DANE FINANSOWE

Macroeconomic environment

Economy and the banking sector in Poland

| Key macroeconomic parameters | 2016 | Banking sector indicators | 2016 | |

| Real GDP growth rate (forecast) | 2.8% | Base interest rate | 1.5% | |

| Nominal GDP per capita (EUR) | 11,200* | Loan to Deposit ratio | 98.9% | |

| GDP per capita in PPS (EU-28=100) | 69%* | Non-performing loans ratio | 7.0% | |

| Average annual inflation rate | -0.6% | Total Capital Ratio (TCR) | 17.6%* | |

| Unemployment rate | 6.3% | Return on Assets (ROA) | 0.8% | |

| Population | 38 M | Return on Equity (ROE) | 7.8% |

Source: Central Statistical Office (GUS), Eurostat, Polish Financial Supervision Authority.

* Data as of September 30, 2016.

Summary of changes

2016 was an eventful time with numerous changes taking place around the globe. Apart from the surprises in the political arena (the US election and the Brexit referendum), past year was also marked by the alleviation of concerns about growing deflation trends in many economies and recovered hopes for faster growth in the global economy. The political changes are a source of hope for financial markets. However, it is much too early to assess what impact on the global economy they will have.

Poland’s economy reported a slowdown. According to the initial data, GDP rose by 2.8% in 2016 (against 3.9% a year ago), which is well below expectations from the beginning of the year. In fact, 2016 saw numerous growth forecasts being revised down with every consecutive quarter turning out to be worse than expected (except for Q4). Looking at the downward trajectory of growth one can notice one more clear trend - private consumption is replacing investment as the main growth driver. It is worth stressing that the structure of the economic growth had not witnessed a shift like the one reported in 2016 for many years. In Q4 2016 private consumption rose by ca. 4-4.1%, whereas investment dropped by over 5% compared with +3.1% and +4.5% YoY, respectively, at the end of 2015. In other words, the difference between the contributions of private consumption and investment to GDP growth went up from 0.4 pp to record-high 3.6-3.7 pp in H2 2016. Changes in the remaining categories, i.e. a greater contribution of public consumption and changes in inventories, were in the background.

Accelerating private consumption came as no surprise - the growth rate increased from 3.2% in early 2016 to ca. 4.1% in Q4. Much has been said about the fundamental reasons behind the growth in consumption, but let us repeat the most important of them, i.e.: fast growth of real wages driven by low inflation (deflation prevailed for the most part of the year) and increasing mismatch between demand and supply in the Polish labour market (companies find it increasingly difficult to fill in vacancies); payment of 500+ child benefits, which accounted for ca. 40% of growth in household incomes; further improvement in household sentiment with household optimism hitting a record high according to some estimates.

As far as investment is concerned, the deep reduction in investment expenditure (-7.7% reported in Q3 marking the worst result in 15 years) was derivative of numerous, uncorrelated factors. These include primarily the exhaustion of funds from the EU’s previous budget and a delay in the preparation of new projects, which led to an investment gap, visible especially in the activity of local governments and railway companies. Secondly, the delayed spending of EU funds led to a drop in private investment, which was additionally stimulated by the growing uncertainty about the tax and regulatory environment and prospects for the global economy. Thirdly, investment in the linear infrastructure (water supply and sewage systems, power infrastructure) was badly affected by the announced legal changes, which resulted in a 50% decrease in the sector’s investment activity.

Inflation remained negative in 2016 with average rate dropping by -0.6% against 2015. Thus, the figure was only slightly higher than a year ago. The first period of deflation in Poland’s history lasted until Q4, when rising oil prices, the strengthening dollar and base effects (with an additional contribution of higher food prices) pushed inflation up to 0.8% YoY. The period of persistent deflation and economic slowdown met with a calm reaction from the Monetary Policy Council, which focused on medium-term aspects and stressed the temporary nature of both deflation and the slowdown. As a result, interest rates were kept unchanged throughout 2016 while the Council’s rhetoric was subject to only minor changes as new, initially pessimistic, and later optimistic data was coming in.

Throughout 2016 the zloty was weaker than in 2015. In fact, every day in 2016 (apart from the first week of the year) the EUR/PLN exchange rate was higher than on the same day a year before. The year started with a dramatic weakening of the zloty due to the downgrade of Poland’s rating by S&P and growing political risk. In February and March, improved perception of Polish assets and very favourable conditions in the emerging markets (dovish rhetoric and actions of central banks) resulted in a major strengthening of the zloty. The perception of Polish assets deteriorated again in Q2 due to a negative combination of both domestic (speculation around possible statutory solutions to the CHF loans issue) and international factors (aversion to the emerging markets, the Brexit vote). The second half of the year was the time of US election. The zloty weakened against the euro (for the third time that year) with PLN traded at 4.50 to the euro following the outcome of the vote. The major strengthening of the dollar that took place immediately after the election pushed the USD/PLN pair up to 4.30. As a result, the zloty fell to a new multi-year low against the dollar.

The market for treasury securities was marked by similar volatility in 2016. Compared with 2015, yields on Polish Treasury bonds went up from 1.62% to 2.03% for two-year securities, from 2.23% to 2.88% for five-year bonds and from 2.94% to 3.63% for ten-year bonds. Similarly to the exchange rate of the zloty, the demand for Polish bonds was determined by both domestic and foreign factors. In particular, in late 2016 the Polish bond market proved sensitive to growing expectations regarding economic growth and inflation in both Poland and globally. This pushed up both the risk-free rate (i.e. yields on German and US bonds) and the spread between the yield on Polish Treasury securities and German and US securities with the same maturities. The Warsaw capital market revived thanks to improved sentiment for the Polish economy and inflow of capital to the emerging markets. At the end of 2016, the main indices were by ca. 10% higher than at the beginning of the year.

Development of economy and banking sector in the Czech Republic

| Key macroeconomic parameters | 2016 | Banking sector indicators | 2016 | |

| Real GDP growth rate (forecast) | 2.2% | Base interest rate | 0.05% | |

| Nominal GDP per capita (EUR) | 16,400* | Loan to Deposit ratio | 78.3% | |

| GDP per capita in PPS (EU-28=100) | 87%* | Non-performing loans ratio | 4.8% | |

| Average annual inflation rate | 0.6% | Total Capital Ratio (TCR) | 17.7%* | |

| Unemployment rate | 4.0% | Return on Assets (ROA) | 1.4%* | |

| Population | 10.6 M | Return on Equity (ROE) | 15.3%* |

Source: Eurostat, Česká národní banka (ČNB).

* Cumulative data for 9 months (as of September 30, 2016) or latest available.

GDP, inflation, interest and FX rates

Economic growth in the Czech Republic is expected to have fallen to 2.2% in 2016 from 4.5% recorded in 2015, largely due to the drop in investment linked to the cycle of EU investment funding. In contrast, private consumption and foreign demand have provided a solid positive contribution. GPD growth is expected to pick up to 2.6% in 2017 and 2.7% in 2018 as investment activity recovers, also supported by the continuing strength in domestic consumption.

On November 7, 2013, the Czech National Bank (CNB) committed to sell the Czech crowns and buy euros as needed in order to prevent the crown from appreciating beyond the historically low rate of CZK 27 per euro, while the currency floats freely on the weaker side of this threshold. Since then, the central bank’s board has repeatedly confirmed the validity of this exchange rate commitment. At its most recent meeting on February 2, 2017, it was stated again that the CNB would not discontinue the use of the exchange rate as a monetary policy instrument before Q2 2017.

In 2013-2016, interest rates remained unchanged and the repo rate was maintained at 0.05%.

The year-on-year growth of consumer prices amounted to 2.1% in December 2016 and was significantly higher compared to -0.1% recorded at the end of 2015. The sharp rise in inflation at the close of last year was mainly due to a recovery in food price growth and an unwinding of the year-on-year fall in fuel prices. The average inflation rate for 2016 reached 0.6% and increased by 0.3 p.p. from the preceding year level of 0.3%.

