the first issues of covered bonds bearing interest at a fixed rate in Poland.

The following table presents the issues in 2016.

| Volume | Currency | Date of issue | Maturity | Tenor (in years) | Coupon |

| 300 M | PLN | 09.03.2016 | 05.03.2021 | 5.0 | WIBOR 3M + 120 bps |

| 50 M | EUR | 23.03.2016 | 21.06.2021 | 5.2 | EURIBOR 3M + 87 bps |

| 50 M | PLN | 28.04.2016 | 28.04.2020 | 4.0 | fixed (2.91%) |

| 100 M | PLN | 11.05.2016 | 28.04.2020 | 4.0 | fixed (2.91%) |

| 70 M* | EUR | 19.08.2016 | 28.08.2019 | 3.0 | WIBOR 3M + 77 bps |

| 13 M | EUR | 28.09.2016 | 20.09.2026 | 10.0 | fixed (1.18%) |

| 35 M | EUR | 26.10.2016 | 20.09.2026 | 9.9 | fixed (1.183%) |

| 400 M* | PLN | 15.12.2016 | 25.07.2018 | 1.6 | EURIBOR 3M + 136 bps |

* Private placement.

Bonds issued under the EMTN Programme

In Q1 2016 mBank updated the Prospectus for EUR 3 billion Euro Medium Notes programme (EMTN). On March 23, 2016 the updated Prospectus was approved by Commission de Surveillance du Secteur Financier (CSSF) in Luxembourg. The programme aims at issuing debt securities by mFinance France, a subsidiary of mBank, in many tranches and currencies, with diversified interest structure. In Q3 2016, mBank via its foreign unit mFinance France issued a sixth tranche of Eurobonds with a nominal value of EUR 500 million, maturing in 2020. This 4-year transaction was priced at 1.398% per annum.

The issue was of significant interest to the European investors (135 investors), with a final order book size of EUR 1.3 billion. The transaction settlement date was September 26, 2016. The tranche was rated at "BBB" by both S&P Global Ratings and Fitch Ratings.

The following table presents a summary of outstanding tranches.

| Currency | Amount | Date of issue | Maturity date | Tenor (years) | Coupon |

| CHF | 200 M | 05.09.2013 | 08.10.2018 | 5.0 | 2.500% |

| CZK | 500 M* | 22.11.2013 | 06.12.2018 | 5.0 | 2.320% |

| EUR | 500 M | 24.03.2014 | 01.04.2019 | 5.0 | 2.375% |

| EUR | 500 M | 20.11.2014 | 26.11.2021 | 7.0 | 2.000% |

| EUR | 500 M | 21.09.2016 | 26.09.2020 | 4.0 | 1.398% |

* Private placement.

Funding from European Investment Bank (EIB)

In June 2016, mBank obtained additional funding from the European Investment Bank - a loan of EUR 100 million with a maturity of 8 years. The total debt of mBank towards EIB in euros stood at EUR 946 million and in American dollars at USD 3,387 million on December 31, 2016.

Credit lines from EIB are intended to finance projects implemented by micro, small and medium-sized enterprises with less than 250 employees and to finance projects implemented by companies employing at least 250 FTE, but not exceeding 3 000 employees (i.e. mid-caps).

Bilateral agreement with Industrial and Commercial Bank of China

In May 2016, mBank signed an agreement with Industrial and Commercial Bank of China (Europe) under which ICBC granted mBank a 3-year loan in the amount of EUR 130 million. It is the first loan that has been granted by ICBC to a Polish bank.

Innovations at mBank Group and plans for 2017

In 2016 most of the capital expenditures were spent for technological development. It allowed extension of mBank’s offer supplying clients with highly innovative and convenient transactional solutions.

Corporate Banking:

We delivered a brand new interface for corporate internet banking system (CompanyNet), redesigning customer process flow and allowing migration to electronic documentation. Thanks to simplified processes from customer end, transaction number growth is expected. Next quantifiable result of the project will be additional revenue stream from electronic banking fees. The ultimate benefit is creation of coherent internet and mobile ecosystem designed for corporate customer.

New CRM - the project aimed to simplify processes, optimize the ergonomics and redesign the GUI (Graphical User Interface) to be cross-platform compatible. These changes enable end-users (relationship managers and branch managers) to exchange information in a more efficient and mobile way. The goal was to deliver a brand new user interface for corporate CRM system to enable mobile sales management. Ultimately this will lead to sales increase and speed up internal sales processes.

Retail Banking:

Further development of mBank’s mobile banking application: the aim of this project was to move transactional features from Internet Banking to mobile scenarios (i.e. transactions planned, periodic payments, CRM features, card management). Moreover it delivered new features (i.e. push notifications, inbox, CVC mobile) and refreshed mobile apps by re-building their navigation, information architecture and look & feel as well as provided new tools for sales and communication within the app.

CRM 3.0 - project implemented the new CRM in WEB version enabled centralisation of applications used in sales activities. It resulted in extending client-content information supporting sales in Call Centre.

New Application System aiming at implementation of a new motion system. The system is a platform for customers, which supports sales campaigns for the whole Bank.

Other areas:

Other investments focused on improvement of the IT security, enhancement of the IT infrastructure, integrating brokerage services within mBank Group and assets & liability management. Moreover, the One Network project has been continued, enabling all customers groups to take advantage of an integrated branch network. 2 new Advisory Centers and 8 Light Branches were open during the year, 5 and 11, respectively, are scheduled for the next year.

As a result of investments spent in 2016 mBank is perceived as a financial institution which sets standards of modern banking. The main focus was not only the acquisition of new customers but also further expansion of cross-selling activities.

2017 Plan

In 2017 mBank is going to maintain its organic business growth as well as further develop its specific business model (mobile, direct focus) – differentiating the bank from the competition.

mBank will seek to leverage on its proven ability to incubate high potential financial services and projects. Investments planned for 2017 will strengthen our outstanding digital competences and allow to attract a “digital company” valuation premium.

At the same time we are going to set the pace for the mobile banking revolution. Capital expenditures budgeted for 2017 should develop the “mobile (banking) first” approach within customer-friendly, omni- channel access to the bank. The ultimate goal is the intuitive, simple, hassle-free, friendly banking. e.g. enhancement of navigation, add-on tools to support financial analysis for the customer and extended on- line communication with the customer.

Spreading technological solutions and demographic processes change customers’ behaviours. They are increasingly eager to use non-branch banking as their primary source of contact. The proper understanding of client’s behaviors and preferences, mainly concerning the young generation of customers plays a key role in their acquisition and retention. Investments focused on this goal will allow responsible offering of solutions based on knowledge about clients and adjusting the right offer to the right client. Furthermore it will strengthen mBank’s client acquisition capabilities, especially targeted at the young customers.

Efficiency should support mBank’s profitability in times when returns from core banking products are under growing pressure. This will be supported by digitization and standardization of customer oriented as well as internal processes. mBank’s efficiency will grow due to capital expenditures allowing rational resources management, including operational costs, capital and financing.

As a result of investments aiming at extension of mBank Group’s offer we will supply our clients with highly innovative and most convenient transactional solutions and further improve mobile banking offer also for corporate customers.

And last but not least project planned for 2017 aims at building the new headquarter in Łódź. It was launched at the end of 2016, but the main expenditures are scheduled for 2017. The brand new headoffice will support and foster mBank’s innovative culture by providing motivating environment for staff in order to remain standard setter in modern banking. The new office standard in accordance with modern trends will stimulate motivation and engagement in the team.

Awards and distinctions

Product offer and customer service quality

- In the Golden Banker ranking, mBank ranked second in the “Golden Bank” main category for the highest quality of service and won in the “Advertising Spot” and “Socially Responsible Bank” categories. Moreover, mBank received the “Best Practices in System Security” special prize.

- mBank won the Service Quality Star 2016 in the “Banks” category for the most recommended personal account in 2016. The Bank also received “The Best Bank for Companies” title by Forbes monthly magazine.

- During the Polish Card Gala, which took place in December, the Mastercard Me credit card won two awards in the following categories: the most innovative Polish card of 2016 and the best advertisement for a card product in Polish media in 2016.

