DANE FINANSOWE

CSR Strategy

[G4-34] At the end of 2015, the Management Board of the Bank adopted a strategy defining directions, goals and measures as regards CSR. “Strategy for corporate sustainability and responsibility of mBank S.A.” is a result of group work involving key managers responsible for particular functional areas of the Bank. 2016 was the first year of the strategy implementation. In this report, our aim is to assess the actions taken by us.

The approach to social responsibility management adopted at the strategy building stage is based on the PN-ISO26000 standard. The provisions of the Global Reporting Initiative (GRI) G4 reporting guidelines and of the sector supplement relevant for the industry have been applied as well. In accordance with the guidelines set out in PN-ISO 26000, the work on the strategy was underpinned by meeting two fundamental conditions of corporate social responsibility, i.e. (a) identifying and mapping key stakeholder groups, (b) acknowledging the Bank’s responsibility by defining and indicating key areas of corporate social responsibility. The workshop held at the end of May 2015, attended by key managers of the Bank responsible for areas potentially significant from the point of view of the Bank’s corporate social responsibility helped identify the scope of responsibility and map the stakeholders.

The effects of the workshop and later in-depth interviews with selected managers made it possible to define the following goals and indicators (the main goals are supplemented by lower category targets and measures. Together, they form a comprehensive strategy).

| Measure (KPI) | Milestone (MS) / Measure (M) | 2016 | 2017 | 2018 | 2019 | 2020 |

| Goal 1: We want to understand, respect and share our clients’ values. We want to be open. We want to think and feel like they do. | ||||||

| NPS for a business client (for particular major events) | M | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period |

| NPS for a retail client (for particular major events) | M | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period |

| Goal 2: We want to be a responsible lender. | ||||||

| Number of major social or environmental conflicts in which mBank, being a financial institution, participates indirectly | M | 0 | 0 | 0 | 0 | 0 |

| Goal 3: We want to build an exceptional team, competence and skills. We want to share what’s best about us with others. We want to be unique. | ||||||

| results of the Employee Engagement Survey (assessment of workplace satisfaction) | M | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period | >100% from the previous period |

| Goal 4: We want to reduce our environmental footprint. | ||||||

| Reducing bank’s environmental footprint with respect to: - CO2 emission / revenue - water consumption / revenue - paper consumption / revenue | M | |||||

| Goal 5: We want to improve our management approach. | ||||||

| position in the Ranking of Responsible Companies (guaranteeing a high position among institutions from the financial sector) | M | minimum 8th (among financial institutions) | minimum 5th (among financial institutions) | minimum 4th (among financial institutions) | minimum 4th (among financial institutions) | minimum 3th (among financial institutions) |

| listed in the RESPECT Index | M | |||||

In June 2016, the Management Board adopted the “Code of Conduct”, which once again clearly indicates the key areas of mBank’s corporate responsibility and expected behaviours of employees (see the chapter Responsible company, “Prevention of unethical behaviours”, the frame “Code of Conduct”).

Goal 1: We want to understand, respect and share our clients’ values. We want to be open. We want to think and feel like they do

Dialogue with Clients

[G4-26] It is no coincidence that it is at mBank where numerous pioneering solutions based on collaboration with clients were developed. Openness to dialogue stems directly from the adopted philosophy of carrying on business. It also derives from the five basic values – client-centricity, looking ahead, simplifying, commitment and professionalism – which form the corporate culture.

“The client-centric approach, empathy towards clients” is a fundamental value at mBank. This means that whatever we do, we are always guided by individual needs, preferences and behaviours of our clients, which we are aware of, understand and are able to anticipate. The belief that clients and their needs should be in the centre of all actions taken by us is what underlies our numerous initiatives. Tangible manifestations of the client-centric approach include the apprenticeship in the bank’s branches obligatory for top managers, the 2016 training for all outlet employees in providing service to persons with disabilities, or the provision of customer service in the sign language in a video chat.

The belief that clients and their needs should be in the centre of all actions taken by us is what underlies our numerous initiatives.

mCouncil (mRada)

mCouncil (mRada) is a group of mBank’s ambassadors. mConuncillors (mRadni) were not the employees of mBank nor did they receive remuneration from us for their activity. They were recruited, among others, from clients who showed particular interest in the bank’s operations and were very active on Internet forums, blogs or in social media. After having operated for 16 years, however, mCouncil was suspended as it’s formula had ran out. A new formula of institutionalised dialogue with clients is being developed.

mBank’s consultants active round the clock in social media

mBank has appointed a separate consultant team, composed of the most experienced experts of mLinia. Their task is to answer clients’ questions asked in social media and on major Internet portals and forums. The team monitors Internet services on an on-going basis and is available 24 hours a day 7 days a week. It provides mBank’s clients with quick answers to their questions and helps them in case of any difficulties related to using our products and services.

Contact via Messenger

Market research indicates that Poles use both mobile devices and communicators, the new tool used for transmitting information, more and more frequently. Messenger is among the most popular communicators.

In response to these needs, we introduced changes on mBank’s contact page at the beginning of November. Instead of writing an e-mail, clients can contact us using Messenger. By clicking on the Messenger icon, users are redirected to the application and their messages are sent to the Social Media team. This change supports two elements of the new strategy of mBank – mobility and efficiency. We want our clients to contact us using channels in which we can answer their questions as quickly as possible. Of course they can still contact us via e-mail – the e-mail address is displayed at the bottom of the contact page.

[G4-26] Platform for dialogue and micro-entrepreneurs’ engagement

Meetings with micro-entrepreneurs, organised since the beginning of 2015, have provided a platform for an open dialogue about the needs, barriers and challenges which are part of our client’s daily life, and gave us an opportunity to better understand their way of thinking.

The formula of the project is constantly evolving. Clients share their ideas with us and vice versa. This is how our new product, mKsięgowość, was developed. We asked a group of entrepreneurs we serve about their opinions on the product we were preparing. In the course of the meetings, an idea originated that the tab reminding of important deadlines as regards accounting (e.g. the deadline for payments to the Polish Social Insurance Institution (ZUS) and tax payments) should be displayed on the desktop and not in the application itself. From the clients’ perspective, this makes a significant difference since the desktop screen is undoubtedly viewed more often, so that the information, the so-called task centre, is not likely to go unnoticed. We accommodated these suggestions, thanks to which the final product meets the clients’ expectations even better.

Tomorrow belongs to women. A series of seminars

For several years, we have been organising a one-day event entitled “Tomorrow Belongs to Women”, addressed to key female corporate clients of mBank. Twice a year, we host around 100 women who own companies and sit on management boards of large companies. Also the members of the management board and managers of our bank participate in the meetings.

The seminars are subject-oriented and include a component dedicated to lifestyle as well as a meeting with a special guest – a success business woman. In 2016, our special guests were Kinga Baranowska and Ewa Wachowicz.

Satisfaction survey

[G4-PR5] We listen to our clients actively. Every month, we contact clients to ask for their opinions. As a result, we receive substantial feedback about the quality of service, the functioning of processes and products. We also monitor comments made and opinions expressed by the clients on the Internet – mainly in social networks and on Internet forums and websites related to the quality of service. The information is provided to the persons responsible for particular areas and to frontline employees. Then, upon an analysis, it is translated into specific remedial actions.

Additionally, in regular surveys which we have conducted for many years, we ask respondents about their level of satisfaction with our processes, products or the cooperation with the bank. In 2016, we implemented the strategic project entitled mSatysfakcja in Corporate Banking, which focuses on the key moments in the clients’ relation with the bank, such as meetings in branches, contact with the call centre, completion of a credit application process, closed complaint, experience related to the use of the transactional system or mobile application. In the survey, we ask clients about their willingness to recommend mBank’s services (NPS). Apart from closed-ended questions, we also ask open questions which show the reasons behind clients’ scoring decisions. In the case of negative assessment, we contact selected clients in order to understand the reasons behind their dissatisfaction and help them solve the problem they encountered. All client opinions are analysed as a basis for projected improvements and new implementations at the bank. NPS surveys among retail clients are carried out relatively often; however, using them in the segment of large corporate clients is still a pioneering solution. In the survey, respondents may assess, among others, the quality of channels for filing complaints, availability of our employees and clarity of the responses provided by them. The survey covers not only corporate clients of mBank, but also mLeasing and mFaktoring clients. Thus, we have the opportunity to approach the clients from a more comprehensive perspective and understand them better.