Czech labour market parameters have been improving further. The country’s unemployment rate has remained the lowest in the Central and Eastern Europe (CEE) region. Its seasonally adjusted level reached 4.0% in December 2016 and decreased by 1.1 p.p. year on year.

Banking sector

The favourable developments recorded in the Czech financial sector in past years continued into 2016. The good economic conditions were reflected in growth of the assets of banks, which managed to maintain high profitability and strengthen their capital adequacy. The main challenge for Czech banks is a permanent low interest rate environment, causing a pressure on loan yields. Funding and liquidity profiles continued to be solid with the sector’s loan-to-deposit ratio of 78.3%. Asset quality remained resilient as demonstrated by a further decrease of NPL ratio to 4.8% at the end of 2016 from 5.8% observed a year earlier. Better risk indicators in the Czech Republic compared to other countries in the CEE region reflect the country’s relatively strong industrial base and limited foreign-currency lending (predominantly to corporate customers and almost non-existent in retail segment).

The growth in total retail lending was predominantly driven by mortgage loans, which expanded by 8.9% in 2016, while the volume of consumer and other loans showed a slower increase of 4.1% during the same period. The share of non-performing loans in the total volume of loans to households was 3.2% in December 2016, declining from 4.1% at the end of 2015. The annual growth pace of household deposits accelerated in 2016 and reached 8.4% in December. However, the maturity structure of deposit base has been evolving significantly over the last three years, with demand deposits rising at double-digit rate and term deposits falling by around 5% annually.

After subdued growth in corporate loan volume in 2014, the year-on-year dynamics accelerated visibly during 2015 and stabilized at a moderate pace of around 6% in 2016. The share of non-performing loans in the total volume of loans to non-financial corporations has been constantly declining since 2011 and amounted to 5.0% at the end of 2016, compared to 5.7% a year earlier. Corporate deposits decelerated visibly in 2016 and the end-year volume was almost unchanged versus December 2015.

Development of economy and banking sector in Slovakia

| Key macroeconomic parameters | 2016 | Banking sector indicators | 2016 | |

| Real GDP growth rate (forecast) | 3.4% | Base interest rate | 0.00% | |

| Nominal GDP per capita (EUR) | 14,700* | Loan to Deposit ratio | 98.8% | |

| GDP per capita in PPS (EU-28=100) | 77%* | Non-performing loans ratio | 3.8% | |

| Average annual inflation rate | -0.5% | Total Capital Ratio (TCR) | 17.7%* | |

| Unemployment rate | 9.7% | Return on Assets (ROA) | 1.1% | |

| Population | 5.4 M | Return on Equity (ROE) | 10.0% |

Source: Eurostat, Národná banka Slovenska (NBS).

* Cumulative data for 9 month (as of September 30, 2016) or latest available.

GDP, inflation and interest rates

The Slovak economy has remained on a stable growth path. After a strong GDP expansion of 3.8% showed in 2015, the growth is seen to have reached 3.4% in 2016, underpinned by strengthening household demand and net exports. Although an increase in private investment is unlikely to fully compensate for a pronounced downturn in public investment linked to the cycle of EU investment co-funding in 2016, overall investment is forecast to return to solid growth in 2017 and 2018 thanks to buoyant investment in the car industry and a rise in spending on large infrastructure projects. Private consumption growth is set to accelerate in 2016 and 2017, benefitting from the continued improvement in the labour market, subdued inflation and consequently gains in real disposable income.

In Slovakia, as a member of euro zone, the key interest rate, set by the European Central Bank (ECB), was reduced to 0.00% in March 2016 from 0.05% kept during 2015.

In December 2016, annual inflation stood at 0.2%, compared to a contraction of consumer prices at 0.5% recorded at the end of 2015. The main drags were falling energy and food prices, which were overshadowing rising service prices. The average annual inflation rate for 2016 reached -0.5%, dropping by 0.2 percentage point from -0.3% in 2015.

Since 2014 unemployment in Slovakia has been gradually decreasing in line with the improvement in economic activity and sustained job creation. Its seasonally adjusted rate reached 9.7% in December 2016 and was lower by 1.8 percentage point year on year. At the same time, the participation rate is set to gradually increase, as incentives to join the labour force for the long-term unemployed rise.

Banking sector

Slovak banks have operated in a relatively strong economic environment, but their profitability has been exposed to several headwinds. The ultra-low interest rate level has caused a continued compression of margins in the sector. In addition, following the introduction of a statutory cap on housing loan early repayment fees as from March 21, 2016, the yield on retail loans has been decreasing at an accelerating pace. Consequently, the profitability of the Slovak banking sector improved in 2016 only due to a one-off gain on Visa transaction. With strong lending growth, the overall loan-to-deposit ratio has been gradually increasing and exceeded 98% at the end of 2016. However, the Slovak banking sector’s capital adequacy has remained among the highest in the CEE region, along with the Czech Republic. The overall improvement of the NPL ratio was mainly the result of the high growth in retail loans and stabilisation in the stock of non-performing loans. The NPL ratio for Slovakia is the lowest in the CEE region at 3.8% at the end of December 2016, dropping from 4.2% a year earlier.

The improving economy and low credit costs have promoted strong development of household loans in Slovakia. Retail lending has continued to rise rapidly over the recent years, mainly due to housing loan acceleration, with the year-on-year growth pace exceeding 13% in 2016, spurred recently by demand for credit refinancing. The share of non-performing loans in the total volume of loans to households declined to 3.7% in December 2016 from 3.9% at the end of 2015. Development of retail deposits have shown clearly upward trend since Q1 2014, with the annual dynamics oscillating around 8-9% in 2016. Since the mid-2013 the structure of household deposit base have been changing. The volume of term deposits has been decreasing over the past quarters, what is more than compensated by strong inflows of retail demand deposits, which expanded by more than 17% in 2016.

The favourable economic trends have not been fully reflected in the stock of corporate loans, with its average annual growth rate remaining at around 2.5% in H2 2016. The share of non-performing loans in the total volume of loans to non-financial corporations decreased to 6.3% at the end of 2016 from 6.9% in 2015. After acceleration of corporate deposits at the end of 2015, the year-on-year dynamics visibly slowed down in 2016 and finally were negative in the last month of the year.

Regulatory environment

Amendments to legal acts affecting banks in Poland and changes in recommendations of the Polish Financial Supervision Authority (PFSA)

Amendments to legal acts affecting banks in Poland and changes in recommendations of the Polish Financial Supervision Authority (PFSA) are presented in the table below:

| Legal act / Recommendation | Date of entry into force and a summary of new challenges | Influence on the main areas of the Bank | ||

| YES – the regulation impacts on a given area NO – the regulation does not impact on a given area, or impacts on a given area to a very limited extent |

||||

| Basel III (CRD IV/CRR Regulatory Package ) | 2015 | |||

| January 1, 2014 -> 2019 |

It defines requirements in the scope of, among other things, capital base, liquidity, leverage ratio, corporate governance and remuneration policy. The provisions have been transposed into Polish law by way of the Act on Macroprudential Supervision and amendments to the Banking Law Act. Standards and accompanying documents are being published on an ongoing basis. |

|

YES | |

|

NO | |||

|

YES | |||

|

YES | |||

| Bank Recovery and Resolution Directive (BRRD) | January 1, 2015 |

The Directive introduces the management framework in the scope of bank recovery and resolution. It imposes an obligation to draw up relevant plans (recovery plans - by banks and resolution plans by the competent bodies, i.e. BFG in Poland) and to set up the resolution fund supporting the process. The Directive also stipulates the minimum requirement for own funds and eligible liabilities to allow an effective bail-in of an appropriate amount of liabilities, prevent other banks from being “infected” and counteract a bank run. |

|

YES |

|

NO | |||

|

YES | |||

|

NO | |||

| In December 2016, amendments to CRD IV/CRR and BRRD were proposed and forwarded for further consultation within Basel IV. | ||||

| Act on Macroprudential Supervision over the Financial System and Crisis Management in the Financial System |