- mKsięgowość, a unique service which combines accounting with a bank account and allows clients to keep accounting books smoothly, almost automatically and independently, was awarded in the international Innovation Awards contest organised by Efma together with Accenture. Victory in the competition is determined by votes of financiers from 88 Efma countries.

- mBank in the Czech Republic received three awards, one golden and two silver, in the prestigious “Zlatá koruna” competition and voting. mKonto Business won in the entrepreneurs category (first prize), mKonto in the audience category (second prize) and the transaction service in the on-line application category (second prize).

Mobile banking

- In the fifteenth edition of the “Newsweek’s Friendly Bank” ranking, mBank ranked top in the mobile banking category. The mobile application “Orange Finanse”, a project implemented by mBank in cooperation with its strategic partner, Orange Polska, ranked second in the mobile banking category.

- In the Mobile Trends Awards competition, mBank’s mobile application won the first prize in two categories: the Mobile Banking category (jury’s verdict) and the Mobile Trends Awards special prize category (votes cast by Internet users). Mobile mTransfer also won two awards and was ranked first in the company supporting popularisation of mobile techniques and technologies category (jury’s verdict) and second in the Mobile Trends Awards special prize category (votes cast by Internet users).

Private banking

- For the eight time, Private Banking of mBank was hailed as the best in Poland by Euromoney Magazine, a British financial magazine. mBank was also appreciated in six competition sub-categories, among others, for the best specialist services for the most affluent clients, asset management and intergenerational wealth transfer.

- For the fifth time in a row, Private Banking of mBank received the highest, Five-Star distinction awarded every year by Forbes magazine. The authors of the ranking appreciated the bank for setting the standards of private banking in Poland, as well as for its broad, customized offer and development of mobile banking.

- mBank’s private banking has yet again been recognised as the best in Poland by the prestigious magazines PWM and The Banker.

Brokerage activity

- In May 2016, active participants of the capital market were granted the awards of the WSE, BondSpot and KDPW for 2015. Dom Maklerski mBanku won awards for the highest total value of IPOs on the WSE organised in 2015 and the highest value of trading in non-treasury bonds on all markets listed on Catalyst and the highest share of the market maker in trading in shares on the main floor. Furthermore, mBank was awarded by the WSE Catalyst in the “highest value of non-treasury debt instruments listed on Catalyst in 2015” category and received KDPW’s award for the largest volume and highest value of OTC transactions cleared at KDPW in 2015 and the highest share of the market maker in trading in shares on the main floor.

Other awards

- mBank was named the Best Trade Finance Bank in Poland by Global Finance. The following areas were assessed: trade finance volumes, comprehensiveness and innovativeness of the product offer, transaction competence and experience, as well as the scale of pursued business activity.

- Trade & Forfaiting Review (TFR), the leading industry information service uniting world’s biggest banks which offer Trade Finance products, hailed mBank as the best bank in Poland operating in this area.

- mBank also won the “Diamonds of Private Equity” prize in the Bank of the Year category (Diamonds were awarded by Executive Club).

- mBank triumphed in the innovation category in the Banking Stars competition organised by Dziennik Gazeta Prawna daily and partnered by PwC. Furthermore, mBank also took the second place for overall performance in the same competition.

- mBank was named the Best Digital Bank in Poland by Global Finance and distinguished in the Best Online Treasury Services category in this year’s edition of the annual contest.

- Factors Chain International, the biggest industry organisation, hailed mFaktoring as the best company in terms of the customer service quality in import factoring.

- In the seventh edition of the Employer Branding Stars contest organised by HRstandard, which aims at determining leading companies as regards creating the employer image in Poland, mBank ranked first for its image and recruitment campaign “Get a Taste for Career at mBank” (“Zasmakuj kariery w mBanku”) and for the best recruitment materials in the “Banking Talents” (“Bankowe Talenty”) campaign.

Financial position of mBank Group in 2016

Profit and loss account of mBank Group

[G4-9] mBank Group reported a profit before tax of PLN 1,637.7 million in 2016, compared with PLN 1,617.9 million in 2015 (+PLN 19.8 million, i.e., +1.2%). Net profit attributable to the shareholders of mBank reached PLN 1,219.3 million, compared with PLN 1,301.2 million year on year (- PLN 81.9 million, i.e. -6.3%). Income tax expense amounted to PLN 415.5 million in 2016 compared to PLN 313.7 million in the previous year (+32.4%).

Summary of financial results of mBank Group is presented below.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Total income | 4,093.4 | 4,295.4 | 202.0 | 4.9% |

| Net impairment losses on loans and advances | -421.2 | -365.4 | 55.8 | -13.2% |

| Overhead costs and amortization | -2,050.6 | -1,963.3 | 87.3 | -4.3% |

| Profit before income tax | 1,617.9 | 1,637.7 | 19.8 | 1.2% |

| Net profit attributable to: | 1,301.2 | 1,219.3 | -81.9 | -6.3% |

| ROA net | 1.04% | 0.95% | ||

| ROE gross | 14.7% | 13.6% | ||

| ROE net | 11.8% | 10.1% | ||

| Cost / Income ratio | 50.1% | 45.7% | ||

| Net interest margin | 2.1% | 2.3% | ||

| Common Equity Tier 1 ratio | 14.3% | 17.3% | ||

| Total capital ratio | 17.3% | 20.3% | ||

| Leverage ratio | 7.7% | 8.2% |

The main drivers of the financial results of mBank Group in 2016 included:

- Increase in total income which stood at PLN 4,295.4 million. The improvement was recorded in net interest income and net fee and commission income. In 2016, mBank Group booked gains on the takeover of Visa Europe Limited by Visa Inc., whereas the income in 2015 was increased by the profit on the sale of BRE Ubezpieczania TUiR and signing of agreements accompanying the sale with AXA Group companies and the profit on the sale of shares of PZU S.A.

- Decrease in operating expenses (including amortisation) to PLN 1,963.3 million compared with 2015. In 2016, contributions and transfer to the Bank Guarantee Fund were lower - in 2015, mBank Group reported one-off costs related to payments of guaranteed funds to the deposit holders of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin. Additionally, mBank made contributions to the Borrowers Support Fund in 2015.

- Increase in efficiency measured by the cost / income ratio which stood at 45.7% in 2016, compared with 50.1% in 2015.

- Lower cost of risk at 46 bps, compared with 54 bps in 2015.

- Continued organic growth and business expansion as demonstrated by:

- Increase in the individual client base in Poland, the Czech Republic and Slovakia, and clients of Orange Finance, to 5,348 thousand (+400.5 thousand clients compared with the end of 2015).

- Increase in the number of corporate clients to 20,940 clients (+1,378 clients, compared with the end of 2015).

Net loans and advances went up by 4.2%, compared with the end of 2015, while deposits grew by 12.7%. Consequently, the loan-to-deposit ratio decreased from 96.7% at 2015 year-end to 89.4%.

Changes in the Group’s results translated into the following profitability ratios:

- Gross ROE of 13.6% (14.7% in 2015 ).

- Net ROE of 10.1% (11.8% in 2015).

mBank Group’s capital ratios increased year on year. Total capital ratio stood at 20.3% at the end of December 2016, compared with 17.3% in the previous year. Common Equity Tier 1 capital ratio reached 17.3%, compared with 14.3% at the end of 2015. Leverage ratio amounted to 8.2% at the end of December 2016, compared with 7.7% in 2015.