The results of NPS among corporate clients are good and have been improving – the level of NPS (for all the cpororate clients) increased by 36% compared with 2015. Still, the NPS is the aim at its own, since what counts is the process of collecting feedback from clients and the actions taken on the basis of it, aimed at improving the clients’ satisfaction as regards their relationship with the bank.

We also engage in mystery shopping on a regular basis. Quality audits are cyclically conducted in branches, mLine and the Online expert service. The auditors assess branches in face-to-face conversations, acting as potential and actual clients. We conduct such an audit in different scenarios. The auditors visit branches, contact the call centre, write e-mails, use the Online expert service to obtain information, among others, about the offer of individual accounts, accounts for companies, loans, deposits or to ask different questions related to the bank’s services. After every audit, the level of meeting the applicable standards is assessed.

Our employees also monitor the opinions about the quality of mBank’s services registered on the website jakoscobslugi.pl on an ongoing basis. Every opinion is analysed and forwarded to a relevant unit which introduces relevant remedial measures (contact with a branch or person responsible for the area where the clients see room for improvement).

„Closed loop”

Thanks to the results of the research we are more aware of clients’ needs and expectations. We strive to determine what we can change and optimise, and finally, in another cycle of research, to assess whether the obtained results are satisfying. This is a kind of a closed loop.

In the survey, respondents may assess, among others, the quality of channels for filing complaints, availability of our employees and clarity of the responses provided by them. We try to reach those employees of the client who are directly involved in cooperation with the Bank and the matter in question in order to ensure that the results are as comprehensive as possible. Opinions of those persons are an invaluable source of information for us. Our employees involved in the satisfaction assessment not only analyse the statistics, but they also review each survey. Relationship managers can view the results of the assessment in the CRM system. Their task is to conduct more detailed interviews and assist in finding a solution to identified problems. Clients’ opinions sometimes lead to significant system or organisational changes. What is more, we always endeavour to explain the reasons behind particular solutions (e.g. clients relatively often point to the excess complexity of some specific clauses, which, however, are obligatory regulatory clauses that the Bank must comply with).

The attention we dedicate to analysing business clients’ opinions is perceived positively by them. With every year, the number of clients participating in the NPS survey increases. Clients who are positively surprised by the bank’s approach more and more often declare that they are willing to recommend our services to other entrepreneurs.

The dialogue with clients is not only an invaluable source of knowledge and a tool helping to improve processes and products. It also directly translates into building trust and long-term partnership relations.

Reliable, clear and transparent communication of products

[PR DMA, G4-PR1] Retail clients have voiced the need for complex banking documentation to be simplified for a long time. We noticed that our agreements did not fulfil the clients’ needs and expectations. The conducted qualitative research confirmed that the language used in the agreements was too difficult, while the specialised banking terminology and the rigid document structure discouraged the clients from reading an agreement carefully. We decided that this needed to change and started a new chapter regarding the contact between the client and the bank.

The project entitled Action Renovation is a revolutionary change in the way of thinking about agreements. An agreement has to be understandable for clients as it forms the backbone of their long-term relationship with the bank. This is why we introduced a completely new format of agreements. We removed the unpopular paragraphs which hardly anybody read. Instead, we concentrated on explaining the principles of our products and on provisions which help clients find the content which is of particular interest to them. Our new agreements do not include typical legal terms. Instead, they are presented in the form of the table, some information are highlighted with colours, there are questions and answers, as well as symbols indicating client’s obligations and rights or supplementary information. The language of our agreements is simple and clear. We know that our clients are constantly in a hurry and look for information which they need here and now. Therefore, we handle one topic in one paragraph and provide clients with tips on how to adjust a given product to their individual needs. Through an agreement, we want to build partnership and ensure the security of the client’s relation with the bank. Clear message and an intuitive structure of the document are our priorities. We address our clients with respect, but at the same time avoid impersonal forms such as e.g. “borrower” or “account holder”.

In the previous year, further arguments were subject to changes under Action Renovation. The new agreement form received a very warm welcome from our individual clients. Three out of four agreements concluded in 2016 were drawn up in the new format. In surveys, clients assessed the agreements as clear or rather clear – nobody evaluated them in negative terms as regards clarity.

mBank simplifies credit agreements

The terms and conditions of a loan in the form of a clear table, with an explanation of the most important financial terms – such is the layout of the new credit agreement of mBank. It is another step taken to simplify all the documents signed by our clients, right after an account agreement.

We have changed a cash loan agreement to make it clear and understandable to the client. This is why, while providing the same scope of information, we decided not to use the difficult, specialist jargon and clauses.

The content of the new document was divided into subjects providing answers to specific questions of our clients, e.g. when they will receive funds, what the repayment schedule and the interest rate will be. Subsequent subpoints are highlighted in different colours, and details are presented in the form of a table. The formal specialist jargon has been limited to the necessary minimum. We explain the most important terms clients may find difficult to understand, e.g. WIBOR or BOK.

The agreement was consulted with clients prior to its introduction. The bank analysed the manner in which clients read agreements, elements they find important and what they want to learn from them.

Simultaneously, the bank has started to simplify the documents for corporate clients. An agreement on secured credit line offered to corporates was the first to undergo changes.

Complaints

Retail Client

As part of the complaint process management, we systematically analyse clients’ needs and spare no efforts to act in line with their expectations. The research we have carried out indicates that the most satisfied clients are those who have never experienced any problems when using the bank’s services, this is why we focus our key initiatives on preventing reasons behind complaints.

We do this by:

- analysing a potential risk of complaints when developing new products with the most user- friendly construction possible;

- analysing reasons behind complaints filed by clients and improving other processes on the basis of the conclusions drawn,

- minimising the scale of complaints filed in emergency situations

- building “client-centric” attitude among the bank’s employees.

Once a complaint has been filed, we try to satisfy first the most important expectations of our client, i.e. solve the problem and provide a clear answer in a friendly manner.

We improve the handling process by successively shortening its duration, standardising measures and eliminating downtime.

When communicating with clients, we apply mKanon, i.e. the rules developed by the bank for equal and emphatic communication which takes into account the client’s point of view and meets their expectations.

It is very important to us to handle complaints effectively so that a given problem does not happen in the future. We want to serve our clients the way we would like to be served ourselves.

The complaint process does not end in providing a reply to the complaint. We want our clients to assess it on an ongoing basis. Through surveys by phone and e-mail we study clients’ satisfaction with the complaint process. The results of these surveys and clients’ suggestions provide rich material for analysis and further work on improving quality standards.

A request for feedback in the process of complaint handling

Is the client satisfied with the solution proposed in the process of complaint handling? To answer this question, in 2016 we created a tool for the assessment of the complaint process in the form of an e-mail survey. Upon solving the complaint, the client receives a questionnaire form with 5 questions about our process, i.a. how long it took us to handle the problem, whether the reply to the complaint was exhaustive and whether the problem was effectively eliminated. We also ask our clients for their comments and proposals for the process optimisation.

These questionnaires have become a mine of information about clients’ opinions and employees’ attitudes.

Clients’ reactions are positive and they are willing to share their observations with us. The standard response rate for an e-mail questionnaire totals approx. 3%, while in this case we have a 10% feedback, which gives us over 1000 opinions of clients monthly!

After 5 months from the implementation of this solution, also thanks to several optimisation measures, almost 60% of clients give positive, even enthusiastic opinions about our bank.

We consider it a great success arising from hard work and strong commitment of the teams responsible for complaint handling.