Q4 2015/ January 1, 2016

|

The Act partially introduces CRD IV and BRRD into Polish law, by, among others, appointing the BFG to be the authority responsible for resolution in Poland. As regards capital requirements, the capital buffers effective since 1 January 2016 are important. These include the conservation buffer (1.25% of the total risk exposure amount in 2017), the buffer on other systemically important institutions imposed individually on particular banks for the first time in October 2016, the systemic risk buffer (its value is unknown at the moment of report preparation) and the counter-cyclical buffer, at present at 0%. The level of compliance with the combined buffer requirement affects banks’ dividend policies. Additionally, the Act lays down corporate governance principles, framework provisions on disclosures and crisis management rules. |

|

YES |

|

NO | |||

|

NO | |||

|

YES | |||

| Act on Covered Bonds and Mortgage Banks | 2016 | |||

| January 1, 2016 | The amendments to the Act introduce solutions to foster the development of mortgage banking in Poland. The amendments aim at increasing the attractiveness of covered bonds as safe financial instruments, which should help to reduce the mismatch between maturity dates of long-term loans and short-term deposits used to finance them. |

|

NO | |

|

YES | |||

|

NO | |||

|

YES | |||

| Act on Capital Market Supervision | January 1, 2016 | The provisions of the Act of 12 June 2015 on Amendments to the Act on Capital Market Supervision and certain other acts entered into force on 1 January 2016, introducing changes to the system of financing the supervision. All entities operating on the capital market have been obliged to pay annual fees for the supervision. This has changed the size of charges that were earlier incurred only by certain market participants. |

|

NO |

|

NO | |||

|

YES | |||

|

NO | |||

| Act on Tax on Certain Financial Institutions | February 1, 2016 | The Act levies a monthly tax of 0.0366% (0.44% p.a.) on selected financial institutions, including banks. The tax is calculated at the end of every month on the basis of the value of their total assets in excess of PLN 4 billion reduced by the value of own funds and Treasury securities. |

|

NO |

|

NO | |||

|

YES | |||

|

YES | |||

| Act on Assistance to Borrowers in Difficult Financial Situation | February 19, 2016 | The aim of the Act is to provide interest-free returnable financial support to natural persons who took out a mortgage loan and meet specific criteria. The funds necessary to provide such support come from the Borrowers Support Fund financed by banks (an initial amount of PLN 600 million) proportionally to the value of their portfolios of mortgage loans for households which are over 90 days past due. |

|

NO |

|

NO | |||

|

YES | |||

|

NO | |||

| Act on Financial Market Supervision | March 2016 | The amendment aims at protecting consumers against unfair provisions in contracts concluded with lenders. It sets the maximum amount of non-interest costs, i.e. total costs a client must pay under a consumer credit agreement aside from interest. In addition, the Act caps the amounts of fees and interest on overdue debt. |

|

NO |

|

NO | |||

|

NO | |||

|

YES | |||

| Act on the Bank Guarantee Fund, Deposit Guarantee Scheme and Resolution | October 9, 2016 | The Act implements the EU Bank Recovery and Resolution Directive (BRRD) and Directive on Deposit Guarantee Schemes (DGS) into Polish law. The Act and implementing regulations thereto amend the rules governing the way banks and cooperative savings and credit unions (SKOKs) make contributions to the (guarantee and resolution) funds maintained by the BFG, impose the obligation to prepare recovery plans on financial institutions, and oblige the BFG to draw up resolution plans in cooperation with the entities concerned. As part of the latter process, the BFG will set minimum requirements for own funds and eligible liabilities (MREL) for every bank. The regulation introduces a number of requirements concerning the provision of specific data and information to the BFG, significantly expanding the reporting requirements applicable hitherto. |

|

NO |

|

YES | |||

|

YES | |||

|

YES | |||

| Market Abuse Regulation (596/2014, MAR) | July 3, 2016 | The Market Abuse Regulation changes the rules on market abuse prevention. The most important provisions include the modification of how confidential information should be prepared and disclosed in order to ensure proper communication with investors and prevent market manipulation. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| European Market Infrastructure Regulation (EMIR) | 2016/entry into force of certain >provisions has been postponed |

The Regulation governs the functioning of financial markets including, in particular, risk mitigation. It requires transactions to be cleared centrally through a central counterparty and sets margining requirements. |

|

NO |

|

YES | |||

|

NO | |||

|

YES | |||

| Recommendation K | March 1, 2016 | The Recommendation lays down qualitative guidelines for registers of collateral for covered bonds. It has been adjusted to the new legal framework created by the amended Act on Covered Bonds and Mortgage Banks which entered into force on 1 January 2016. The Act should make the purchase of and trading in covered bonds more secure and thus, indirectly, facilitate the development of the Polish mortgage lending sector. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Recommendation W | June 30, 2016 | The Recommendation sets standards for model risk management and creates the framework for the development, approval and quality assessment of models with a view to mitigating risk arising from the application of models. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Dividend Policy | 2017 | |||

| 2017 |

In accordance with the PFSA’s stance of 6 December 2016 on dividend policy in 2017, the existing criteria governing the payment and maximum amount of dividend paid to banks’ shareholders have been changed. The existing criteria, i.e. lack of recovery plan activation, a positive result of supervisory review and evaluation process (BION score), adequate level of financial leverage, and fulfilment of relevant capital requirements, have been expanded by the criterion of being other systemically important financial institution and the criterion of significant exposure to FX housing loans for households. |

|

YES | |

|

NO | |||

|

NO | |||

|

NO | |||

| Recommendation C | January 2017 |

The Recommendation sets out the rules for identification, measurement, monitoring and mitigation of concentration risk. All these processes should be covered by the internal control system, including interdependencies between exposures to particular risks. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Recommendation Z | 2017 |

Draft Recommendation Z on corporate governance in banks has been subject to consultation since December 2015. The Recommendation covers the corporate governance principles provided for in other regulations, e.g. the Banking Law. The date of entry into force of the Recommendation depends on the approval time of the Regulation of the Minister of Finance on Risk Management System, Internal Control System, Remuneration Policy and Detailed Method for Internal Capital Estimation. |

|

NO |

|

YES | |||

|

NO | |||

|

NO | |||

| Amendments to the Payment Services Act | February 2017 |

The amendments to the Payment Services Act include, among other things, the introduction of payment accounts with basic features defined in EU regulations. Banks will be obliged to provide every consumer free of charge with a payment account with basic features, given that they have no other bank account in the Polish zloty offering identical features. Holders of such accounts will be able to make free wire transfers and withdraw cash at ATMs and in bank branches free of charge under the conditions stipulated in the Act, however, without the option to link the account with any credit products. |

|

NO |

|

YES | |||

|

NO | |||

|

YES | |||

| MIFID II & MIFIR | 2018 | |||

| 2018 |

The set of ESMA technical standards on transparency requirements for trading venues and investment firms and on the obligation for investment firms to execute transactions in certain shares on a trading venue or a systematic internaliser was published in 2015. The standards will be implemented on January 1, 2018. |

|

NO | |

|

YES | |||

|

NO | |||

|

NO | |||

Impact of the appreciation of the Swiss franc on the position of borrowers, the banking sector, and mBank

Proposal of the Polish Banks Association

Several days after the Swiss franc’s abrupt surge in mid-January 2015 the Polish Banks Association (ZBP) proposed solutions to help CHF borrowers repay inflated credit instalments.

The package of solutions, the so-called “Six-pack”, has been implemented by banks and includes:

- taking into account the negative CHF LIBOR;

- narrowing the currency spread;

- extending the repayment period at the client’s request;

- not requesting new collateral or loan insurance from the borrowers who repay their instalments on time;

- option to convert the loan using the fixing rate of the National Bank of Poland (NBP);

- introducing more flexible rules for restructuring mortgage loans applicable to clients.

