Innovations at mBank Group

Mobile application

Mobility-based technologies find application in a wide range of business models, while their capabilities are almost revolutionary compared with the time when mobility was still at a nascent stage. Today, it is difficult for many people to imagine life without a smartphone, which became an indispensable tool we use on a daily basis to make our lives easier.

In the past, in order to pay a bill a client had to visit a bank’s branch. After the Internet revolution, such payments could be made without leaving the house. Today, all it takes to make a payment is a few seconds and clicks on a smartphone; clients no longer need to give the 26-digit account number and can make payments anytime and anywhere. This is the reason why freedom, speed, control, convenience and personalisation are what the users of mobile technologies appreciate the most. In line with the forecasts for the development of e-commerce market in Poland, in a few years’ time also the purchase of banking products using mobile technologies will surely become one of the core services offered by banks.

According to a report by PR News, at the end of Q3 2015 the number of active users of mobile banking exceeded 5 million. mBank boasts the greatest number of mobile users, which stood at 1,162,000 in Q3 2015.1 The number of mBank’s clients that have already gone mobile is twice the Polish market average.2

1. Source: http://prnews.pl/raporty/raport-prnewspl-rynek-bankowosci-mobilnej-iii-kw-2015-6551613.html

2. According to Finalta Research 2015

All mBank’s applications were downloaded 1,057,480 times, which represents a 44% increase compared with the previous year.

- The share of client logins in the mobile channel rose by half: in December nearly one in three logins to mBank were from a mobile device.

- In 2015, the number of mobile channel users surged by almost 45% year on year.

- The clients’ activity in the mobile channel, as measured by the number of logins per one user, increased nearly by half in twelve months.

Over the last two years, mBank’s mobile application, launched in February 2014, won a large group of new users, and based on a survey of actual needs of the clients, was enriched with a number of new functionalities. Following an enthusiastic reception received by new functionalities such as balance check without login, quick cash loan, P2P transfers or mobile mOkazje and PUSH notifications, mBank decided to pursue further development.

The key new elements of mBank’s application include:

- New section “Deposits”, which makes the deposit offer available via mBank’s mobile application more attractive by offering products on special terms in the mobile tariff dedicated solely to those who downloaded the application. Now, the application users can use offers which so far had only been available via the Internet Banking channel, such as Offer for You or 3-day Deposit

- Mobile mTransfer, which allows clients to pay for their purchases on PayU/Allegro platform in only one click in mBank’s application

- Currency mPlatform, which allows clients to exchange currencies online in the application

- Multi-person Authorisation of Transactions, which allows for a "double-check" authorisation in the application. This functionality makes it possible to authorise transfers set up on another device

- BLIK service, which allows clients to quickly pay for their purchases, make ATM withdrawals and pay online via smartphones. For more information about BLIK functionality, please see the “BLIK Service” section

- Payment of invoices using the QR codes scanning functionality

- NFC payments for Android system available to Orange subscribers

- Additional facilities, such as an option to repeat a transfer or answer to a transfer or quick supply of account number

- Change of authorisation limits on payment cards - the amount or number of limits can be changed monthly or daily

- mLine in a click, which allows clients to connect with mLine consultants directly from the application, without the need to dial the number manually or log in using one’s client number and telecode

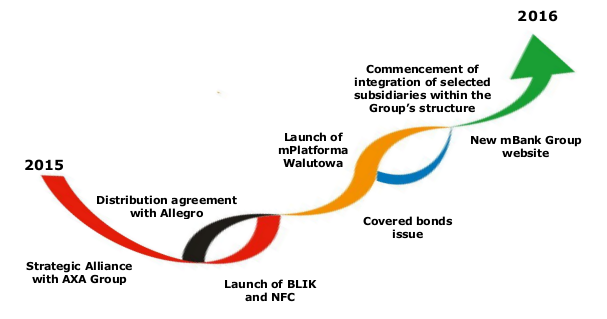

2015 was also an important year for mBank’s website development, which underwent a major overhaul. The new website launched in November was designed in line with the RWD (Responsive Web Design) technology, which provides an optimal viewing and interaction experience across a wide range of devices used to browse it. For more information about mBank’s new website, please see “New website” section.

Each year mBank is awarded numerous distinctions for the quality of services and products offered and wins contests against competitors from both Poland and abroad.

A small sample of what mBank Group managed to achieve with the support of its clients during its 27-year presence on the Polish market is presented below:

- February 2015 - prestigious Mobile Trends Awards were handed out for the fourth time to the best companies and institutions from the mobile technologies sector. The award committee named the winners in as many as seventeen categories, while three special prizes went to the authors of applications selected by Internet users. mBank won in the following categories: mobile banking and Mobile Trends Awards special prize.