Corporate client

In the process of complaint handling, we consider clients’ satisfaction crucial. We try to handle complaints of corporate clients in a quick, thorough and diligent manner.

A corporate banking client may lodge a complaint in a form they find convenient: by phone, e-mail, in writing or in person at a bank’s branch. Electronic banking plays an important role in the process. The client may file a complaint via mBank CompanyNet system in an easy and convenient way. Thanks to this channel, a complaint is forwarded directly to the corporate branch maintaining a client’s account. Through mBank CompanyNet, the Client is notified of the receipt of a complaint by the bank, the person handling the complaint, and the reply to the complaint once the problem has been resolved.

We consider clients’ complaints an indispensable source of knowledge. This is why we try to analyse constantly reasons behind complaints. Using information from clients, we adjust our product offer to their needs and expectations. Customer service quality is also analysed in the complaint handling process, and its standards are improved on an ongoing basis.

Security of clients and their data

[PR DMA, G4-PR8] We regularly update and upgrade the technological solutions used that allow us to protect transaction systems, mobile applications, as well as other IT resources against hostile attacks and any unauthorised actions of third parties. We also monitor unusual behaviours, carry out internal controls and audits to prevent hackers from accessing the bank’s IT systems. However, the security of transactions depends not only on the financial institution but also on clients.

The clients who do not pay attention to whether they use secure connection with the bank’s transactional system, do not guard their one-off passwords, do not use any anti-virus software, or those who freely disclose their sensitive data expose themselves to risk. The transaction limits on payment cards set individually by the client may also serve as security. We monitor card transactions and detect all anomalies and unusual behaviours that can be a symptom of frauds committed by third parties. A private unsecured PC, tablet or mobile phone, on whose security the bank has no impact, may also pose a threat. A device without an up-to-date anti-virus software, access protection or with applications downloaded from unreliable sources exposes its user to risk.

In 2016 mBank continued its first social campaign promoting online security “You don’t do it in real life? Don’t do it online!”, launched in November 2015. The campaign was addressed not only to the bank’s clients but to all internet users who bank and make other transactions online.

Its aim was to explain – via various communication channels, including the website www.mBank.pl/uwazniwsieci – the possible threats lurking online and how to protect oneself from it. The campaign was based on the concept of moving risky online situations to real life. Some well-known vloggers have become the ambassadors of the campaign: Krzysztof Gonciarz on the channel “The Beeczka”, the authors of “Abstrachuje” and “5 sposobów na...”. They told their followers about risky online behaviour.

Additionally, natemat.pl and aszdziennik.pl websites promoted the campaign with their action, based on the most popular campaign hashtag #mojezlehaslo.

The campaign attracted many viewers, in TV channels it reached over 81% of the target group, over 1 million Internet users visited the dedicated website to find out about the published information, and the average time visit totalled 2 minutes. YouTube spots views totalled over 4 million. In 2016 the campaign was among the finalists of the "Educational business activities. List of the most significant initiatives” project, conducted by the Responsible Business Forum (Forum Odpowiedzialnego Biznesu).

The security campaign hailed the Social Campaign of the Year (May 2016)

In the eighth edition of the Social Campaign of the Year competition organised by the Foundation for Social Communication, 85 projects were entered, out of which the jury selected winners in the 10 main categories. The jury of the competition is composed of experts in social marketing and, in particular, in social campaigns and actions for the public good. The mBank’s campaign that drew attention to online security was considered the best in the “Campaigns organised by companies and companies’ foundations” categories.

The jury stressed that the first social campaign in mBank’s history, “You don’t do it in real life? Don’t do it online!”, used an analogy to convincingly draw attention to threats arising from careless behaviour in the Internet.

Broňa and Robert came back to school to share their knowledge about cyber-security

Broňa Dvořáček and Robert Chrištof, CZ/SK mBank managers, came back to school. As part of the “Bankers go to school” project of the Czech Banking Association (ČBA), they visited secondary schools to discuss with students the important issue of safe online behaviour.

The issue of cyber-security is still slightly underestimated in the Czech Republic. Students of the third and fourth grade, who participated in the “Bankers go to school” project, spend a few hours daily surfing the net. This is why the bank experts tried to draw their attention to online threats, teach them how to identify a hacker’s attack and explain preventive measures used by banks.

It turned out that the Czech students are interested in cyber-security; their reactions and questions revealed that they consider the issue important and they are aware of possible risks. On the other hand, most of them give little weight to the issue of mobile security.

In 2014-2015 we did not report any justified claims concerning personal data leakage.

Golden security rules

Security in electronic banking, including mobile banking, depends not only on the bank, but also on you. To avoid threats, one should act carefully and apply the principle of limited trust.

Golden security rules are presented below.

- Carefully read the information and notifications displayed during logging in and executing transactions. Keep in mind that criminals can make fake websites, including fake bank websites. If you have noticed something surprising in the layout of mBank’s website or spotted an odd activity, contact us immediately.

- Carefully read text messages, including transaction confirmations. The operations, bank account number and amount provided in the message must be consistent with those ordered by you in the transaction service. Pay attention to the content of text messages received from the bank even if you execute transactions very often.

- If any message or element of the transaction or mobile service has raised your doubts – stop the operation and contact mLine consultant or online expert immediately. We are at your disposal 24 hours a day.

- Do not open any suspicious e-mails or attachments. Beware of links in e-mails! They may infect your device with malware. That applies to your every e-mail address and all the received e-mails.

- Do not open the website of the bank’s transaction service via a link from e-mail or Internet search engine. Cyber- criminals can fake addresses. Use the log in button on the website of mBank.pl or log in directly at: https://online.mbank.pl/pl/Login. Always check whether the connection is encrypted (whether the lock is displayed before the address).

- Do not install additional software on a computer, tablet or mobile phone on request – bear in mind that the bank never asks for it (especially via e-mails, text messages or messages on the bank’s website!). Software or application may be used by cyber-criminals to take control over your device.

- Bank only using tested devices, avoid logging in on someone else’s computers, tablets or mobile phones. Follow the principle of limited trust.

- Download applications for mobile devices only from official stores: AppStore (for iOS system), Google Play (for Android system), Windows Phone Store or Windows Store (for Windows systems). Software available there is verified, so it guarantees security.

- Up-do-date and legal software must be installed on your device: an operating system, an anti-virus software and a recommended browser. Cyber-criminals use software vulnerabilities. Updates of legal software often eliminate such “vulnerabilities,” thus hampering criminal activities.

- Carefully read mBank’s warnings against new threats. It will help you avoid problems. We keep you posted on the identified threats.

- Protect your online security and read the following sections: safe online banking from computer, mobile phone and tablet, safe use of credit cards.

Banking without borders

Mobility

[FS13, FS14] In 2000 mBank, at the time a new brand on the market of banking services, revolutionised retail banking. For over 16 years we have been setting new trends and directions in mobile and online banking. mBank has been a synonym for innovative banking solutions. We are a mobile banking leader, we prove that “m” stands for mobility.

At the same time, we are aware that IT and mobile technology change our life and the world around us, giving us comfort, speed and unlimited access to banking services. The moment mBank entered the market, almost overnight everyone who had access to the Internet, the coverage of which was getting broader and broader year after year, was able to use the modern banking services, regardless of their place of residence. It was enough to have access to the internet which was becoming increasingly common.

Our business model of access to banking services automatically became a reply to the threat of exclusion of inhabitants of less urban areas. mBank’s social innovativeness consisted in a total redefinition of the business model rather than looking for fragmentary solutions. Banking services became more available to the disabled who had trouble visiting the bank’s branch. Since February 2014, our clients have been offered an original and upgraded mobile application built from scratch by our specialists and adjusted to actual needs of its users.

Last year the potential of our bank platform was recognised by the officials of the Ministry of Family, Labour and Social Policy implementing the “Family 500+” programme. As an effect of our agreement, our platform developed to provide commercial banking services has become a convenient tool thanks to which thousands of Polish families could easily apply for the child benefit under the above programme.