In May 2015, ZBP followed up with new measures. Banks declared financial and organisational involvement in the introduction of additional support for clients who took out housing loans, especially loans in foreign currencies. These measures include:

- extending the applicability period of the first ZBP package by the end of 2015 with an option to extend the applicability of certain solutions even further;

- setting up internal stabilization funds dedicated solely to CHF borrowers;

- allocating PLN 125 million from banks’ own resources to the Mortgage Loans Restructuring Support Fund, whose creation by way of an act is requested by the banks declaring financial support;

- making it possible for the borrowers who took out mortgage loans in foreign currencies to meet their own housing needs to transfer mortgage collateral in order to facilitate the sale or exchange of flats.

The subsidies from internal stabilization funds would be granted if the exchange rate of CHF exceeded a pre-defined threshold. This solution would be available to the borrowers who are ready to undertake to convert their loans at a specified exchange rate and meet specific income criteria. The support would be addressed to the borrowers whose income at the time of requesting for an amending annex is below the average monthly income in the national economy and whose flat or house is not bigger than 75 or 100 square metres respectively. Another condition is regular repayment. According to the declaration signed by banks, the subsidies would be granted when the CHF exchange rate exceeded PLN 5, yet the amount of the subsidy cannot be higher than PLN 0.33 per 1 CHF. According to ZBP’s estimations, in 10 years the amount of subsidies paid by banks from the stabilization funds would reach approximately PLN 3.5 billion. Certain aspects of ZBP’s proposal were later incorporated into the Presidential Bill on the Borrowers Support Fund.

The Mortgage Loan Restructuring Support Fund has been in operation since February 19, 2016. It aims at helping mortgage borrowers, regardless of the loan currency, who found themselves in financial straits due to an adverse event such as unemployment or illness. The support would account for up to 100% of the principal and interest instalment over 12 months, but would not be higher than PLN 1,500 monthly. Except for special cases, the support would be reimbursable. The fund is financed by banks (initial value of PLN 600 million) proportionally to the volumes of their portfolios of mortgage loans to households, for which the delay in repayment exceeds 90 days. mBank’s contribution to the Fund in 2015 amounted to PLN 52.1 million.

Presidential bill on refunding certain amounts due under loan and credit agreements

On August 2, 2016, the Chancellery of the President published the presidential bill on refunding certain amounts due under loan and credit agreements. The act covers agreements concluded from July 1, 2000 to August 26, 2011, when the so-called Anti-Spread Act came into force, and provides for reimbursement of the currency spreads charged in this period, i.e. the difference between the reference rate (NBP buy/sell rate + 0.5%) and the exchange rate adopted by the bank at the time of disbursement and repayment of the loan, plus 50% of statutory interest. The act applies to loans of up to PLN 350,000 per person and is addressed to individuals and entrepreneurs who did not apply depreciation charges and did not deduct interest from tax. The funds to be reimbursed will be deducted from the outstanding loan principal, and in the case of already repaid loans, the amount will be returned in cash. The act adopted a heterogeneous approach to denominated and indexed loans by using different reference exchange rates for the two types of loans. The Chancellery of the President estimated the cost for the banking sector at PLN 3.6-4 billion.

Moreover, it was announced that an additional capital requirement for FX mortgage loans would be imposed on banks to encourage them to voluntarily convert these loans into PLN. The requirement is supposed to be much higher than 150% (currently it is 100%) and it will increase gradually so that loans are converted over time. Should banks refuse to voluntarily convert the loans, legislative and court measures will be taken.

On September 1, 2016, NBP published its remarks about the bill. They referred, among others, to the provision on the level of the limit adopted, the fact that the act would cover repaid loans and entrepreneurs, and the name of the act. NBP also said that the implementation of the new law would cost banks more than the sponsors of the bill estimated – according to the initial estimates of NBP, the costs may be twice as high. NBP expressed its doubts about the fact that the amount of the spread refund would be calculated in a foreign currency instead of PLN as this would create an unjustified benefit for the borrowers, and consequently, inflate the costs to be borne by banks. In the opinion of NBP, there are no reasonable grounds for calculating (50% of) statutory interest on the spread refund. Another issue that NBP was concerned about was the method of setting the “reference” rate (any excess over this rate has to be refunded by banks to their clients) for indexed loans at the level of the NBP sell rate adjusted by 0.5%, whereas for denominated loans the reference rate is the NBP buy rate adjusted by 0.5%. According to NBP, in order to ensure equal treatment of borrowers who took out denominated and indexed loans, the legislator should consider replacing the NBP sell rate (adjusted by 0.5%) with the buy rate (adjusted by 0.5%) in the formula proposed in the bill.

According to the PFSA, the costs of the spread refund to be borne by banks would total PLN 9.3 billion, whereas the Polish Banks Association (ZBP) estimated that the cost of implementing the act in the proposed form would stand at PLN 7.7–14.0 billion depending on the level of spreads applied.

On October 20, 2016, the Sejm (lower chamber of the Polish parliament) discussed the bill for the first time. The Sejm decided to refer the presidential bill to the public finance committee.

Recommendations of the Financial Stability Committee of January 13, 2017

On January 13, 2017, the Financial Stability Committee (KSF) composed of the representatives of the National Bank of Poland (NBP), the Polish Financial Supervision Authority (PFSA), the Ministry of Finance and the Bank Guarantee Fund (BFG), issued a resolution on the recommendation regarding the restructuring of the FX housing loans portfolio. The Committee is of the opinion that the portfolio of FX loans does not generate any significant risk to the stability of the financial system in economic terms. The situation of the vast majority of households which took out FX loans is good, and their resilience to further exchange rate shocks is high. This stems from higher initial income buffers, the high increase in nominal wages that took place since loan origination, and low level of interest rates in foreign currencies. According to KSF, any potential invasive legal solutions that would lead to general conversion of FX housing loans, regardless of their form, are inadequate. Hence, the portfolio of FX housing loans generates a systemic risk in the context of potential consequences of the invasive legal solutions advocated in the public debate. KSF recommended that the Minister of Finance, PFSA and BFG take actions aimed at encouraging the banking system to convert exposures in foreign currencies into PLN.

Recommendations for the Minister of Finance:

- Increasing the risk weight for FX loans immediately, from current 100% to 150%.

- Increasing the minimum LGD (Loss Given Default) for FX mortgage loans.

- Introducing changes in the Borrowers Support Fund to increase the use of the fund. The resources could be used to support voluntary restructuring.

- Neutralising the excessive tax burden arising from the restructuring of CHF loans.

- Introducing a systemic risk buffer at the level of 3% applicable to all exposures (within the existing capital buffers).

Recommendations for PFSA:

- Updating the supervisory review and evaluation process (Polish: BION) methodology and expanding it with rules, enabling assignment of an appropriate capital add-on to relevant risk factors.

- Supplementing the additional capital requirements applied currently in the 2nd pillar, which are related to operational risk, market risk and risk of cross default.

- Issuing a set of good practices for the restructuring of FX loans, stipulating:

- that it is necessary to identify all risk and cost types;

- that excessive concentration of FX housing loans and the risk related to these loans may lead to the conclusion that there is no guarantee of safe and stable management of the bank;

- that, as far as the stability of the sector is concerned, it is justified to actively restructure the portfolio of FX loans by means of individual agreements with borrowers;

- that the restructuring process should be conducted in an organised way so that it does not threaten the appropriate levels of regulatory capital;

- that banks are obliged to draw up plans for the restructuring process;

- effective incentives to restructuring for banks and borrowers, making it possible to waive any future claims in exchange for more favourable conditions of restructuring;

- desirable practices accompanying the restructuring process;

- and taking into account the opinion of the European Central Bank regarding bills on FX housing loans.