Income of mBank Group

Total income generated by mBank Group was PLN 4,295.4 million in 2016, compared with PLN 4,093.3 million in 2015, which represents an increase of PLN 202.0 million, i.e. 4.9%. The increase was mainly driven by improved net interest income and net fee and commission income.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Interest income | 3,660.5 | 3,872.9 | 212.4 | 5.8% |

| Interest expense | -1,149.1 | -1,040.0 | 109.1 | -9.5% |

| Net interest income | 2,511.4 | 2,832.9 | 321.5 | 12.8% |

| Fee and commission income | 1,433.9 | 1,550.8 | 116.9 | 8.2% |

| Fee and commission expense | -536.8 | -644.4 | -107.6 | 20.1% |

| Net fee and commission income | 897.2 | 906.4 | 9.3 | 1.0% |

| Dividend income | 17.5 | 3.3 | -14.2 | -81.0% |

| Net trading income | 292.9 | 244.6 | -48.3 | -16.5% |

| Gains less losses from investment securities, investments in subsidiaries and associates |

314.4 | 261.3 | -53.1 | -16.9% |

| The share in the profits (losses) of joint ventures | -0.1 | -0.1 | 0.0 | -24.1% |

| Other operating income | 245.8 | 243.8 | -2.1 | -0.9% |

| Other operating expenses | -185.8 | -196.8 | -11.0 | 5.9% |

| Total income | 4,093.3 | 4,295.4 | 202.0 | 4.9% |

Similar to 2015, the net interest income remained mBank Group’s largest income source in 2016 (66.0%). It reached PLN 2,832.9 million, compared with PLN 2,511.4 million in 2015 (+12.8%). High net interest income was mainly driven by an increase in interest income combined with a simultaneous cost reduction.

Net interest margin, calculated as a relation between net interest income and average interest-earning assets, stood at 2.3%, compared with 2.1% in 2015.

| Average interest rate (mBank) | ||||||||||

| Retail Banking (Poland and foreign branches) |

Corporate and Investment Banking |

mBank total | ||||||||

| 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | 2014 | 2015 | 2016 | ||

| Deposits | PLN | 1.60% | 1.10% | 0.93% | 1.90% | 1.30% | 1.00% | 1.70% | 1.20% | 0.95% |

| FX | 0.50% | 0.30% | 0.24% | 0.20% | 0.10% | 0.11% | 0.40% | 0.20% | 0.19% | |

| Total loans |

PLN | 8.10% | 6.60% | 6.47% | 3.90% | 3.30% | 3.13% | 5.80% | 5.00% | 4.89% |

| FX | 2.10% | 1.40% | 1.42% | 2.30% | 2.40% | 2.17% | 2.10% | 1.60% | 1.56% | |

| Mortgage loans |

PLN | 4.30% | 3.60% | 3.60% | ||||||

| FX | 1.90% | 1.30% | 1.26% | |||||||

Interest income grew by PLN 212.4 million, i.e. 5.8% year on year, and amounted to PLN 3,872.9 million. Similar to 2015, loans and advances remained the main source of the Group’s interest income (71.1%). Interest income from loans and advances increased by PLN 168.6 million, i.e. 6.5% year on year, and reached PLN 2,753.2 million. The growth resulted mainly from the change in the structure of the retail loans portfolio – increasing share of high margin products, with a simultaneous decrease in the share of mortgage loans in foreign currencies characterised by lower margin. In 2016, interest income from investment securities fell by PLN 42.7 million, i.e. 5.7% due to lower average yields on T-bonds in 2016. Interest income from debt securities held for trading increased by PLN 25.9 million, i.e. 50.6%, driven by a considerable (almost seven-fold) increase in the volume of these securities in 2016. Interest income on derivatives classified into banking book amounted to PLN 196.7 million, i.e., rose by 24.9% compared with 2015, due to increased volumes of such transactions. At the same time, there was an increase in interest income concluded under the cash flow hedge accounting (+ PLN 13.3 million, i.e. +28.6%) and from cash and short-term deposits (+PLN 7.4 million, i.e., +14.9%).

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Loans and advances including the unwind of the impairment provision discount | 2,584.5 | 2,753.2 | 168.6 | 6.5% |

| Investment securities | 750.7 | 708.0 | -42.7 | -5.7% |

| Cash and short-term placements | 49.9 | 57.3 | 7.4 | 14.9% |

| Trading debt securities | 51.1 | 77.0 | 25.9 | 50.6% |

| Interest income on derivatives classified into banking book | 157.5 | 196.7 | 39.3 | 24.9% |

| Interest income on derivatives concluded under the fair value hedge | 46.6 | 59.9 | 13.3 | 28.6% |

| Interest income on derivatives concluded under the cash flow hedge | 14.2 | 15.9 | 1.7 | 12.3% |

| Other | 6.0 | 4.9 | -1.1 | -18.2% |

| Total interest income | 3,660.5 | 3,872.9 | 212.4 | 5.8% |

Decrease in interest expenses in 2016 resulted mainly from lower interest expense arising from amounts due to customers (a decrease by PLN 57.4 million, i.e. 8.2%) due to lower interest rates on deposits and a considerable inflow of cash into current accounts of clients. Interest expense arising from amounts due to banks decreased by PLN 20.2 million, i.e., 21.2%, mainly due to the repayment of loans granted by Commerzbank Group totalling CHF 800 million. 2016 saw a decrease in interest expense arising from issue of debt securities by PLN 19.4 million, i.e. 7.3% as a result of decrease in the cost of the EMTN programme (EMTN tranche in the amount of EUR 500 million was redeemed in October 2015) and costs of debt issuance on the Polish market. At the same time, interest expense arising from subordinated debt also decreased (by PLN 10.3 million, i.e., 13%) due to repayment of the loan in the amount of CHF 200 million in June 2015.

Net fee and commission income, accounting for 21.1% of mBank Group’s total income, increased slightly year on year. It reached PLN 906.4 million in the analysed period, representing an increase of PLN 9.3 million, i.e., 1.0%.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Payment cards-related fees | 342.3 | 361.9 | 19.6 | 5.7% |

| Credit-related fees and commissions | 287.3 | 308.5 | 21.2 | 7.4% |

| Commissions for agency service regarding sale of insurance products of external financial entities | 149.8 | 166.8 | 17.0 | 11.4% |

| Fees from brokerage activity and debt securities issue | 123.0 | 142.0 | 19.1 | 15.5% |

| Commissions from bank accounts | 165.7 | 170.1 | 4.4 | 2.6% |

| Commissions from money transfers | 102.8 | 110.6 | 7.7 | 7.5% |

| Commissions due to guarantees granted and trade finance commissions | 49.0 | 58.8 | 9.8 | 20.1% |

| Commissions for agency service regarding sale of products of external financial entities | 113.5 | 115.4 | 1.9 | 1.7% |

| Commissions on trust and fiduciary activities | 22.3 | 25.0 | 2.7 | 12.0% |

| Fees from portfolio management services and other management-related fees | 14.9 | 13.5 | -1.4 | -9.3% |

| Fees from cash services | 39.7 | 51.1 | 11.4 | 28.7% |

| Other | 23.6 | 27.1 | 3.5 | 14.7% |

| Total fee and commission income | 1,433.9 | 1,550.8 | 116.9 | 8.2% |

Commission income went up by PLN 116.9 million, i.e., 8.2% year on year. Payment cards-related fees rose by PLN 19.6 million, i.e. 5.7% year on year. The increase was stimulated by a higher number of clients and issued payment cards as well as by the number and volume of transactions (value of non-cash transactions grew in 2016 by 21.2% year on year and the number of transactions rose by 27.8%). Credit- related fees and commissions surged by PLN 21.2 million, i.e., 7.4% due to the increased sales of non- mortgage loans. Commissions for agency service regarding sale of insurance products of external financial entities were by 11.4% higher in 2016, compared with 2015 (+PLN 17.0 million). Fees from brokerage activity and debt securities issues grew by 15.5%. Commissions from bank accounts rose (by PLN 4.4 million, i.e. 2,6%) as a result of a growing client base. The growth in transactional banking and a higher number of transactions translated into an increase in commissions from money transfers (+7.5%). Similarly, income from fees for cash services reported an increase (+28.7%).

Fee and commission expense grew in 2016 by PLN 107.6 million, i.e. 20.1%. The highest growth was recorded in the payment cards-related fees and commissions paid to external entities for agency service regarding the sale of the Bank’s products.

Dividend income amounted to PLN 3.3 million in 2016, compared with PLN 17.5 million in 2015. The decrease resulted from the payment of a dividend amounting to PLN 14.2 million by PZU S.A. in 2015, whereas the Bank did not hold any shares in this company in 2016.