The agreement between mBank and the Ministry of Family, Labour and Social Policy concerning the “Family 500+” programme

The agreement between the bank and the Ministry refers mainly to the possibility of using electronic banking system to submit applications under the “Family 500+” programme, thanks to which clients of mBank and Orange Finanse may apply for the child benefit online, without the need to visit the municipal office and present documents in paper form.

Holders of an account with mBank or Orange Finanse could file an application for the benefit on the first effective day of the programme, i.e. already on April 1, 2016.

The application form is available in the electronic banking system upon logging into the bank. The bank transfers the client’s application to the public administration system (Emp@tia), and a competent administration authority reaches a decision.

We spare no effort to increase availability of our services. Last year we developed our application and implemented express transfers via BLIK system using the beneficiary’s phone number.

mBank develops BLIK. P2P transfers using a phone number available

mBank has introduced into its mobile application the possibility of P2P transfers via BLIK system using the beneficiary’s phone number.

mBank’s clients using a mobile application and BLIK can make a P2P transfer for the benefit of another person and do not have to provide the beneficiary’s account number, even if the latter is an account holder with another bank.

The concept of express transfers executed via BLIK and Express ELIXIR is very simple: no additional authorisation is required and the execution is prompt. In order to receive a transfer via BLIK, you just need to register your phone number in the application. To make a transfer, all you need to know is the beneficiary’s phone number. In a couple of seconds, funds are credited to the beneficiary’s account. At present, P2P transfers via BLIK may be made between clients of mBank, Bank Millenium, ING Bank Śląski and Bank Zachodni WBK.

#YOLO in banking. mBank with a new offer for the youth

mBank has introduced new financial products developed to satisfy cravings of the youth. A special logo for this group of clients and a new style of communication have been introduced. The bank wishes to get to generation Z, i.e. consumers who are 13-24 year old. By 2020, mBank intends to acquire 0.5 million new clients of the young generation.

Though from the business point of view a young person is an investment for banks, with time their activeness and hence profitability grow even twice.

Regardless of the age group, young people have one thing in common: they do not have own funds. They do not get much from their parents nor earn a lot, but they have vast consumer needs. This is why mSaver is perfect for them – it allows them to put aside small amounts during everyday shopping to use these funds for hobbies and entertainment. We have also prepared mOkazje (mDeals) for them, i.e. discounts for shopping combined with a unique card they can select out of 30 ready designs or design by themselves.

Outlets available to the disabled

[FS13, FS14] The end of 2015 and 2016 were crucial to our bank as far as changes for the benefit of the disabled are concerned. Depending on the type of disability, the client may select the most convenient form of contact and submit an instruction via the transactional system, mLinia available 24/7 (an automated service or a consultant), a bank’s outlet or an online expert. What is important, the client may contact us using audio chat, video chat, chat or sign language customer service.

Since the beginning of August 2016, mBank has been offering customer service in the Polish sign language. Deaf clients may have an online video chat with a bank expert who knows the language or use translation services available in every bank’s outlet. The initiative is the most comprehensive solution of this kind on the financial services market. The bank has hired consultants who know the sign language and have been working in the deaf community for many years. We have also trained employees from branches so that they are able to help clients with this disability. The communication takes place with the use of an available on-line interpreter from the Polish Association of the Deaf. Before that, we created a dedicated website (https://www.mbank.pl/pomoc/dostep-zdalny/osoby-niepelnosprawne/), where the disabled may find comprehensive information on how to contact the Bank the way that suits them the best. Our Bank also actively took part in the work carried out by the team for serving clients with disabilities operating at the Polish Bank Association, jointly creating the guidelines of the “Best Practice”.

Our employees participated in training that aimed at sensitising them to the needs of the disabled. All employees of mBank’s branches, contact centre, financial services centres and mFinanse underwent the training. 92 employees participated in workshops organised in cooperation with Fundacja Integracja (Integration Foundation), where they had direct contact with a blind person and a guide dog. Exercises and lectures pointed out the barriers encountered by people with disabilities on an everyday basis.

We have also worked out other solutions for our clients, e.g. a person not able to place a signature may, in the presence of an mBank’s employee, place a fingerprint on an instruction, agreement or application in paper form in the place reserved for their signature. Then an mBank’s employee – at the client’s request – enters the client’s name and surname, together with own signature and stamp, next to the fingerprint. It is also possible to send documents by mail, i.e. a visit to the branch is not necessary, provided a notary’s confirmation has been delivered. Each client may grant a power of attorney.

The majority of our outlets, i.e. approx. 72% , are adjusted to the needs of people in wheelchairs. Moreover, mFinanse representatives may even meet with the client outside the branch, e.g. at the client’s home or another place agreed beforehand. An updated list of branches adjusted to the needs of people in wheelchairs is available on the Bank’s website. The typical cash desk furniture in branches is adapted to serving clients standing at the counter, which is a barrier to the people using wheelchairs. However, bank tellers serve disabled clients in wheelchairs not at the counter, but at a table low enough to allow the clients to talk comfortably with our employees.

On the mBank’s website, one may find the list of ATMs (including addresses) adjusted to the needs of the blind, i.e. equipped with headphone jacks and voice messages that make it possible to withdraw cash.

It is worth reminding that partially sighted and blind people may use the new transactional system of mBank since November 2015. The new websites have been adjusted to the needs of this group of clients and designed in line with the Web Content Accessibility Guidelines (WCAG). A special software facilitates the use of the transactional system. With the use of a synthetic voice or Braille, the transactional system informs the user about everything what is present on the screen. NVDA (NonVisual Desktop Access) is the recommended software for the transactional system.

One Network

mBank has been rebuilding its branch network. We try to locate our branches in places frequently visited by clients, e.g. shopping malls. Since 2012, mBank has been implementing the One Network Project to end the existing division into retail and corporate branches. They have been replaced by advisory centres and the so called “light” branches located in shopping malls. The advisory centres will be available in all cities where mBank currently operates its branches. They are usually located in modern buildings that can be easily accessed by the disabled.

The newly opened mBank branches stand out from competitors thanks to modern technological solutions – they feature interactive store fronts reacting to motion, innovative touch screens which present mBank’s offer in an intuitive way and interesting applications in the children’s zone.

mBank’s own network is complemented by about 100 outlets of mFinanse which specialises in selling bank accounts, loans, insurance as well as investment and savings products. These outlets are located in shopping malls and operate under the mBank brand. Additionally, the company has ca. 50 back-office units which are visited by clients as well and whose employees meet with clients also outside the outlets of mFinanse.

Compliance with regulations

[G4-SO7, G4-SO8, G4-PR2, G4-PR4, G4-PR9] On 29 July 2016, the President of the Office of Competition and Consumer Protection (UOKiK) issued the so-called material standpoint regarding the class action against mBank heard by the Court of Appeal in Łódź on the initiative of a group of borrowers having mortgage loans denominated in CHF (file no.: I ACa 1058/15). The case pertained to loan agreements with a variable interest rate. The standpoint of the President of the UOKiK was submitted to the Court of Appeal.

The Supreme Court, which examined mBank’s appeal against the rulings of the first and second instance courts, decided that the basis for setting the variable interest rate (laid down in those agreements) was not legally flawed, therefore the agreements were binding upon both the borrowers and mBank. The Supreme Court found solely that a part of the applied clause was abusive. This rules out the possibility of deeming the loan agreements null and void.

Despite this fact, the President of the UOKiK presented an opinion that, in fact, ignores the decision made by the Supreme Court in this respect.

It should be stressed that not only the Supreme Court represents this standpoint since similar rulings have been issued by courts of lower instances in similar cases.