Recommendations for BFG:

- Taking account of the risk arising from FX housing loans in the method of calculating contributions to the bank guarantee fund.

mBank Group’s portfolio of FX mortgage loans

In response to market demand, based on funding provided by its parent entity in the form of medium-term and long-term loans, mBank offered mortgage loans in foreign currencies, mainly the Swiss franc (CHF), to its retail clients in 2003-2011. The volume of these loans grew the fastest in 2008-2009; their sales started going down gradually as of 2010; finally, sale of CHF loans was discontinued in August 2011. Consequently, the CHF mortgage loan portfolio has been falling steadily, by ca. CHF 350 million per year, with a large part of this amount being repaid in the form of early payments. At the end of 2016, the value of the portfolio stood at CHF 4.5 billion (PLN 18.7 billion). The mortgage loan portfolio of mBank Group stands out as the best-quality credit product of the Bank. The non-performing loans ratio (NPL) totalled 3.7% at the end of 2016, higher than the sector average (2.9%), resulting from the application of a conservative “cross-default” method.

Market environment

mBank Group operates in a changing market environment. Currently, the following factors impact the operations of the banking sector in Poland:

- a low interest rate environment – interest rates in Poland are at historically low levels – the NBP reference rate stood at 1.5% and WIBOR 3M reached 1.73% at the end of 2016. The low interest rate environment depresses generation of net interest income;

- limited interchange rates, i.e. commissions paid to the bank by the settlement agent for every non- cash transaction made with a payment card issued by the bank, to the level of 0.2% for debit cards and 0.3% for credit cards (from the end of January 2015). It restricts the generation of net fee and commission income;

- the introduction of a new tax on certain financial institutions (so called „bank tax”) in February 2016 in the amount of 0.44% of assets annually;

- stricter regulatory requirements, putting pressure on capital, costs as well as operations;

- proposals to convert the mortgage FX loans, mainly CHF loans, to PLN and draft Act on a refund of excessive spreads related to loans proposed by the Presidential Office (so called „spread bill”), stipulating the reimbursement of spreads over the acceptable level charged by banks in 2000-2011 (for more information see chapter 2.2. Regulatory environment);

- consolidation of the banking sector – banks with insufficient scale give way to bigger and stronger entities. Consequently, the share of five largest institutions in total banking assets in Poland grew from 43.9% in 2010 to 48.3% in 2016 (according to PFSA);

- challenges related to the management and storage of personal data and deposits security in the Internet – cyber risk;

- spreading technological solutions and demographic processes change clients’ behavior. Customers increasingly prefer to bank outside of the branches as their main contact center with banks;

- declining trust in the banking sector as a result of the ongoing debate in relation to the FX mortgage loans, started on 2015;

- non-financial sector players (FinTech) are gradually entering traditional banking territories and offer innovative financial solutions. Additionally, the PSD2 Directive (Payment Services Directive 2) as of November 2015 will abolish banks’ monopoly in the market for payment services (the deadline for EU members to adjust local regulations is 2 years).

mBank Group in the financial services market

At the end of 2016, mBank was among the largest Polish banks across all relevant market segments.

Most of the Group subsidiaries also rank high in their respective market segments. The table below presents the market share and the position of mBank and of selected subsidiaries at the end of 2016 compared to 2015 and 2014:

| Business category | Market position in 2016* | Market share | ||

| 2014 | 2015 | 2016 | ||

| Corporate Banking | ||||

| Corporate loans | 6.3% | 6.3% | 6.1% | |

| Corporate deposits | 8.8% | 9.8% | 10.1% | |

| Leasing | 3 | 7.4% | 7.6% | 6.9% |

| Factoring | 8 | 7.9% | 7.8% | 7.3% |

| Retail Banking in Poland | ||||

| Total loans | 6.3% | 6.5% | 6.5% | |

| of which mortgage loans | 7.4% | 7.7% | 7.5% | |

| Non-mortgage loans | 4.6% | 4.7% | 5.0% | |

| Deposits | 5.3% | 5.7% | 6.1% | |

| Retail Banking in the Czech Republic | ||||

| Total loans | 1.2% | 1.4% | 1.4% | |

| Of which mortgage loans | 1.6% | 1.8% | 1.8% | |

| Non-mortgage loans | 0.5% | 0.6% | 0.7% | |

| Deposits | 1.3% | 1.4% | 1.6% | |

| Retail Banking in Slovakia | ||||

| Total loans | 0.7% | 0.8% | 0.7% | |

| Of which mortgage loans | 0.8% | 1.0% | 0.8% | |

| Non-mortgage loans | 0.3% | 0.4% | 0.4% | |

| Deposits | 1.5% | 1.4% | 1.6% | |

| Investment Banking | ||||

| Financial markets | ||||

| Treasury bills and bonds | 14.8% | 12.8% | 16.2% | |

| IRS/FRA | 27.3% | 15.4% | 11.5% | |

| FX spot and forward | 10.9% | 12.1% | 16.1% | |

| Non-Treasury securities | ||||

| Short-term debt securities | 4 | 8.1% | 6.8% | 9.8% |

| Corporate bonds | 4 | 12.9% | 12.4% | 11.5% |

| Bank debt securities** | 1 | 34.3% | 36.4% | 34.6% |

| Brokerage | ||||

| Equities trading | 10 | 3.9% | 5.0% | 4.4% |

| Futures | 2 | 18.0% | 16.1% | 12.3% |

| Options | 4 | 17.9% | 12.8% | 9.7% |

Source: Own calculations based on data from mBank, NBP, WSE, CNB, NBS, Fitch Polska, Polish Factors Association, Polish Leasing Association, press reports.

* Where determinable.

** Excluding “road bonds” issued by Bank Gospodarstwa Krajowego (BGK).

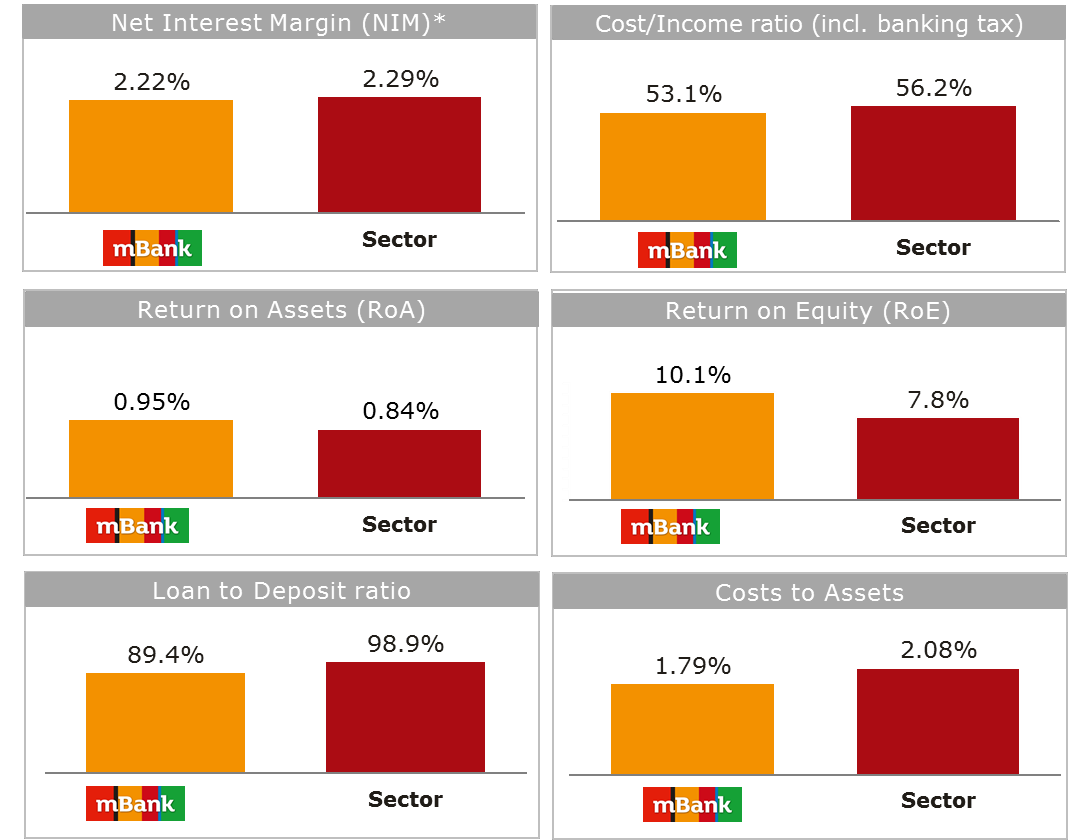

mBank Group and the Polish banking sector performance in 2016

mBank’s performance relative to the overall banking sector in 2016 was very strong, as presented in the comparisons of key efficiency and profitability ratios in the following graphs:

Source: Own calculations, based on statistics published by the Polish Financial Supervision Authority (data as of December 31, 2016).