Net trading income stood at PLN 244.6 million in 2016 and was lower by PLN 48.3 million (16.5%) year on year. The decrease in the net trading income was mainly driven by a negative other net trading income and result on hedge accounting (- PLN 25.8 million, compared with PLN 4.2 million year on year) predominantly due to the valuation of interest rate derivatives. The foreign exchange result decreased by PLN 18.3 million (-6.3%) owing to the negative valuation of currency interest rate swaps (CIRS).

Gains less losses on investment securities in 2016 stood at PLN 261.3 million in 2016, compared with PLN 314.4 million in 2015. The settlement of Visa Europe Limited takeover by Visa Inc. amounting to PLN 251.7 million was posted in 2016. In 2015, mBank Group reported gains on the sale of BRE Ubezpieczania TUiR and signing of agreements accompanying the sale with AXA Group companies amounting to PLN 194.3 million and on the sale of PZU S.A. shares totalling PLN 125.0 million.

Net other operating income (other operating income net of other operating expenses) amounted to PLN 46.9 million in 2016, which represented a decrease of PLN 13.1 million, i.e., 21.8% year on year. Net income from sale or liquidation of tangible assets, intangible assets, assets for sale and inventories generated primarily by mLocum increased by PLN 3.2 million (for more details on the results of mLocum see Chapter 6.6. “Subsidiaries of mBank Group). In 2016, net income from insurance activities was not recorded following the sale of BRE Ubezpieczenia TUiR in 2015, while net income from insurance activities in 2015 included income generated in Q1 2015 amounting to PLN 23.9 million.

Costs of mBank Group operations

Total overhead costs of mBank Group (including amortisation) stood at PLN 1,963.3 million, representing a decrease by 4.3% year on year. The decrease was driven predominantly by one-off costs incurred in 2015.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Staff-related expenses | -854.8 | -876.7 | -21.9 | 2.6% |

| Material costs | -633.9 | -671.3 | -37.5 | 5.9% |

| Taxes and fees | -24.7 | -22.8 | 1.9 | -7.5% |

| Contributions and transfers to the Bank Guarantee Fund | -278.2 | -161.7 | 116.4 | -41.8% |

| Contributions to the Borrowers Support Fund | -52.1 | 0.0 | 52.1 | -100.0% |

| Contributions to the Social Benefits Fund | -7.3 | -7.1 | 0.3 | -4.3% |

| Amortization | -199.6 | -223.7 | -24.0 | 12.0% |

| Total overhead costs and amortization | -2,050.6 | -1,963.3 | 87.3 | -4.3% |

| Cost / Income ratio | 50.1% | 45.7% | - | - |

| Employment (FTE) | 6,540 | 6,528 | -12 FTEs | -0.2% |

In 2016 staff-related expenses went up by PLN 21.9 million, i.e. 2.6%. The change was driven by higher remuneration costs. The number of FTEs decreased from 6,540 at the end of 2015 to 6,528 FTEs at the end of 2016.

Material costs increased in the reported period by PLN 37.5 million, i.e. by 5.9%. mBank Group reported higher material costs in the IT area in 2016, among others due to the implementation of innovative mobile banking solutions.

The contribution to the Bank Guarantee Fund (BFG) paid by mBank Group decreased by PLN 116.4 million, compared with 2015. The reduction in the amount of charges to the BGF was driven predominantly by one- off costs incurred in 2015, which were related to a PLN 141.7 million payment of guaranteed funds to the deposit holders of Spółdzielczy Bank Rzemiosła i Rolnictwa in Wołomin. In 2016, a PLN 10.9 million transfer was made to the Bank Guarantee Fund due to the bankruptcy of Bank Spółdzielczy w Nadarzynie (Cooperative Bank in Nadarzyn). In 2015 mBank also made a contribution to the Borrowers Support Fund in the amount of PLN 52.1 million.

Amortisation charges increased in 2016 due to higher amortisation of intangible assets.

Changes to the income and costs of mBank Group contributed to a decrease in the cost / income ratio which stood at 45.7% in 2016, compared with 50.1% in 2015.

Net impairment losses on loans and advances

Net impairment losses on loans and advances in mBank Group amounted to PLN 365.4 million in 2016, compared with PLN 421.2 million in 2015, which represents a decrease by PLN 55.8 million, i.e. 13.3%. The cost of risk stood at 46 bps in 2016, compared with 54 bps in 2015.

Net impairment losses on loans and advances in the Retail Banking amounted to PLN 284.9 million in 2016, compared with PLN 224.3 million in 2015. The increase was caused by the changing sructure of the loan portfolio with the growing share of non-mortgage loans (unsecured loans) as well as depreciation of polish zloty against Swiss franc and euro.

Net impairment losses on loans and advances in Corporates and Financial Markets stood at PLN 78.2 million in 2016, compared with PLN 178.5 million in 2015. The drop in provisions reported in 2016 was caused by a release of credit risk provisions related to the sale of non-performing receivables and payment of the loan insurance by KUKE (Export Credit Insurance Corporation).

Contribution of business lines and segments to the financial results

Data based on the internal management information of mBank Group.

Financial results of mBank Group’s business lines

| PLN M | 2015 | 2016 | Change in PLN m |

Change in % |

Share in profit before tax |

| Retail Banking | 1,060.7 | 1,023.9 | -36.8 | -3.5% | 62.5% |

| Corporate and Investment Banking | 537.4 | 498.6 | -38.8 | -7.2% | 30.4% |

| Financial Markets | 80.2 | 90.9 | 10.7 | 13.3% | 5.6% |

| Other | -60.4 | 24.3 | 84.8 | -140.4% | 1.5% |

| Profit before tax of mBank Group | 1,617.9 | 1,637.7 | 19.9 | 1.2% | 100.0% |

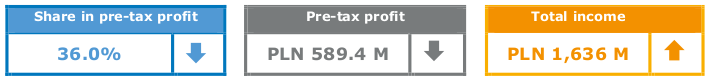

The Retail Banking segment made the biggest contribution (62.5%) to the profit before tax of mBank Group. The contribution of Corporates and Financial Markets constituted 36.0% of the Group’s profit before tax, including Corporate and Investment Banking (30.4%) and Financial Markets (5.6%).

Changes in the consolidated statement of financial position

Changes in assets of mBank Group

[G4-9] The assets of mBank Group increased by PLN 10,220.5 million, i.e. 8.3% in 2016. Total assets stood at PLN 133,743.5 million as at December 31, 2016.

The table below presents the change in the asset lines of mBank Group.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Cash and balances with Central Bank | 5,938.1 | 9,164.3 | 3,226.1 | 54.3% |

| Loans and advances to banks | 1,897.3 | 3,082.9 | 1,185.5 | 62.5% |

| Trading securities | 557.5 | 3,800.6 | 3,243.1 | 581.7% |

| Derivative financial instruments | 3,349.3 | 1,808.8 | -1,540.5 | -46.0% |

| Net loans and advances to customers | 78,433.6 | 81,763.3 | 3,329.7 | 4.2% |

| Investment securities | 30,737.0 | 31,393.4 | 656.4 | 2.1% |

| Intangible assets | 519.1 | 582.7 | 63.6 | 12.3% |

| Tangible fixed assets | 744.5 | 757.4 | 12.8 | 1.7% |

| Other assets | 1,346.6 | 1,390.1 | 43.6 | 3.2% |

| Total assets | 123,523.0 | 133,743.5 | 10,220.5 | 8.3% |

Loans and advances to customers retained the largest share in the balance sheet of the Group at the end of 2016. The net volume of loans and advances to customers increased by PLN 3,329.7 million, i.e. 4.2% year on year. They represented 61.1% of the balance sheet total as at December 31, 2016, compared with 63.5% at the end of 2015.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Loans and advances to individuals | 46,258.7 | 48,949.8 | 2,691.1 | 5.8% |

| Loans and advances to corporate entities | 33,446.6 | 34,174.3 | 727.7 | 2.2% |

| Loans and advances to public sector | 1,520.7 | 1,228.2 | -292.5 | -19.2% |

| Other receivables | 183.4 | 228.5 | 45.1 | 24.6% |

| Total (gross) loans and advances to customers | 81,409.4 | 84,580.8 | 3,171.4 | 3.9% |

| Provisions for loans and advances to customers (negative amount) | -2,975.9 | -2,817.5 | 158.4 | -5.3% |

| Total (net) loans and advances to customers | 78,433.5 | 81,763.3 | 3,329.7 | 4.2% |

Gross loans and advances to retail customers increased by PLN 2,691.1 million, i.e. 5.8%. The volume of mortgage and housing loans increased slightly by PLN 1,184.9 million, i.e. 2.7%, mainly due to depreciation of the zloty against the Swiss franc and systematic repayments of mortgage loans, while sales decreased by 36.1% and reached PLN 2,879.4 million in 2016 compared with 4,503.0 million in 2015. In addition, in 2016, the Group granted PLN 6,128.9 million worth of non-mortgage loans, representing a 25.9% increase in sales year on year. Net of the FX effect, loans and advances to retail customers grew by 3.3% in 2016.