At the beginning of September 2016, the Supreme Court dismissed mBank’s appeal against the ruling of the Court of Appeal in Szczecin regarding a request for cancellation of enforceability of an enforceable title (the bank’s enforcement title with an enforcement clause) in one of individual cases. In that case, however, the Supreme Court did not take into consideration the indexation of the disputable loan. The Supreme Court emphasized that the loan granted by the bank should be repaid.

In 2016, the Office of Competition and Consumer Protection (UOKiK) did not make any decisions which would result in penalties being imposed on our bank or any of the subsidiaries covered by this report.

More information on regulations in chapter 2.2. Regulatory environment.

Educational activities

[SO DMA, G4-SO1, FS16] mBank’s foundation (mFoundation) represents the social involvement of mBank. mFoundation, established as BRE Bank Foundation in 1994, was one of the first corporate foundations in the banking sector.

Its mission is to support programmes aimed at enhancing education and quality of life through actions coherent with the image and policy of mBank. In line with the “m for mathematics” (“m jak matematyka”) strategy, adopted in November 2013, mFoundation focuses its efforts on supporting mathematical education. The strategy pursued in 2014-2016 will be also followed in 2017-2020.

See the movie about mFoundation

The “m for mathematics” strategy constitutes a response to one of the key social problems which is a widening gap in science eduction. The lack of basic knowledge and skills connected with elementary mathematics hampers the development of competences necessary to make conscious financial decisions and, at the same time, is an obstacle limiting the number of science and technology graduates. This may, in turn, take its toll on the supply of engineers and on the development of enterprises operating in Poland. Looking at the issue comprehensively and going beyond the banking area, we decided to focus on mathematical education.

A step towards the future: even PLN 20 thousand for the best thesis in mathematics from mFoundation

In 2016, we launched the first edition of an annual competition: “A Step towards the Future” (“Krok w przyszłość”) for the best student thesis in mathematics. The winner will be awarded the “STEFCIO” statuette and PLN 20 thousand.

Each year the best students and graduates of mathematics will be awarded for presented and defended master’s or bachelor’s theses or for theses in mathematics written independently and published in international scientific journals.

A single pool of prizes awarded by mFoundation totals PLN 40 thousand. The jury, headed by Prof. Paweł Strzelecki, dean of the Faculty of Mathematics, Informatics and Mechanics, University of Warsaw, awards the main prize amounting to PLN 20 thousand and two distinctions of PLN 10 thousand.

The best thesis in mathematics should promote innovative and original solutions or set new research directions or methods. In addition to the financial award, the author will receive the STEFCIO statuette. The name of the statuette reminds of the achievements of Stefan Banach, an outstanding Polish mathematician. The prize will be awarded every year on March 30, on the birth anniversary of Stefan Banach.

A new grant programme: “Holidays with Mathematics” for children from Łódź

In 2016, mFoundation for the first time organised the “Holidays with Mathematics” (“Wakacje z matematyką”) grant competition addressed to local non-governmental organisations, libraries and informal groups under the honorary patronage of the President of the City of Łódź. The winners could receive even PLN 5 thousand for the organisation of holiday activities promoting mathematics among children from Łódź. Seven beneficiaries were awarded grants in the pilot edition of the programme. As many as 661 children and teenagers took part in over 200 hours of maths classes.

Children, teenagers, teachers and parents are, in particular, the beneficiaries of the actions supported by our foundation. Primary schools, lower secondary schools and secondary schools, NGOs, tertiary education institutions and public libraries may apply for grants as part of the foundation’s programmes. All projects supported by the foundation increase the quality and effectiveness of mathematical education in Poland.

mFoundation spent a total of PLN 2.9 million on mathematical education in 2016.

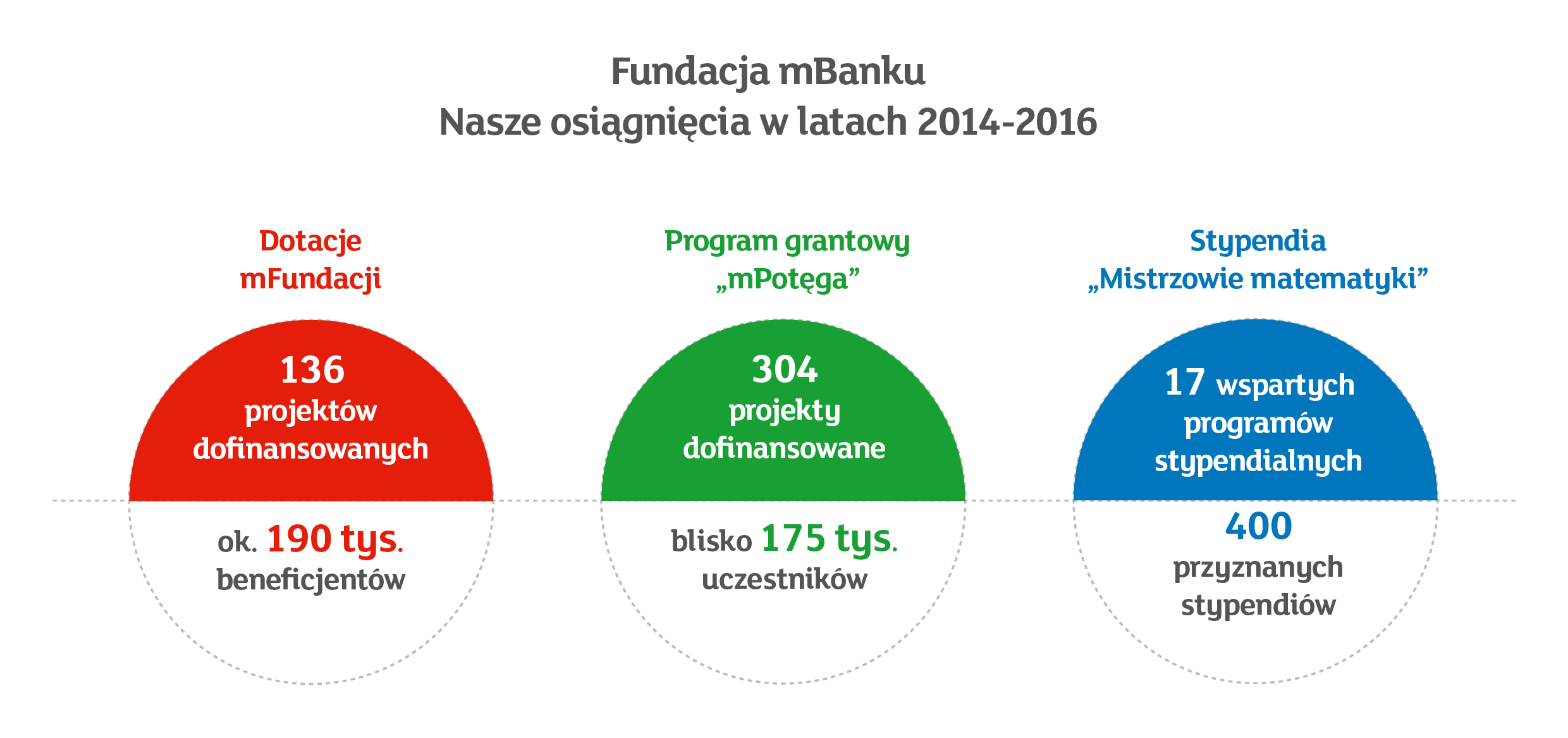

The “m for Mathematics” strategy (“m jak matematyka”) was pursued through three flagship activities: grants, the “mPower” (“mPotęga”) grant programme and the “Masters of Mathematics” (“Mistrzowie matematyki”) scholarship programme in 2016. mFoundation provides one-time financial support to development projects in the scope of mathematical education. Applications for grants may be submitted throughout the year and are examined once a month. In 2016, mFoundation supported 75 mathematical projects covering almost 70 thousand students, teachers and parents. In total, in the first three years of the strategy, nearly 190 thousand beneficiaries took part in the activities supported by the foundation.

The grants from mFoundation were used to support local and countrywide projects. We supported 26 schools, 27 non-governmental organisations, three tertiary education institutions and six kindergartens in 2016.