* To the average assets.

Outlook for the banking sector and mBank Group for 2017

What will 2017 bring for the Polish economy?

| Economic indicators | 2015 | 2016 | 2017P |

| GDP growth (YoY) | 3.9% | 2.8% | 3.4% |

| Domestic demand (YoY) | 3.4% | 2.8% | 4.5% |

| Private consumption (YoY) | 3.2% | 3.6% | 3.9% |

| Investment (YoY) | 6.6% | -5.5% | 5.3% |

| Inflation (eop) | -0.5% | 0.8% | 1.5% |

| MPC rate (eop) | 1.50 | 1.50 | 1.50 |

| CHF/PLN (eop) | 3.92 | 4.11 | 3.89 |

| EUR/PLN (eop) | 4.26 | 4.40 | 4.20 |

Source: mBank’s estimates as of 02.02.2017.

In 2017 the Polish economy will accelerate again. mBank estimates the growth rate to go up to 3.4% from 2.8% in 2016. The growth structure will be better-balanced - the contribution of consumption will not change significantly, while investment will stop falling and will take over as one of the main growth drivers (starting from Q2 in the most probable scenario).

Private consumption will be rising by over 3% YoY throughout 2017 (with the average annual rate hitting 3.9%). It will be helped, on the one hand, by continued excellent consumer mood and, on the other, by consumption smoothing, an economic concept according to which the reaction to the expected lower growth of real household incomes (end of the statistical effects of the 500+ programme and return of inflation to the NBP’s target range) will be limited.

As regards investment, the rebound in investment demand will be supported primarily by growing public investment. Apart from purely statistical effects (linear infrastructure), the developments in this area will be determined by the implementation of ambitious investment plans by local governments and railway companies. Looking at the capacity utilization in companies and moderately optimistic results of surveys covering firms’ investment plans, private investment should be growing as well. New contracts and spending from the EU budget will lead to a major rebound in investment - mBank expects investment to rise by 5.3% YoY.

At the same time, the (average annual) inflation rate should go up to 2.2% with the biggest part of the increase taking place in early months of the year. Driven by base effects, a weakening zloty and a slow increase in core inflation, the inflation rate is expected to hit 2-2.5% at the turn of Q1 and Q2. In the following months the impact of growing fuel prices will be decreasing gradually. Whether inflation goes up further (or rather stays high) in the second half of the year will depend on the prices of consumer goods and services included in the core part of the basket.

Zloty and Polish bonds

mBank expects the zloty to strengthen slightly in 2017 on better sentiment towards emerging markets, faster economic growth around the world with Poland being one of its beneficiaries, and a gradual improvement in domestic risk perception. These trends will also support the Polish capital market, which lagged behind many emerging markets in 2016. In the market for Treasury securities, improved sentiment towards Poland and falling risk premium will result in a flattening yield curve, a lower spread to German and US bonds and a narrowing spread between the yields on bonds and IRS rates. At the same time, there is no escape from the close relation between bond yields and inflation. This is why 2017 will not be the “year of bonds”.

The market for Treasury securities was shaped and stabilised by a growing role of domestic banks in financing public debt. The gradual increase in the value of Treasury bonds in banks’ portfolios (in particular those with maturities of up to 2 years) reflects the considerably higher growth in deposits compared with loans and was supported by the tax incentives created by the new bank levy introduced in early 2016. The Bank estimates the difference between the growth rates of deposits and loans to stay unchanged in 2017. At the same time, the capacity of domestic banks to absorb the additional supply of bonds will still be substantial.

Banking sector and monetary aggregates

As a result of increasing interest (increase in credit margins in 2016), stricter requirements concerning the LtV ratio and relatively low attractiveness of mortgage loans caused by additional burdens imposed on banks, the growth in mortgage loans will remain low. This will be offset by faster growth in consumer loans (driven, among others, by the positive impact of the government’s 500+ programme on creditworthiness) as well as solid growth in corporate loans (in particular, in investment loans), where the bank tax should trigger certain restructuring and consolidation.

Although a significant decrease in the interest on deposits is expected (another effect of the bank tax and the restructuring of balance sheet size), it should not have a major impact on the growth in household deposits. At present, investment alternatives are unattractive, while a higher increase in nominal incomes (driven by both higher wages and social benefits) will translate into more deposits flowing into the banking sector. The end of the statistical effects of the 500+ programme (first payments were made in May 2016) will be the only factor reducing the growth in deposits in 2017.

Outlook for mBank Group

| Net interest income & NIM | (slightly positive) |

|

|

|

|

| Net Fee & Commission income | (slightly positive) |

|

|

| Total costs | (slightly negative) |

|

|

|

|

|

|

| Loan Loss Provisions | (neutral) |

|

|

|

|

Implementation of mBank Group Strategy for 2012-2016

The underlying principles of the Bank’s “One Bank” Strategy, which was adopted in July 2012, were to improve the long-term profits and income generating capacity of the Group supported by a sound balance sheet and by providing clients with a high level of technological support and simultaneously a stronger internal integration – strengthened by brand and network unification.

The Group achieved a great majority of its strategic goals. The structure of balance sheet has been improved in terms of funding diversification, including strengthening of client deposits’ role and loan to deposit ratio decline from 125.1% in 2011 to 89.4% in 2016. Additionally, long-term liquidity has been kept high and the capital position has been organically strengthened. Despite a turbulent environment, which challenged some of the profitability assumptions, the Bank is positioned above the market in terms of profitability, revenue growth and remains one of the best banks in Poland in terms of cost efficiency. At the same time, the Bank kept its focus on internal integration of its business model (including the unification of brands, integration of traditional corporate banking services with investment banking offer, migration of former MultiBank customers to the new mBank platform, consolidation of brokerage business and Private Banking under the umbrella of mBank).

The table below presents financial objectives set under Strategy for 2012-2016.

| Strategy for 2012-2016 | ||

| Financial objectives | Target values | As at the end of 2016 |

| Loan-to-deposit ratio | approximately 115% by 2016 | 89.4% |

| Net Stable Funding Ratio (NFSR) | minimum 110% | 114% |

| Core Tier 1 ratio | approximately 11% | 17.3%* |

| Cost-to-income (C/I) ratio | maximum 48% | 45.7% |

| Gross ROE | minimum 15% | 13.6% |

| Net ROA | minimum 1.4% | 1.0% |

* Common equity Tier 1 Capital ratio calculated in line with Basel III rules.

Current and future trends in banking and mBank’s positioning

Currently, the banking sector operates in a fast changing environment and is affected by a number of factors, which impact its activities and determining future targets. The wide-spread technological solutions and demographic processes change clients’ behavior. A huge amount of information, reaching from a number of channels require the choice of the necessary and elimination of the useless ones. Non-financial sector players are gradually entering traditional banking territories (the trend is more pronounced outside of Poland) putting additional pressure on banks’ earnings and their own ability to innovate and compete with a much wider group of market players. Growing regulatory requirements and less attractive market environment blurs the existing advantage of Polish banks over the Western competitors. The previous market reality, including (higher nominal interest rates and the level of transactional fees, relatively reasonable prudential and regulatory fees, lack of fiscal discrimination of the banks, ensured a relatively higher return on capital and higher efficiency in comparison to banks operating in other countries. The current and future challenges require re-visiting of long-established beliefs.