Gross loans and advances to corporate customers increased by PLN 727.7 million, i.e. 2.2% compared with the end of 2015. Net of reverse repo/buy sell back transactions and the FX effect, loans and advances to corporate customers increased by 3.6% against the end of 2015.

The volume of gross loans and advances to the public sector decreased by PLN 292.5 million, i.e. 19.2%.

Investment securities constituted mBank Group’s second largest asset category (23.5%). In 2016, their value increased by PLN 656.4 million, i.e. 2.1%. The government bond portfolio increased by 27.0% year on year, while the portfolio of debt instruments issued by the central bank decreased by 75.6%.

The balance of trading securities went up by PLN 3,243.1 million in 2016 primarily as a result of extending the treasury bonds portfolio.

Changes in liabilities and equity of mBank Group

The table below presents changes in liabilities and equity of the Group in 2016:

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Amounts due to other banks | 12,019.3 | 8,486.8 | -3,532.6 | -29.4% |

| Derivative financial instruments and other trading liabilities | 3,173.6 | 1,599.3 | -1,574.4 | -49.6% |

| Amounts due to customers | 81,140.9 | 91,418.0 | 10,277.1 | 12.7% |

| Debt securities in issue | 8,946.2 | 12,660.4 | 3,714.2 | 41.5% |

| Subordinated liabilities | 3,827.3 | 3,943.3 | 116.0 | 3.0% |

| Other liabilities | 2,140.7 | 2,584.5 | 443.9 | 20.7% |

| Total Liabilities | 111,248.0 | 120,692.3 | 9,444.3 | 8.5% |

| Total Equity | 12,275.0 | 13,051.2 | 776.2 | 6.3% |

| Total Liabilities and Equity | 123,523.0 | 133,743.5 | 10,220.5 | 8.3% |

Amounts due to customers remained the dominant funding source of mBank Group. Their share in the Group’s funding structure grows systematically. They accounted for 68.4% of the Group’s liabilities and equity at the end of 2016, compared with 65.7% at the end of 2015.

Amounts due to customers increased by PLN 10,277.1 million, i.e. 12.7% to PLN 91,418.0 million in 2016.

The growth was driven by an increase of amounts due to retail clients which were higher by PLN 7,377.9 million, i.e. 16.0% compared with the end of 2015. Current accounts grew by 17.2%. Term deposits increased by 13.1%.

Throughout the year, amounts due to corporate customers increased by PLN 2,959.6 million, i.e. 8.6%. The growth was mainly driven by increased balances of current accounts (+31.3%), loans and advances received (+15.6%) and repo/sell buy back transactions (+46.3%). The volume of term deposits decreased by 27.0% in the analysed period. Excluding repo transactions, amounts due to corporate clients rose by 7.4% compared with the end of 2015.

Amounts due to other banks decreased by PLN 3,532.6 million, i.e. 29.4% to PLN 8,486.8 million compared with the end of 2015. A significant decline was observed in loans and advances received. In 2016, mBank took out loans in EUR totalling EUR 230 million and repaid a loan of CHF 800 million. The value of deposits placed by other banks with mBank, term deposits and repo transactions also declined.

The share of debt securities in issue in mBank Group’s financing structure increased from 7.2% at the end of 2015 to 9.5% at the end of 2016. Their value grew by PLN 3,714.2 million, i.e. 41.5% year on year. This change was driven mainly by the issue of covered bonds by mBank Hipoteczny worth PLN 850 million and EUR 168 million and depreciation of the zloty against the euro and the Swiss franc.

Subordinated liabilities rose by 3.0% in 2016, mainly due to changes in the Swiss franc/zloty exchange rate, as the subordinated liabilities to Commerzbank are denominated in the Swiss franc.

In 2016, equity grew by PLN 776.2 million, i.e. 6.3% as a result of an increase in retained profits, while its share in total liabilities and equity of mBank Group accounted for 9.8% at the end of 2016 (9.9% as at December 31, 2015.)

Retail Banking

[G4-4, G4-8, G4-9, FS6] mBank’s Retail Banking segment serves 5,348 thousand  individual clients and microenterprises in Poland, the Czech Republic and Slovakia online, directly through the call centre, via mobile banking and other state-of-the-art technological solutions, as well as in a network of 154* branches. The Bank offers a broad range of products and services including current and savings accounts, accounts for microenterprises, credit products, deposit products, payment cards, investment products, insurance products, brokerage services, and leasing for microenterprises. In 2013, the Bank launched a modern, user-friendly online platform (New mBank) designed from scratch, which provides more than 200 new functionalities, solutions and improvements.

individual clients and microenterprises in Poland, the Czech Republic and Slovakia online, directly through the call centre, via mobile banking and other state-of-the-art technological solutions, as well as in a network of 154* branches. The Bank offers a broad range of products and services including current and savings accounts, accounts for microenterprises, credit products, deposit products, payment cards, investment products, insurance products, brokerage services, and leasing for microenterprises. In 2013, the Bank launched a modern, user-friendly online platform (New mBank) designed from scratch, which provides more than 200 new functionalities, solutions and improvements.

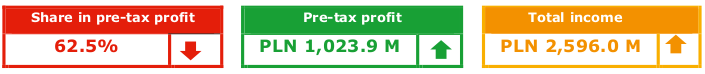

Key financial data (at the end of 2016):

Key business data:

| (thousand) | 2012 | 2013 | 2014 | 2015 | 2016 |

| Customers | 4,134 | 4,229 | 4,551 | 4,947 | 5,348 |

| Distribution network (pcs.) | 262 | 261 | 281 | 302 | 316 |

| Loans to retail clients, incl.: | 37,704 | 38,308 | 41,560 | 46,259 | 48,950 |

| Mortgage loans | 30,996 | 30,818 | 32,892 | 36,670 | 37,719 |

| Non-mortgage loans | 6,708 | 7,489 | 8,668 | 9,588 | 11,231 |

| Deposits of retail clients | 33,234 | 34,203 | 39,285 | 46,117 | 53,495 |

Key highlights

- Increase in the retail customer base by more than 400 thousand year on year.

- More than 1.3 million of mobile application’s users, up by 21.9% year on year.

- Sales of PLN 6.1 billion worth of non-mortgage loans, up by 25.9% year on year.

- Increase of retail deposits by 16.0%, mainly driven by growing current accounts (+17.2% year on year).

- Increase of the value of payment card transactions carried out by mBank by 21.2%; increase in the number of card transactions by 27.8% year on year.

- Increase of core income to PLN 2,596.0 million, i.e. up by 9.7% year on year.

* Including 138 in Poland Polsce and 16 in Czech Republic and Slovakia; excluding mFinanse (43) and mKiosks (119).