Another key initiative of mFoundation is the “mPower” grant programme executed in cooperation with Good Network Foundation (Fundacja Dobra Sieć). The purpose of “mPower” is to develop mathematical skills in the younger generation by inspiring teachers, parents and enthusiasts of mathematics to seek creative and attractive ways of learning the world of numbers by children and young people. The grants of up to PLN 5 and 8 thousand may be applied for yearly by primary and secondary schools as well as social organisations, tertiary education institutions, libraries and non-formal groups (research clubs, parent councils) represented by a partner organisation.

mPotęga became a countrywide programme in 2016. As many as 210 out of 880 applications sent were awarded grants. The total amount of the awarded grants was three times higher than in the previous year and reached PLN 1.2 million. Over 55 thousand beneficiaries took part in the projects conducted within the third edition of mPower. For more information on the programme go to www.mPotega.pl

Gold for mPower

The 2016 edition of the Golden Banker competition had for the first time featured the “Socially Responsible Bank” category. Both the title and a golden statuette were given to mBank for the mPower grant programme organised by mFoundation.

The Golden Banker competition was held by Bankier.pl and Puls Biznesu for the seventh time. One of the several new categories for financial institutions that year was the “Socially Responsible Bank” category. The winners were selected by Internet users in a vote. Most of them voted for mBank’s Foundation and its mPower grant programme. “Socially Responsible Bank” was one of the most popular categories in the poll - Internet users voted more willingly for CSR activities than for the best advertising spot.

The mPower grant programme is one of the key activities of mBank’s foundation conducted within the CSR Strategy titled “m for Mathematics”. An underlying aim of the programme is to bring mathematical education to the young generation - students of primary and secondary schools. The previous two editions of the programme enabled the execution of 96 mathematical projects in which over 16 thousand students and parents participated.

The foundation runs also the “Masters of Mathematics” programme, addressed to NGOs which offer scholarship programmes as part of their statutory activity. These organisations may apply for subsidising scholarships for pupils and students who are outstandingly talented in the field of mathematics. In 2016, mFoundation granted twelve non-governmental organisations PLN 333 thousand for scholarships for 156 talented mathematicians. In total, including the first and second edition of the programme, the foundation awarded 400 scholarships to talented young mathematicians.

For more information on the foundation’s activities, including the Activity and Financial Report for 2016 go to www.mFundacja.pl.

Goal 2: We want to be a responsible lender

Follow what you borrow (Kredyt ma się rozumieć TM)

We want our clients to make conscious decisions, especially when they are connected with cash loans. At the end of 2015, our clients could see the first results of the “Responsible Lending” (“Odpowiedzialne kredytowanie”) programme which is composed of a few significant changes.

Constructive communication of the credit process

The first change refers to communicating rejections. Clients used to receive terse information about their loan application being rejected. Since the beginning of December 2015, clients whose loan applications were rejected have been informed about the reasons for it in an open and precise manner. Additionally, clients are informed about which steps they may take and who they may contact. Sometimes it is sufficient to close a credit card the client does not use or to clarify issues which have an adverse effect on the client’s scoring in the Credit Information Bureau’s reports, in order to receive a positive answer during the next creditworthiness assessment. We changed also the graphic layout of rejection letters to make them more friendly and readable.

Since December 2015, client advisors may inform their clients about the reasons behind negative decisions.

We promote clear and friendly communication in the whole credit process. Our clients are informed about subsequent stages and can follow them so that they know what is happening to their loan applications. The time needed to examine a loan application is usually shorter than twenty minutes.

The ABC of Loans

Another area was connected with launching The ABC of Loans (ABC Kredytu) subpage on mBank’s website (https://www.mbank.pl/indywidualny/kredyty/abc-kredytu/). A cost calculator was launched in December and a whole website devoted to responsible lending featuring a creditworthiness calculator, a tool that proved to be the most popular with clients, were launched in Q1 2016. In June 2016, communication was completed with information leaflets regarding lending and the assessment of creditworthiness.

mBank Group adopts “Good Practices on Consumer Loan Advertising Standards” (“Dobre praktyki w zakresie standardów reklamowania kredytu konsumenckiego”, July 2016)

The recommendations have been worked out in cooperation with the Polish Bank Association (Związek Banków Polskich), the Conference of Financial Companies (Konferencja Przedsiębiorstw Finansowych) and the Loan Companies Association (Związek Firm Pożyczkowych). They pertain to creating advertising messages by financial market entities. The aim of the recommendations is to standardise the scope of information provided in advertising messages, which will enable clients to compare various offers. The recommendations focus on three aspects: the manner of presenting the legal guidance, general guidelines for creating advertising materials and the specification what an advertisement of a credit product should look like depending on the information carrier, in order to be understandable and transparent to the recipients of the message.

Refusal to finance irresponsible business activities

[d. FS1, d. FS2, d. FS3] mBank formally supported the Ten Principles of the UN Global Compact in 2015, thus becoming a signatory of the initiative. Our support for this initiative was a conscious decision as a consequence of which we decided to limit relations with enterprises breaching the UN Global Compact’s principles. Apart from the standard mechanisms of business risk assessment in the banking sector, which include reputation risk assessment, we formally adopted the “Policy on Providing Services and Financing to Entities Operating in Areas that are Particularly Sensitive in Terms of mBank’s Reputation Risk”. This policy imposes restrictions on providing services to enterprises that conduct business activity:

- based on child labour, forced labour, slave labour, labour connected with forced resettlement or blatantly infringing human rights in any other way;

- focused on economic exploitation of valuable natural areas under protection (including the Arctic), and resort to gross violation of environmental regulations;

- that threatens world heritage sites.

The restrictions apply to the credit process and bank account opening. They apply to new clients and new financing of existing clients, including rollovers, starting from January 1, 2016.

Our other procedures, indirectly, take account of the impact of the client’s operations on the social and natural environment. In the case of financing investments (e.g. industrial investments), we primarily try to eliminate legal risk (it is verified whether a given investment has legally binding decisions and permits issued by competent authorities). We limit the risk of investing clients’ funds in projects carried out in violation of the law (e.g. projects where the necessary public consultations were not conducted or those which do not compensate for the expected environmental losses). In the case of big investment projects financed with syndicated loans, we employ a technical advisor or demand that one is employed, to supervise the investment process and monitor it on an ongoing basis. As a result we are able to identify potential irregularities, including those concerning social and environmental aspects, on time. At the stage of drawing up the credit report, as part of the assessment of market environment, our representative may indicate social and environmental risks. The analyst assessing the risk may in justified cases forward the case to a higher decision making level, and the case, through the credit committee, may reach the management board.

Goal 3: We want to build an exceptional team, competence and skills. We want to share what’s best about us with others. We want to be unique

Organisation and its culture

[LA DMA] The most important internal regulations governing issues connected with employment and employee management include the “Work Rules at mBank”, “Remuneration Rules at mBank” and “Rules on Awarding Bonuses to mBank Employees”. They are supplemented by procedures regarding recruitment, development activities, and employee evaluation. Particular polices and procedures are adopted by mBank and then by its subsidiaries. In practice, as far as the characteristics of the conducted business activity do not require any exceptions, the same solutions are applied in whole mBank Group.

mBank Group’s incentive system

The incentive system of mBank is based on the remuneration policy and intangible elements (e.g. possibility of career development). The incentive system plays a key role in developing corporate culture and builds a competitive advantage by acquiring and retaining competent employees.

The remuneration policy at mBank covers both the base salary (fixed component) as well as the variable part depending on the objectives achieved by the whole organisation and by individual employees.

In 2016, incentive programmes both for the Management Board Members and Key Managers were implemented at mBank Group.

Incentive Programme for the Management Board Members of the Bank

On March 14, 2008, the Ordinary General Meeting of mBank adopted an incentive programme for the Management Board Members of mBank.