While creating our „mobile Bank” Strategy, we focused on three trends, which in our opinion dominate in the current market environment and determine our future activities. These are: client era, mobility era and efficiency era.

Client era

The time of focusing solely on creating and improving products has come to an end. Clients are at the centre of attention and banking, following the steps of other sectors, has also entered the era of the customer. Agile market disruptors (today e.g. Uber, Airbnb) are obsessively focused on meeting the needs and solving of the most significant issues of the consumers, who increasingly expect to be treated in the same way by mBank. The offering should be constructed in a way that it fulfils real client need and understanding of the offer and making the right decisions takes minimal amount of time. Only products and functionalities that are used and appreciated by clients should be developed.

In our opinion, every interaction between us and the client should fulfil three critical criteria:

- realization of the need - authentic need of the client will be realized;

- ease - in a simple and friendly manner, almost unnoticeable;

- customer experience in line with mBank brand - creating positive emotions in line with our brand.

In order to get to know better and understand the preferences of the retail clients mBank will improve the Net Promoter Score (NPS), i.e. the organized process of measuring clients’ satisfaction, already ingrained in the corporate and investment banking area. In terms of change of a shift in mBank’s marketing philosophy – satisfied clients shall partially replace costly marketing activities - our goal as an organization is to have as many satisfied customers, brand ambassadors, as possible. The NPS numbers will not be the value in itself. The key value of the NPS system will be to deliver the precious knowledge for the organization, the system will be treated as a managing tool, indicating the critical areas of relations with the clients requiring an improvement on the our side.

Mobility era

Smartphone, currently perceived as a first truly personal computer, will become a management centre of client’s lives. The average user spends almost 3 hours a day with a smartphone and “Millennials” do not part with their device for the entire day. The majority admit that the first thing they do after waking up is reaching for a phone. The observed high dynamics of the increasing popularity of mobile solutions does not mean however that the market has already reached its peak. On the contrary - in mBank we expect that in the next few years a real smartphone revolution will take place. Mobile solutions will enter almost every aspect of life - mobility (mobile solutions) will be incorporated as a way of life.

Lean market disruptors, revolutionizing the existing force system on different markets (e.g. transport, travel, entertainment) offer the best applications, providing really mobile end-to-end customer experience and ultimate convenience (e.g. Uber, Airbnb, Spotify, Netfilx).

Our three main advantages that position mBank to make a quantum leap in mobility are:

- unique brand – “m” easily associated with mobility;

- customers – younger and relatively more tech-savvy, hence more open for new banking possibilities;

- digital processes mastered, as a consequence of Internet DNA of the retail division.

Efficiency era

Polish banks have until recently been functioning in a market reality allowing significant advantage over the western counterparts in terms of return on equity (ROE) and efficiency (C/I). Since the beginning of 2015 that advantage has diminished significantly due to the growing regulatory requirements, new banking tax, other additional levies (including BFG contribution for covering the loses of cooperative bank and SKOK earlier). Less favourable market environment exerts pressure on net interest income (interest rates on historically lowest level) and fees and commissions income (interchange fees on one of the lowest levels in Europe). The capital requirements are growing and the banking operations are limited by new liquidity indicators. The banking paradigms are changing, nevertheless return on investors’ capital remains the most basic measure for efficiency of an organisation, key from shareholders’ perspective.

mBank has a good starting position thanks to its effective multichannel business model, in particular digital channels and a limited branch network. The bank does not have a structural cost problem, which necessitates cost adjustments in a scale observed in many other bans in Poland and abroad as well as an effective, predictable risk management.

Mobile Bank - Strategy for 2016-2020

mBank Group’s Strategy until 2020, titled mobile Bank, was accepted by mBank’s Supervisory Board on June 10, 2016. The strategy sets the framework for most important strategic activity directions of the Group. It rests on three pillars creating a canvas for implementing specific business actions to be undertaken by mBank over the next years. There are: client centricity, leveraging on mobility and continued improvement of efficiency. The „mobile Bank” Strategy also defines the foundations for the strategy implementation, including engagement of mBank employees, principles of the organization development as well as a framework for the bank’s technological agility.

Mission: „To help. Not to annoy. To delight... Anywhere.”

mBank’s mission reflects the emergence of the client and mobility eras, which are the two most critical factors about to shape the business models at financial institutions.

„mobile Bank” Strategy pillars:

- Empathy for the client – all mBank’s actions will be driven by clients and their individual needs, preferences and behaviours. mBank’s ultimate goal is to make sure that clients want to choose it permanently and are keen to recommend it, having been highly satisfied with its services. The goals of the Empathy pillar defined in the new mission are the following:

- To help. To offer what clients really need and when they need it. To construct the offer in such way that it fulfils actual needs of the clients. To simplify so that understanding of the offer and making the right decisions takes minimal amount of time.

- Not to annoy the clients, facilitating the cooperation with the bank and to minimize the hassle and effort for the customers. To deal efficiently with customers’ difficulties during the first contact between a client and the bank, regardless of the contact channel.

- To delight the clients by making them feel special and appreciated thus creating the most valuable brand ambassadors at mBank. Satisfied employees are also the natural ambassadors of mBank’s services, therefore mBank will strongly promote among them the use of its offer, mobile solutions in particular.

- Mobility – it is mBank’s ambition to be the synonym of mobile banking, focusing on the following priorities: convenience, usability and simplicity from customer’s point of view. Consequently the development of new application functionalities will be concentrated on three main areas:

- Mobile Hub: gate in a multichannel strategy in contacting the client - Regardless of the starting of a transaction – each distribution channel will be a click away on the client’s tablet or smartphone. At the same time mBank expects, that most contacts in the 2020 perspective will commence on a smartphone which will be a “gate” for the client to seamlessly switch between channels;

- Reinforcing the role of mobile banking as a contact channel: minimizing the functionality gap between mobile and internet - mBank will ensure bigger independence of the mobile channel and will limit its functionality gap compared to other distribution channels;

- Customer engagement through use of innovative, unique functionalities engaging the client - mBank will create and reinforce the habit of using its mobile application, which will consequently generate additional opportunities to approach customers with an adequate product offering.

- Efficiency - focus on efficiency supports mBank’s profitability in times when returns from core banking products in Poland are under significant pressure. Business development in terms of asset classes, maturities, sources of financing and concentration of the business activity (groups of products and client segments, presence on foreign markets) will be carried out in full compliance with the rules for optimal cost efficiency and process digitalization, efficient capital allocation and stable funding.

Strategy enablers

Implementation of specific, strategic initiatives will require strong engagement of employees of the entire Group, as well as targeted, agile IT strategy. As such, the foundations for the strategy implementation are:

- Engaged people: mBank will create conditions for full engagement of employees in building a friendly working environment allowing them to achieve their ambitions. The priority of HR strategy is attracting and retaining the best and motivated specialists and managers in the sector.

- Technological advantage: mBank will skilfully build world class IT organization and its agile, client-driven IT will become a source of the bank’s competitive advantage.

mBank Group financial targets

In a rapidly evolving business, regulatory and technological environment, a reliable formulation of financial targets in a 5 year horizon becomes a significant challenge. mBank, leveraging on its key strengths has in the past been able to outperform most of its competitors in terms of financial results. It remains mBank’s strategic goal to be positioned among the leading banks in Poland in terms of key financial measures.

Determining financial targets for the years 2016-2020 has been based on mBank’s ambitious assumptions regarding mainly cost effectiveness as well as returns on equity and assets. Moreover, mBank’s intention is to pay dividend of at least 50% of profits, subject to regulatory (Polish Financial Authority’s) consent, as well as to further strengthen its funding base.