Summary of Retail Banking segment financial results

The Retail Banking segment generated a profit before tax of PLN 1,023.9 million in 2016, which represents a decrease by PLN 36.8 million, i.e. 3.5% year on year.

| PLN M | 2015 | 2016 | Change in PLN M |

Change in % |

| Net interest income | 1,565.6 | 1,762.4 | 196.9 | 12.6% |

| Net fee and commission income | 507.3 | 517.7 | 10.4 | 2.0% |

| Dividend income | 0.1 | 0.0 | -0.1 | -93.5% |

| Net trading income | 95.7 | 100.3 | 4.6 | 4.8% |

| Gains less losses from investment securities, investments in subsidiaries and associates |

194.0 | 230.4 | 36.4 | 18.8% |

| Net other operating income | 3.3 | -14.8 | -18.2 | -542.7% |

| Total income | 2,366.0 | 2,596.0 | 230.0 | 9.7% |

| Net impairment losses on loans and advances | -224.3 | -285.0 | -60.7 | 27.0% |

| Overhead costs and amortization | -1,077.4 | -1,108.6 | -31.2 | 2.9% |

| Taxes on Group's balance sheet items | -3.6 | -178.5 | -174.9 | 49.6x |

| Profit before tax of Retail Banking | 1,060.7 | 1,023.9 | -36.8 | -3.5% |

The profit before tax of Retail Banking in 2016 was driven by the following factors:

- Increase in total income by PLN 230.0 million, i.e. 9.7% year on year to PLN 2,596.0 million. Increased income from the core business: net interest income went up by PLN 196.9 million (due to the change in the structure of credit portfolio – increasing share of high margin products), and net fee and commission income was higher by PLN 10.4 million (rise in the number of payment cards issued, the number and volume of transactions as well as in lending and insurance commissions). Moreover, the increase in total income was stimulated by a rise in gains less losses from investment securities, investments in subsidiaries and associates by PLN 36.4 million, driven by the booking of the settlement of the takeover of Visa Europe Limited by Visa Inc. (in 2015 the profit was posted due to the sale of BRE Ubezpieczenia TUiR and the signing of agreements accompanying the sale with AXA Group companies).

- Increase in operating expenses (including amortisation) by PLN 31.2 million, i.e. 2.9% year on year, driven mainly by the 20.4% growth in amortisation.

- Increase in net impairment losses on loans and advances by PLN 60.7 million, i.e. 27.0% year on year caused by a change in the structure of the retail loans portfolio with the rising share of non- mortgage loans (unsecured loans) and weaker zloty against the Swiss franc and the euro.

- Tax on the Group’s balance sheet items at PLN 178.5 million.

Activity of the Retail Banking area (Bank)

| thousand | 31.12.2014 | 31.12.2015 | 31.12.2016 | YoY change |

| Number of retail clients, including: | 4,551.5 | 4,947.3 | 5,347.9 | 8.1% |

| Poland | 3,789.4 | 4,127.7 | 4,455.3 | 7.9% |

| Foreign branches | 762.1 | 819.7 | 892.6 | 8.9% |

| The Czech Republic | 534.2 | 573.1 | 628.9 | 9.7% |

| Slovakia | 227.9 | 246.5 | 263.7 | 7.0% |

| PLN M | ||||

| Loans to retail clients, including: | 41,444.0 | 46,168.7 | 48,926.1 | 6.0% |

| Poland | 38,526.0 | 42,344.7 | 44,646.4 | 5.4% |

| mortgage loans | 30,540.1 | 33,473.4 | 34,112.7 | 1.9% |

| non-mortgage loans | 7,985.9 | 8,871.3 | 10,533.7 | 18.7% |

| Foreign branches | 2,917.9 | 3,824.0 | 4,279.7 | 11.9% |

| The Czech Republic | 2,250.5 | 2,899.6 | 3,310.9 | 14.2% |

| Slovakia | 667.5 | 924.4 | 968.8 | 4.8% |

| Deposits of retail clients, including: | 38,999.4 | 45,645.4 | 53,662.8 | 17.6% |

| Poland | 33,381.0 | 39,273.6 | 45,727.6 | 16.4% |

| Foreign branches | 5,618.5 | 6,371.8 | 7,935.2 | 24.5% |

| The Czech Republic | 3,788.6 | 4,488.0 | 5,630.5 | 25.5% |

| Slovakia | 1,829.8 | 1,883.7 | 2,304.7 | 22.3% |

| Investment funds (Poland) | 5,252.1 | 5,736.2 | 5,792.3 | 1.0% |

| thousand | ||||

| Credit cards, including | 327.4 | 332.4 | 340.3 | 2.4% |

| Poland | 296.9 | 303.6 | 309.4 | 1.9% |

| Foreign branches | 30.6 | 28.8 | 30.9 | 7.0% |

| Debit cards, including: | 3,032.2 | 3,242.7 | 3,438.4 | 6.0% |

| Poland | 2,445.3 | 2,701.0 | 2,876.0 | 6.5% |

| Foreign branches | 586.8 | 541.8 | 562.4 | 3.8% |

| Distribution network | ||||

| Advisory Centres within "One Network" Project | 1 | 4 | 6 | |

| Light branches within "One Network" Project | 2 | 9 | 17 | |

| mBank (former Multibank) | 130 | 123 | 115 | |

| mKiosks (incl. Partner Kiosks) | 67 | 83 | 98 | |

| mFinanse Financial Centres | 46 | 47 | 43 | |

| Czech Republic & Slovakia | 35 | 36 | 37 | |

Product mix, acquisition and marketing

In 2016, the number of retail banking clients of mBank rose by 400.5 thousand, mainly thanks to active acquisition, focused marketing efforts, product mix development and effective cross-selling.

In 2016, mBank considerably simplified the offer of personal accounts and withdrew the following products: eKonto, eKonto mobilne, eKonto mobilne plus and mKonto Multi. They were replaced with the eKonto account in two versions: eKonto with a standard tariff and eKonto with a plus tariff. Both accounts include a mechanism releasing the client from a debit card fee in a situation when the client makes at least five cash-less transactions a month using the card.

mBank continues its marketing campaign based on a slogan: “Follow what you borrow”, stressing clear lending rules and repayment security. The main aim of the campaign is to build awareness that mBank has an attractive credit offer and create an image of the bank boasting the simplest lending conditions. Measures taken within the Responsible Lending initiative are an inherent part of the campaign and communication, and a comprehensive credit guide, the one of its kind on the market, addressed to mBank’s clients, “Credit ABC”, is a crowning achievement of that action.

Moreover, in June 2016 mBank launched the third edition of the promotion encouraging clients to actively use mBank’s mobile application (Mobile Clients Have It Better - 3rd edition).

In 2016, mBank cooperated with a key player on e-commerce market - PayU - in the scope of granting instalment loans for online shopping, reaching high sales of this product (an increase by approx. 170% of the value of granted loans).

The development of the area of cash and instalment loans focused also on the range of cross-selling initiatives, offering clients i.a.:

- the fully remote process of consolidation of loans from other banks;

- a possibility to increase funding under a cash loan in a quick and simple way;

- an option to split payments debiting their current and savings accounts into instalments.

The Bank made it possible for its retail clients to apply for child benefits under the Family 500+ Programme.

In 2017, the retail banking will take up challenges based on the use of the new sources of information about clients, such as e-public administration or social media.

Offer for small and medium-sized enterprises

In the area of small and medium-sized enterprises (SME), one of the main achievements in 2016 was the launch of mAccounting developed in cooperation between mBank and SuperKsięgowa (Extor S.A.). Thanks to the exchange of basic data between banking and accounting systems, SMEs receive benefits which so far have only been available to corporate clients, including automatic monitoring of payments, quick invoicing, simplified invoice payment, analysis of business partners, electronic settlement of tax returns and up-to-date tax data.

With the aim to acquire new clients, mBank incorporated a new promotion “Good start with mBank” into the offer of company accounts. When opening a company account, the client may also order a stamp, a card holder and business cards for his/her new business. This offer is available in mBank’s outlets, and since August 2016 it has been offered via direct channels - on the Internet and in the call centre.

Moreover, in an attempt to broaden its offer for small and medium-sized enterprises, the Bank and Akademickie Inkubatory Przedsiębiorczości (Academic Business Incubators, owner of Business Link, an office network) launched a new promotion “mBusiness account plus office”. All clients who decide to open company accounts will be offered free access to Business Link infrastructure for a period of 6 months. Business Link operates 11 business development hubs available round the clock, which makes it the largest such network in Poland. The offices are located in 10 largest Polish cities. As part of the Partner’s ecosystem, the clients will have an unlimited access to the office space in the largest Polish cities and will have the chance to meet with mentors/experienced entrepreneurs who can show them possible development opportunities and help them establish valuable business relations with other businessmen, while innovative companies may seek help in finding investors.