Under the programme, the Management Board Members of the Bank have the right to take up bonds with pre-emptive right to take up shares of mBank and, as originally planned, to take up shares of Commerzbank AG. In 2010, the programme was changed in the part concerning shares of Commerzbank, so that the Management Board Members may obtain the right to receive a cash equivalent corresponding to the value of the shares of Commerzbank calculated on the basis of the average share price on the date when the right to receive the equivalent originated.

All the rights under payments settled in cash equivalent based on shares of Commerzbank and all the rights under payments settled in mBank S.A. shares within the framework of the programme have already been granted. The last settlements under this programme will take place in 2016.

On December 7, 2012, the Supervisory Board decided to replace the 2008 incentive programme with a new incentive programme. Under the new programme, the Management Board Members of the Bank have the right to receive a bonus, including a “non-cash bonus”, paid in the Bank’s shares, including phantom shares (i.e. virtual shares).

The non-cash bonus, in which members of the Board have a right to take up bonds with pre-emptive rights to acquire shares, was granted under the programme for 2012-2013. The right to purchase the bonds will be realized in three equal annual deferred tranches, on the lapse of, respectively, 12, 24 and 36 months from the date of acquiring the right to non-cash bonus by the Management Board Member. Conditions of receiving as well as the amount of deferred tranche not paid out yet under non-cash bonus depend on the assessment of the financial position of the Bank by the Remuneration Committee and the performance evaluation of member of the Board for a period longer than one financial year.

The bonds may be acquired by the eligible people over the years 2014-2021.

On March 31, 2014, the Supervisory Board acting in line with the recommendation of the Remuneration Committee approved the mBank S.A. Incentive Programme Rules which replaced the mBank S.A. Incentive Programme Rules of December 7, 2012.

Under the programme, the Management Board Members of the Bank are eligible to receive a bonus, including a non-cash bonus paid in Bank shares, including phantom shares.

The basis of the acquisition of the right to receive a bonus and of the calculation of the bonus amount for a financial year includes:

- net return on equity (net ROE) of mBank Group;

- monthly remuneration of the Management Board Memeber at December 31, of the financial year for which the bonus is to be awarded.

One part of the base bonus is the equivalent of 50% of the base amount calculated depending on the ROE. As the remaining 50% of the base amount, the Remuneration Committee of the Supervisory Board may award the other part of the bonus if it decides that the Management Board Member has achieved the annual/multi-annual business development target. The decision whether to award the other part of the bonus is made at the sole discretion of the Remuneration Committee of the Supervisory Board, which uses its own judgment to confirm whether the MbO are achieved, taking into account the situation on the financial markets in the previous financial periods.

The two parts of the bonus constitute the base bonus of the Management Board Member for the financial year. 40% of the base bonus is not deferred and is paid in the year when it is determined, as follows: 50% in cash and 50% in Bank shares, or bonds with a pre-emptive right to take up shares, or phantom shares.

The remaining 60% of the base bonus is deferred and paid in three equal tranches in three subsequent years after the year when the base bonus is determined, as follows: 50% of each deferred tranche in cash and 50% of each deferred tranche in Bank shares, or bonds with a pre-emptive right to take up shares, or phantom shares.

The Supervisory Board acting on the basis of a recommendation of the Remuneration Committee of the Supervisory Board may decide to withhold the full amount or to reduce the amount of the deferred tranche depending on later assessment of the performance of the Management Board Member in a time horizon longer than one financial year, i.e., for a period of at least 3 years, taking into account the Bank’s business cycle as well as the risk inherent in the business of the Bank but only if the action or omission of the Management Board Member had a direct and negative impact on the financial results and the market position of the Bank in the period of the assessment, and only if at least one of the elements covered by the score card is not achieved.

The Remuneration Committee of the Supervisory Board may decide to withhold the full amount or to reduce the amount of the non-deferred and deferred bonus for the financial year, including the deferred tranches not yet paid, in cases referred to in Article 142.1 of the Banking Law Act. Withholding the full amount or reducing the amount of a non-deferred and deferred bonus or any deferred tranche by the Remuneration Committee of the Supervisory Board may also apply to a deferred and non-deferred bonus, including a deferred tranche not paid to a Manager following the expiration or termination of the contract.

2008 Incentive Programme for Key Managers of mBank Group

On October 27, 2008, the Extraordinary General Meeting of the Bank adopted an incentive programme for the key staff of mBank Group, i.e. Bank’s Directors and representatives of the key staff.

In 2010, the Management Board of the Bank decided to launch the programme and approved the list of participants for Tranche III. Within Tranche III 13,000 options were granted. In 2011 within the Tranche IV and V programme 20,000 options and 19,990 options were granted. The rights started to be exercised in 2012 for Tranche III, in 2013 for Tranche IV and in 2014 for Tranche V. In 2011 a decision was taken on suspension of the programme and not activating the remaining tranches. All the bonds granted within this programme have been already acquired by the entitled persons.

On April 11, 2013, the Extraordinary General Meeting of the Bank adopted a resolution amending the rules of the employee programme, which replaced the incentive programme for key management staff of mBank Group from 2008.

The aim of the programme is to ensure growth of the Company’s shares value by linking the interest of the key staff of mBank Group with the interest of the Company and its shareholders and implementing variable components of remuneration of persons holding managerial positions in the Group in accordance with the Resolution of the Polish Financial Supervision Authority.

During the programme the rights to acquire bonds under Tranche VI have been granted, which may be exercised in three equal parts after 12, 24 and 36 months from the date of granting these rights, in accordance with the internal regulations adopted in mBank Group specifying rules of variable remuneration of the employees having a material impact on the risk profile at mBank Group. The bonds may be acquired by the entitled persons during the programme term, but not later than by December 31, 2022.

On March 31, 2014, the mBank Supervisory Board acting in line with the recommendation of the Remuneration Committee approved a resolution amending the employee programme rules, which replaced the 2013 employee incentive programme for key staff of the mBank Group; however, for persons who acquired bonds or were granted the right to acquire bonds in Tranche III, IV, V or VI, the programme will be carried out under the existing principles.

Starting with Tranche VII, the right to acquire bonds granted to an eligible person will be divided into four parts exercisable as follows: one part – non-deferred bonds representing 50% of 60% of the discretionary bonus amount granted for the financial year in the year when the right was determined, and then subsequent three equal parts – deferred bonds representing 50% of 40% of the discretionary bonus amount granted for the financial year on the lapse of 12, 24, and 36 months after the date that the right was granted, in accordance with internal regulations of mBank Group governing the rules of variable remuneration for mBank risk-takers.

The Management Board of the Bank/the Supervisory Board of a subsidiary may decide to suspend the programme in whole or to reduce the number of non-deferred or deferred bonds in a given tranche for an eligible person in cases referred to in Article 142.1 of the Banking Law Act, i.e., occurrence or risk of a balance-sheet loss, risk of insolvency or bankruptcy, conditions laid down in agreements with programme participants under which work or other services are provided to the Bank and the subsidiaries.

Detailed information on the incentive programmes is presented in Note 44 to the Consolidated Financial Statement of mBank Group for 2016 under the International Financial Reporting Standards.

Management by Objectives (MbO):

Since 2011 mBank has been operating a management by objectives system (MbO). For a few years now the MbO system has covered not only mBank employees, but also all the employees of the key subsidiaries of mBank Group, thereby ensuring effective cooperation and communication across mBank Group.

The process of setting and cascading MbO objectives for 2016 started in late 2015 in both mBank and selected subsidiaries of the group. We placed a strong emphasis on solidarity and integration objectives as well as those driving cooperation in mBank and across the Group. It is a long-term process which will, in effect, provide mBank Group with a lasting competitive advantage and a tool which supports its long-term strategy on an ongoing basis.

The MbO system supports the implementation of 2016-2020 Strategy.The knowledge of strategic goals will allow mBank Group to focus employees' involvement on the most important issues, improving their effectiveness and saving time.