The table below presents mBank Group’s financial aspirations:

| Financial measure | Target point |

| Cost efficiency, Cost-to-Income (C/I) |

Top 3 in Poland, each year i.e. to be one of three most effective listed banks in Poland |

| Return on capital, RoE net |

Top 3 in Poland, each year i.e. to be among the three most profitable listed banks in Poland from the RoE standpoint adjusted for dividend distribution |

| Assets profitability, RoA net |

Top 3 in Poland, in 2020 i.e. to be one of three listed banks in Poland with highest return on assets |

| Capital position, capital adequacy in terms of core capital CET1 |

Maintain the ability of dividend pay-out in terms of CET1 ratio, annually - maintain the ratio minimum 1.5 p.p. above capital requirement for mBank |

| Financial stability, Loans/Deposits ratio (L/D) |

Maintain the L/D ratio at most not significantly higher than 100%, each year |

The pillars of the “mobile Bank” Strategy in mBank’s activities

The pillars of mBank Group’s strategy for 2016-2020 have been developed in response to the most important challenges faced by banks in terms of running business activities. According to mBank, these pillars include the client era, the mobility era and the efficiency era. At present, mBank focuses on these three pillars which are also to set the directions for the Bank’s future operations. Below you can find our activities within the three most important trends in banking which, at the same time, constitute the pillars of our strategy.

Client-centric approach

The new “Mobile Bank” Strategy is our response to the challenges posed by the era of clients who serve as the starting point for all our decisions. The Bank’s mission and the desired clients’ experience of the relation with the Bank have been defined in the strategic document. We concentrate on a consistent building of a fresh, dynamic brand attracting new generations of consumers and entrepreneurs whose aim is to develop themselves, act, and fulfil both their plans and dreams. We emphasised the need for acting on three levels: satisfying clients’ needs (both the needs clients are aware of and “the needs of tomorrow”); in a simple and client-friendly manner, in the way characteristic of a modern institution being the icon of innovation; evoking positive associations and, at the same time, being completely different from other brands. Mobility at the level incomparable to the one offered by our competition should be the element distinguishing us from others.

We ran a number of activities in 2016 which broadened our knowledge about clients’ needs and expectations and enabled us to assess the Bank’s operations from their perspective. We apply all methods for acquiring this knowledge: market research, both quantitative and qualitative; ethnography; customer journey map; in-depth NPS survey. Additionally, we are guided by the analysis of data from our systems which is conducted with the use of available cutting edge technology.

We have considerably improved the analytics arising out of clients’ complaints. This allows us to remove the reasons for complaints and, consequently, to increase the quality of services rendered to our clients. Thanks to these actions, the number of complaints has dropped despite the significant growth in the number of clients and the volumes of transactions.

Cultural and communication activities run every day at the Bank bring clients and their needs nearer to all mBank’s employees. We believe that successful relations with clients do not depend on front office employees only, but also on the work of those who have no contact with clients on a daily basis, which means that they have no opportunity to develop sensitivity to clients’ problems based on their personal experience.

In order to get closer to our clients and understand each other better, we have worked on communication language addressed to clients using not only conventional methods (training sessions with language experts) but also modern ones (algorithm to evaluate if documents are clear and correct). Agreements offered to our clients are written with the use of a revolutionary simple and “nonlegal” language as their clarity is one of our characteristic that distinguishes us from others.

We have implemented a wide range of technological innovations for our clients (i.e. a very popular mobile payment assistant) and we are still working on new innovations (mobile phone payments).

The strategy has provided for a new function in mBank Group – position for customer centricity culture and client relations, Management Board Plenipotentiary. The centralisation and high position of this function aim at, in an exact sense, – the coordination and standardisation of activities influencing clients’ experience, and in a symbolic sense – stressing the significance which the Management Board attaches to these issues.

Mobility

The mobile application, launched in February 2014, has won a large group of new users over the last three years, and based on a survey of actual needs of the clients, has been enriched with a number of new features. Mobile banking services are used systematically by over 1.1 million clients, an average user does banking via mobile devices 18 times a month. The “mBank PL” application offers a wide range of convenient and unique solutions, e.g. the “loan in 30 seconds” which now accounts for 18% of overall cash loan sales.

Following the positive reception of the new features introduced in 2015, such as the payment of invoices using QR code scanning, NFC payments for Android system (available to Orange subscribers), and the option to change the authorisation limits on payment cards, mBank decided to pursue further development.

In 2016 we introduced a number of new features and improvements into the application, including:

- “mLine in a click” service, which allows clients to connect with mLine consultants directly from the application, without the need to use one’s ID and telecode;

- option to change card transaction limits;

- possibility of logging into the application with a fingerprint;

- express transfers using telephone numbers within the BLIK system;

- possibility of purchasing travel insurance (at present, 15% of travel insurance policies are bought via the application);

- “Payment Assistant” service which reminds clients of all regular payments, suggesting the amount due and the payment date and allowing them to quickly settle invoices;

- mobile Authorisation - a service allowing users to authorise transactions made in the transaction system via the mobile application. Instead of typing passwords received in a text message, all that the client needs to do is to log into the application and accept (or reject) a given transaction with one click.

In February 2016 the mobile application was ranked the best banking application in the Mobile Trends Awards competition, and in September it won the "Newsweek Friendly Bank" ranking in the “Mobile Banking” category. For more information about the awards granted to mBank Group, see chapter 6.1. Key projects and innovations of mBank Group in 2016.

Efficiency

One of the signs of efficiency improvement at mBank Group was the implementation of the Lean approach in mCentrum Operacji.

The object of the operating activity of mCentrum Operacji (mCO) is to support the settlement of processes at mBank, in terms of both retail and corporate banking. The effective handling of processes constitutes an important element supporting the Bank in the achievement of the market success. The most significant factor in the operational area is increasing the efficiency of activities with a simultaneous maintenance of high quality of products offered to clients. This thesis was brought into focus when the decision about implementing the Lean approach was made in H2 2012.

The Lean approach was implemented in operations “from the bottom”. This means that few small optimisation projects were launched at the very beginning. Operational employees were involved for this purpose and their creativity and knowledge about what does not work properly in the processes were used. First successes encouraged us to develop a culture of small changes in other areas. On that basis, it was decided to build and develop a culture of a continuous improvement in the whole operational area. Currently, depending on needs, various tools are applied from the wide range of those available under Lean Management. The most popular tools include whiteboards, mainly because of their usefulness and wide application range. The most significant indicators of process measurement, which are discussed at short, daytime meetings, are visualised with the use of the whiteboards. Thanks to that, it is possible to monitor processes on an ongoing basis and response swiftly to emerging threats, i.e. a rapid growth of the volume and, consequently, a risk of failure to meet the deadline contracted with a client. These changes could be successfully implemented due to the commitment of the company’s management that conducts weekly “economic visits” in particular operational divisions emphasising the significance of and need for the changes.

Today one can say without hesitation that the cultural change has taken place. Operations, where, at the same time, the biggest increase in commitment among employees was reported in 2016, constitute a continuously developing area of the Bank.

All these activities generate measurable effects:

- 54% is the total result of optimisation calculated per FTE from the beginning of work on the improvement of the processes in operations;

- 85% is the increase in the employees’ commitment measured according to a survey conducted by Aon Hewitt.

During the process of operational transformation, we completed several initiatives, necessary to achieve the aim. One of the most important initiatives was the implementation of the comprehensive project measurement system, known as OPOS. It is a tool supporting the management of processes and the employees’ effectiveness.

A second part of improvements, i.e. the digitalisation of the carried out processes, has been implemented parallel to the introduction of the Lean approach. With the use of IT solutions including “The Correspondence Circulation System” (SOK) and ECM, i.e. a repository to store and browse electronic versions of documents, we completed initiatives, thanks to which:

- from June 2015, over 80% of operational processes have been conducted paperless and employees have been using only the application and two monitors to handle them;

- 25 thousand pages of printouts were eliminated monthly in 2016. In order to further develop the operation area, a continuous improvement of the processes is planned, taking into consideration:

- opportunities brought by new technologies, e.g. robotisation;

- process automation;

- further digitalisation of processes, including in particular the elimination of paper from banking product lifecycle and, consequently, the growth of mobility;

- further development of Lean Management, with the focus on employees.

mBank

mBank