2016 was yet another period in which mBank confirmed its leading role in the e-Commerce and m- Commerce transaction area. The Mobile mTransfer solution, making the mTransfer service available in the mobile channel, was once again appreciated by the market in the “Debut of the Year” category at Ekomersy 2015 gala. In addition, Mobile mTransfer was recognised in the Mobile Trend Awards 2016 competition and won 1st award for “Company supporting the popularisation of mobile techniques and technologies” and a Special Award - 2nd place in a vote by Internet users. For more information about awards for mBank Group in 2016, go to section 6.1. Key projects and innovations of mBank Group.

At the beginning of 2016 mBank also expanded the mPlatforma Walutowa service, an FX platform (dedicated to small and medium-sized enterprises) with individual clients segment, offering them mKantor. mKantor offers all the benefits of mPlatforma Walutowa: making transactions in two clicks, very attractive FX rates, and the possibility to make transactions via the mobile application.

In the area of financing of companies a new product was added to the product offer: an overdraft facility guaranteed by COSME (an EU programme aimed at the strengthening of competitiveness of companies), which combines higher credit amounts with attractive terms of financing. In the case of investment loans with de minimis guarantee and registered pledge, the collateral catalogue was expanded so that mortgage is no longer the main security for the loan.

In March 2016 mBank also obtained the consent of the Minister of Digital Affairs to establishing a centre of confirmation of ePUAP (electronic public administration services platform) trusted profiles, starting the process of integration of the Bank with electronic public administration services. At the same time, the Bank offered account maintenance services to limited partnerships, associations, schools and educational institutions.

Mobile application

The mobile application, launched in February 2014, has won a large group of new users over the last three years, and based on a survey of actual needs of the clients, has been enriched with a number of new features. Mobile banking services are used systematically by over 1.3 million clients, an average user does banking via mobile devices 18 times a month. The “mBank PL” application offers a wide range of convenient and unique solutions, e.g. the “loan in 30 seconds” which now accounts for 18% of overall cash loan sales.

Following the positive reception of the new features introduced in 2015, such as the payment of invoices using QR code scanning, NFC payments for Android system (available to Orange subscribers), and the option to change the authorisation limits on payment cards, mBank decided to pursue further development.

In 2016 we introduced a number of new features and improvements into the application, including:

- “mLine in a click” service, which allows clients to connect with mLine consultants directly from the application, without the need to use one’s ID and telecode;

- option to change card transaction limits;

- possibility of logging into the application with a fingerprint;

- express transfers using telephone numbers within the BLIK system;

- possibility of purchasing travel insurance (at present, 15% of travel insurance policies are bought via the application);

- “Payment Assistant” service which reminds clients of all regular payments, suggesting the amount due and the payment date and allowing them to quickly settle invoices;

- mobile Authorisation - a service allowing users to authorise transactions made in the transaction system via the mobile application. Instead of typing passwords received in a text message, all that the client needs to do is to log into the application and accept (or reject) a given transaction with one click.

In February 2016, the mobile application was ranked the best banking application in the Mobile Trends Awards competition, and in September it won the "Newsweek Friendly Bank" ranking in the “Mobile Banking” category. For more information about awards for mBank Group in 2016, go to section 6.1. Key projects and innovations of mBank Group.

Cooperation with AXA Group

In 2016 the cooperation with mBank’s strategic partner in the insurance sector, AXA Group, was continued. It started in 2015, along with the finalisation of the sale of shares in BRE Ubezpieczenia TUiR and conclusion of distribution agreements, governing long-term cooperation between mBank Group and AXA Group with regard to the distribution of insurance products.

Works are pending on intensifying cross-selling and stand-alone sales among the Bank’s clients.

In the insurance area, in 2016 the Bank made travel insurance available in the mobile channel and launched civil liability insurance (OC) and comprehensive motor insurance (AC) for small and medium-sized enterprises. Moreover, the Bank offered a new product, individual term life insurance, which is sold in the network of mBank and mFinanse.

mBank: get cancer off your chest (odetchnij pełną piersią)

The above slogan was used in mBank’s campaign supporting its clients in their decision on taking out insurance in case of developing malignant breast cancer. The activities were aimed at women who tend to forget about themselves in the daily hustle and bustle. The campaign lasted until the end of November 2016.

Breast cancer is the type of cancer most frequently diagnosed in women in Poland. According to some sources, over 16 thousand Polish women develop breast tumor yearly. What is worse, the majority of patients are diagnosed when the cancer is already at an advanced stage, whereas early detection gives patients the best chance of treating the tumor successfully. In Poland, as little as one in four women use the opportunity to undergo free mammography. This is why education and prevention are of major importance.

The campaign was related to breast cancer, but the insurance covers much more. The product is addressed to both women and men, and it covers a long list of malignant tumours. The insurance is available in three versions. The maximum amount to be paid to a client in the event of cancer diagnosis is PLN 100 thousand. The product was developed in co-operation with the insurance company AXA, which also co-organises all activities.

Cooperation with Orange

It has already been two years since the joint-venture of mBank and Orange, Poland’s leading landline telephone, mobile, Internet and data transfer provider, called Orange Finanse, was launched.

At the end of 2016, the number of Orange Finanse accounts reached over 330 thousand, including approximately 100 thousand opened in 2016 alone. Orange Finanse became one of mBank’s key acquisition channels.

2016 was a period of changes in the product offer supported by marketing campaigns promoting the Orange Finanse brand among the existing and prospective clients of Orange. The key component of the new offer is the option for active users of the Bank’s services to lower their monthly phone bills in a period of up to 24 months. A new, more comprehensive credit offer was introduced in June 2016. The existing clients of Orange Finanse can now take out cash loans of up to PLN 150 thousand in all Orange stores.

In 2016, Orange Finanse was enhanced with new interesting functionalities in the mobile application and online banking. For example, by clicking a dedicated button in the mobile application, the users of all platforms can now quickly get in touch with the Bank’s contact centre, a one-of-a-kind solution on the market. Another novelty is the Payment Assistant sending text messages reminding them of upcoming transfers.

H2 2016 was marked with further efforts to improve selling competences of Orange stores’ employees. Tests of new selling scenarios and client communication methods were conducted and a series of training sessions was implemented to broaden the knowledge on Orange Finanse products.

In September, Orange Finanse ranked second in the mobile banking category of the Newsweek’s Friendly Bank ranking (mBank ranked first). This means advantage over competition in terms of easy navigation in mobile application, effective channels of communication with the Bank and services and functionalities available in the application.

For more information about the strategic cooperation with Orange, go to chapter 6.1.Key projects and innovations of mBank Group.

Development of the retail banking offer in Poland

Loans

The graph below presents the structure of the Retail Banking loan portfolio in Poland at the end of 2016:

In 2016 new sales of non-mortgage loans amounted to PLN 5,639.5 million, up by 25.3% year on year. Sales of mortgage loans in 2016 stood at PLN 2,186.9 million (including sales of mBank Hipoteczny), which represents a decrease of 36.5% year on year. The drop in sales of mortgage loans, with non-mortgage loans increasing at the same time, was mainly driven by changes in the strategy and focus on sales of higher margin products.

2016 was another year when the portfolio of non-mortgage loans granted to households grew dynamically, by PLN 1,662.4 million, i.e., 18.7% year on year. The portfolio of mortgage loans stood at PLN 34,112.7 million, with an increase by PLN 639.3 million year on year.

The NPL ratio of the mortgage loan portfolio slightly dropped year on year, and stood at 3.7% at the end of 2016.

Deposits and investment funds

In 2016, the balance of savings products (term deposits and savings accounts) grew by PLN 6,453.9 million, which represents a 16.4% rise compared with the end of 2015. The strong sales results in the area of savings products were possible thanks to a number of initiatives taken, including:

- implementation of the effective process of term deposits retention, which aims at retaining the base of maturing term deposits and strengthening the long-term relations with the Bank’s clients;

- special offers supporting cross-selling - promotional offer of Open-end Investment Funds combined with term deposits;

- introduction of the umbrella fund Promising mFunds (in Polish: mFundusze Dobrze Lokujące) comprising three strategies of investment funds, varying in terms of risk;

- implementation of subscriptions for investment certificates of Closed-end Investment Funds and structured certificates;

- enabling clients to invest in new subscriptions for structured deposits;

- introduction of public offering of corporate bonds for retail clients.