The MbO system has the following functions in the organisation:

- it translates directly into mBank's and mBank Group’s performance by imposing discipline and involving the entire organisation in the achievement of results;

- it forms a direct communication platform which enables sharing information on the role and involvement of individual employees in developing the organisation and achieving the strategic goals of mBank.

[G4-LA2] At mBank we offer employees fair terms and conditions of employment, in every aspect. We have a comprehensive approach to remuneration policy (i.e. we look from the perspective of the whole remuneration, including the basic remuneration, commissions and bonuses). We want to offer our employees a friendly and discrimination free workplace. In particular subsidiaries, we offer a very similar range of employee benefits, e.g. we co-finance access to private medical care and to sports facilities (sports cards).* Additionally, employees have also the possibility of joining a group life insurance.

* Sports cards were available in mLocum until H2 2016. They are to be made available again in 2017.

Family Care - a pilot project

As an employer, we are aware how difficult it may be to combine career and family. That is why we invited employees who are parents to participate in a pilot phase of the new Family Care benefit. The aim of the pilot phase was to better understand the needs of our employees and help us decide whether to offer this benefit on a permanent basis.

The assumption of the programme is to ensure professional babysitting at home in emergencies when an employee cannot take care of his/her child on his/her own or just needs a break. Care and nursing services will be provided by persons with relevant education and experience verified during a multi-stage recruitment process.

The pilot phase lasted six months (from April 1 to September 30, 2016) and was funded by the bank. As many as fifty mBank’s employees at any location in Poland could take part in the programme.

The Employee Benefits Fund allows us to support current employees and those who have retired for whom mBank was the last employer. Such support is available to current and former employees and their closest ones who are in a difficult personal situation (e.g. sickness). In justified cases we finance periodic medical care (medical pre-paid package) for mBank’s retired employees. The same fund is used to finance home repair loans, holiday benefits, sports and recreation as well as cultural and educational activities.

What is important, we do not differentiate employees according to the type of employment contract - all employees (employed for a trial period, for a fixed term, for a fixed term of substitution as well as trainees and interns) have access to the same employee benefits.

“Quitting Smoking May Backfire” („Nie rzucaj, bo wróci”) – an anti-nicotine programme for employees of mBank Group

World No Tobacco Day, created by the World Health Organisation (WHO), is observed every year on May 31. On this occasion, all employees of mBank Group were invited to participate in an anti-nicotine programme.

During information meetings conducted by a therapist in Łódź and Warsaw, participants learned what a cognitive behavioural therapy is, why conventional methods of giving up smoking do not work and how to free yourself from the nicotine trap – without the pain of quitting smoking, quickly and effectively.

Smokers had also the opportunity to enroll on one-day training sessions/therapy sessions which were a key part of the programme. The costs of this event were fully borne by mBank.

[G4-LA10] Our goal is to strengthen and popularise a unique organisational culture in the Group’s subsidiaries, which has allowed us to create the innovative brand of mBank. It also makes our bank one of a kind. We wish to encourage our employees to develop their skills, enhance their competences and broaden their, often very special, interests. We not only provide training sessions and programmes aimed at developing managerial, sales and communication competences, but we also support social engagement of our employees and any activities they take to pursue their passions.

We want all our staff (especially those who have just joined mBank) to feel welcome in our organisation, know the rules we adhere to and the values we cherish. That is why new employees, including interns, undergo an introductory training, during which they gain information on procedures, products, history and current activities of the bank.

Banking Talents 2016 are in full swing!

On October 5, 2016, a campaign called “Young Talents Development Programme” was launched. As every year, the Banking Talents campaign follows a multi-channel model, using both offline and online means of communication. We promoted our rotational internships during Absolvent Talent Days in Łódź and Warsaw, AIESEC Career Days at Warsaw School of Economics, at the Faculty of Economic Sciences of Warsaw University and during University Job Fair organised at the Faculty of Management of Łódź University.

For mBank and its subsidiaries development means more than just training sessions. The holistic approach allows us to complement theoretical knowledge with practical experience. We also have specialist tools of knowledge sharing at our disposal. One can choose from a wide range of development tools, from traditional to non-standard ones. Typical forms of development measures are internal and external training, Insight Discovery workshops (allowing optimisation of teams’ work and cooperation of their members), or off-site workshops (improving communication, developing organisational culture). At the same time, apart from development group activities, employees are individually directed to specialist training, courses and certified exams (e.g. ACCA, CFA, CIA, brokerage exams), postgraduate studies, MBA studies, training for legal advisers or coaching. Voluntary activities also play an important role in educating our employees. Helping others is a chance to gain valuable skills and it requires cooperation, project management and empathy.

We encourage our staff to pursue their passions and interests, which enables them to strike a balance between their professional and private life. The right work-life balance has been promoted in our company for years. An example of effective and proactive response to the need to get away from daily work-related problems was launching mBank Clubs. The initiative has been expanding for almost 20 years, gathering people passionate about skiing, tennis, triathlon, volleyball, cooking, board games, fishing and many more. Members of the clubs are ever more willing to get involved in charity work, e.g. take part in charity runs.

We have also been running the “Our people make the difference”(“Wyróżniają Nas Ludzie”) programme for a long time. Its aim is to promote employees who stand out because of professionalism of their actions, collaborative attitude and open communication manner. It serves to build the awareness of the organisation which appreciates attitudes consistent with mBank’s values as well as the quality of the work performed. The programme allows us to recognise and promote employees who e.g. subscribe to mBank’s values through their actions and attitudes, are ahead of time owing to their way of thinking and ideas, show extraordinary involvement, exceeding their basic scope of duties, and contribute to implementing innovative solutions. Employee nominations for the programme are announced once a year. Employees are recognised in both individual and team categories. Successful employees are provided with special development opportunities, tailored for every single edition.

Annual employee engagement survey is of key importance for planning activities in the area of human resources management. It is carried out both at mBank and mBank Group’s subsidiaries. Its results tell most about satisfaction at work and the work atmosphere. An interesting element of the survey is the possibility for employees to communicate their ideas on how to improve work or other anonymous feedback to the organisational units with which they cooperate. We try to encourage employees to share their views, ideas and knowledge. A great example of this principle is the “Knowledge Sharing Programme”.

[G4-56, G4-LA11] The planning and employee appraisal system allows gradual transfer of strategic goals to successive levels of the organisational structure (Management by Objectives). According to the Management by Objectives system (MbO), the objectives of the management board are translated into objectives of directors. Directors delegate these tasks to managers and managers assign them to employees in particular teams. Every objective, both quantitative and qualitative, has defined measures which serve as the criteria for its fulfilment. Employees’ behaviours and attitudes are also subject to assessment. The model of values and behaviours of mBank Group determines expectations in this respect, which form a benchmark in the appraisal process.

Every manager holds individual appraisal meetings with his/her employees. The employee receives feedback from the manager about the effects of his/her work and the manner of performing tasks. This is the moment when the manager expresses his/her appreciation of the strengths and indicates the areas which the employee should improve. The evaluation of attitudes and behaviours was first made during the appraisal for 2015, in Q1 2016.

Cooperation with Łódź University in creating a new study programme

The Digital Banking and Finance undergraduate course at the University of Łódź has been developed by mBank and Accenture since its very beginning. This has given our employees a unique opportunity to prove themselves as lecturers. Students, on the other hand, have a chance to obtain practical and up-to-date knowledge directly from practitioners.

Following in the footsteps of the largest and most innovative companies in the world, mBank wishes to cooperate with the academic circles in educating its future employees. In our opinion, the market demand for finance specialists with extensive digital expertise is still very high. As the course aims at shaping these exact qualifications, its graduates will make sought-after employees.

The course takes three years. Graduates are awarded a bachelor’s degree. After completing a year and a half, students are able to select one of the following majors: Banking 3.0 and IT in Finance. First 100 students started the course in October 2015. As many as 50 employees of the bank are involved in forming the contents of the course.

Employee volunteer projects at mBank