The balances of deposit products increased while the financial discipline was maintained.

The growth in retail clients’ deposit base was accompanied by a slight rise in spending on investment products. Due to unfavourable situation on capital markets in H1 2016, the Bank offered its clients mainly solutions characterized by low or highly-limited investment risk (e.g. structured products, money market funds). In H2 2016, the Bank conducted a subscription of the umbrella fund Promising mFunds and a subscription of investment certificates of Closed-end Investment Funds. In December 2016, the Bank participated in the public offering of corporate bonds.

At the end of 2016, retail deposits in Poland amounted to PLN 45,727.6 million compared with PLN 39,273.6 million at the end of 2015.

Cards

Since 2016, young clients of mBank have been offered new credit cards of the Mastercard Me series. Thanks to these cards, they can express their individuality and satisfy their financial needs at the same time. mBank’s card won the title of “the most innovative card in Poland”, and its commercial was hailed “the best card product commercial in Polish media” at the 2016 Polish Card Gala. Moreover, clients voted mBank one of the top three providers of “the most beautiful Polish card of the year” in 2016 in an online voting. What is so innovative about the card is the possibility of designing its layout and placing one’s own picture or a picture from the Bank’s gallery on it, or alternatively choosing a transparent card.

In 2016, the value of payment card transactions made by mBank’s retail clients exceeded PLN 26 billion, which represents a rise by 21.2% year on year. The number of transactions made by mBank clients grew by 27.8% year on year. mBank’s credit cards are also characterised by a very high average number of transactions per client. The market share of transactions made with the use of mBank’s cards stood at 12.6% at the end of September 2016.

Brokerage operations and asset management

In May 2016, the brokerage services rendered by Dom Maklerski mBanku and mWealth Management were subject to integration within the Bank, as a result of which all brokerage operations of mBank Group are currently offered through mBank Brokerage Bureau, which is an organisational unit of the Bank.

The operations of mWealth Management were taken over by mBank’s Retail Banking segment. In 2016, the Bank developed its comprehensive wealth management services including investment advisory and asset management. The assets managed by Private Banking remained stable year on year and stood at PLN 5.2 billion at the end of 2016.

The year 2016 ended with a great success in respect of the strategies managed as part of asset management services dedicated to mBank’s Private Banking clients. In the latest ranking of asset management by GG Parkiet for Q4 2016, mBank took the leading positions in almost all categories. Aggressive share strategy, sustainable growth model portfolio, stable growth model portfolio and conservative model portfolio ranked first in their categories. In acknowledgement of the top quality services, the Bank received the Euromoney award for the best private banking and wealth management offer in Poland for the eighth time.

The Brokerage Bureau of mBank (BM) provides a comprehensive offer of brokerage services to the largest Polish institutional investors (pension funds, investment funds, asset managers), foreign funds, and individual clients, i.e. retail and affluent clients. The Brokerage Bureau enables clients to trade on regulated markets in Poland and abroad as well as on the OTC (FOREX/CFD) market. As part of wealth management services, clients may use investment advisory and asset portfolio management services. The Bureau is an active player on the primary market – it prepares and conducts public offerings (IPO/SPO/ABB).

At the end of 2016, the Brokerage Bureau maintained 300.3 thousand brokerage accounts (including 5.4 thousand Forex/CFD-related accounts and 1.4 thousand accounts held by financial institutions), which represented an increase by 1.3 thousand year on year.

Retail Banking in the Czech Republic and Slovakia

In 2016, in the Czech Republic and Slovakia, mBank acquired 72.9 thousand clients (out of which 17.2 thousand clients in Slovakia, and 55.7 thousand clients on the Czech market).

The activity of mBank in the Czech Republic and Slovakia in 2016 was focused on intensifying its acquisition efforts, as well as continually building the position of a mobile bank of reference.

The offer was expanded with (as was the case in Poland) a new current and savings account for young clients, which develops alongside the client’s needs in terms of pricing and functionalities.

The branch network modernisation is on track: two new “light branch” financial centres were opened in the Czech Republic and Slovakia. Also, 12 new outlets specialising in banking services were opened as a result of cooperation with Broker Consulting, a Czech agent on the financial services market. mBank is the main banking partner in this undertaking. The cooperation also led to the introduction of two new co-branded cards: a debit and a credit card.

In addition, mBank in the Czech Republic and Slovakia also extended its offer by adding four new debit cards to the offer: gold debit card, debit phone sticker, debit card for entrepreneurs and debit card for the young. Three new credit cards were also added to the offer.

The activity of mBank in the Czech Republic and Slovakia in 2016 won several awards. mBank’s account for entrepreneurs was ranked first on the market, while mKonto account and online banking ranked second in the Zlata Koruna contest. Additionally, mBank’s mortgage loan for refinancing real estate was ranked third in the weekly newspaper Trend. Apart from that, mBank’s mobile application was yet again appreciated, this time with the Golden PCNews award, as one of the best on the Slovak market. mBank in the Czech Republic received the title of “Superbrand 2016”, becoming one of the strongest brands on the local market.

Loans and deposits

At the end of 2016, the loan portfolio of mBank clients in the Czech Republic and Slovakia stood at PLN 4,279.7 million, which represents an increase by PLN 455.7 million, i.e. 11.9% compared with the end of 2015.

The Bank pursued targeted initiatives to grow sales of non-mortgage loans. In 2016 the sales of non- mortgage loans amounted to PLN 489.4 million, up by 25.3% year on year. Sales of non-mortgage loans in the Czech Republic amounted to PLN 361.2 million, up by 24.6% year on year. At the same time, sales of non-mortgage loans in Slovakia increased by 66.1% year on year and stood at PLN 128.2 million.

Sales of mortgage loans decreased by 34.6% year on year to PLN 692.5 million in 2016. Sales of mortgage loans in the Czech Republic totalled PLN 551.0 million compared with PLN 751.3 million in 2015 (i.e. - 26.7%), while in Slovakia it stood at PLN 141.6 million (down by 54.0% year on year). The drop was the consequence of sales efforts in the area of credit products with higher margin and the changes in pricing policy of mortgage loans.

The Bank’s deposit base in the Czech Republic and Slovakia increased by PLN 1,563.5 million or 24.5%. compared to the end of 2015.

Corporates and Financial Markets

[G4-4, G4-8, G4-9, FS6] The Corporates and Financial Markets segment serves  20,940 corporate clients including large enterprises (K1 - annual sales exceeding PLN 500 million), mid- sized enterprises (K2 - annual sales of PLN 30 – 500 million) and small enterprises (K3 - annual sales below PLN 30 million) through a network of dedicated 45 branches. mBank Group’s offer of products and services for corporate clients focuses on traditional banking products and services (including corporate accounts, domestic and international money transfers, payment cards, cash services, and liquidity management products), corporate finance products, hedging instruments, equity capital market (ECM) services, debt capital market (DCM) instruments, mergers and acquisitions (M&A), leasing and factoring. The segment comprises two areas: Corporate and Investment Banking, and Financial Markets.

20,940 corporate clients including large enterprises (K1 - annual sales exceeding PLN 500 million), mid- sized enterprises (K2 - annual sales of PLN 30 – 500 million) and small enterprises (K3 - annual sales below PLN 30 million) through a network of dedicated 45 branches. mBank Group’s offer of products and services for corporate clients focuses on traditional banking products and services (including corporate accounts, domestic and international money transfers, payment cards, cash services, and liquidity management products), corporate finance products, hedging instruments, equity capital market (ECM) services, debt capital market (DCM) instruments, mergers and acquisitions (M&A), leasing and factoring. The segment comprises two areas: Corporate and Investment Banking, and Financial Markets.

Key financial data (at the end of 2016):

Key business data:

Key highlights

- Nearly 1.4 thousand of new corporate clients.

- Increase in corporate deposits by 8.6% year on year to PLN 2,959.6 million.