- July 2015 - every year Forrester Research compiles a ranking of mobile applications designed by European banks (European Mobile Banking Functionality Benchmark). The 2015 edition covered thirteen banks. mBank’s mobile application ranked third, which should be perceived as a considerable distinction, taking into account the scale of the undertaking.

- September 2015 - at this year’s Great Gala of the Banking Industry organised by Newsweek and Forbes magazines, banks competed neck and neck and the rivalry was exceptionally fierce. mBank won as many as four awards and came second in the Mobile Banking category, just a few points shy of the leader.

For more information on awards granted to mBank Group, see chapter Awards and distinctions.

New website

Since November 29, 2015, mBank's clients have been using a new website. Not only the website appearance has changed, but also its layout, graphics and functionalities. The website is based on the Responsive Web Design technology enabling it to adapt the website layout to the screen of a device displaying the content. The technology makes it easier to surf the internet using such devices as smartphones or tablets, reducing to the minimum the need to resize invisible fragments of text and scroll or pan the displayed image to see the entire website.

Clients expect to be able to access quickly interesting content on a given website, regardless of the device they use to open it. Bearing this in mind, a number of improvements have been introduced, such as a new layout and a fast browser, which suggests a further part of a phrase entered by the user. The information is displayed in an organised manner, starting from the most up-to-date content. Additionally, once the user enters a phrase, for example "cash loan", not only are the offer details displayed but also a link to apply for a cash loan at once.

Changes in the website are noticeable as well when the user starts browsing for outlets, ATMs and deposit machines. It is possible to filter an outlet to check not only its address, but also the scope of services.

A new economic website was also launched. All the necessary data was collected in one place and presented in a clear form of graphs. Investors may save data on funds they find interesting in the "favourites" tab, keeping the information within reach whenever he wishes to review it again.

The website designers also kept in mind the needs of blind users or those with poor eyesight. New websites were adjusted to the needs of this group of clients and designed in line with the Web Content Accessibility Guidelines.

Last but not least, one of the most important elements implemented as part of the project is a new common login site for clients from all segments. Retail clients, corporate clients, Private Banking clients and SMEs may switch between their dedicated transactional systems from the level of one site, which is particularly important after the merger of mBank and Multibank.

mBank StartUP Challenge "Cooperate with the bank and visit Tel Aviv!"

In November 2015, young entrepreneurs were given an opportunity to participate in mBank StartUP Challenge competition organised in cooperation with Business Link Polska. The winners were invited to an acceleration programme in Tel Aviv and were given the possibility of entering into business cooperation with mBank.

mBank's mission in the scope of servicing small and medium-sized enterprises (SME) goes far beyond the area of product service. mBank's aim is to create an "entrepreneur's ecosystem", i.e. an environment where a start-up will not only easily use products it needs but also receive support in the process of managing a business - starting from support in its establishment to advisory services regarding its further development.

To accomplish this mission mBank StartUP Challenge - the acceleration programme - has been organised, which is a unique opportunity to develop a business and find international investors. For a business beginner, such a trip is a great opportunity which may be more helpful than money. Moreover, for the Bank it is an occasion to start cooperating with small entities developing products on the verge of innovation.

In order to take part in the competition, candidates were to present how their products may prove helpful in cooperation with the Bank. The proposed activities should help to increase the number of users of the mobile application, encourage mBank's clients to save or invest or enable the Bank to carry out more effective credit risk assessment. The main criterion for the assessment of concepts presented by the participants was the innovativeness of a proposed solution and the possibilities of its application in business.

Additionally, the competition participants were asked to develop the grounds for a business model and use it to present their ideas for cooperation with mBank.

Out of hundreds of applications, the competition organisers - the University Entrepreneurship Incubators Foundation and mBank - selected the best 5 proposals which were presented on December 15, 2015, during the competition gala, taking place at mBank's headquarters in Warsaw.

The competition finalists were the following companies: KoalaMetrics - an entity analysing data in the area of mobile applications, FriendlyScore – an entity using social media data in credit scoring, zapobraniem.pl - a designer of innovative payment solutions in e-commerce area, iWisher - a designer of a platform combining e-commerce with clients' savings goals, and Oort - an entity operating in the area of Internet of Things and SmartHome solutions.

During the gala, each finalist had three minutes for a pitch talk to briefly present its concept.

The winner - KoalaMetrics was awarded with participation in the acceleration programme in Tel Aviv which offers but is not limited to workshops and coaching and mentoring sessions with the aim to develop and refine its business model, as well as meetings with potential investors.

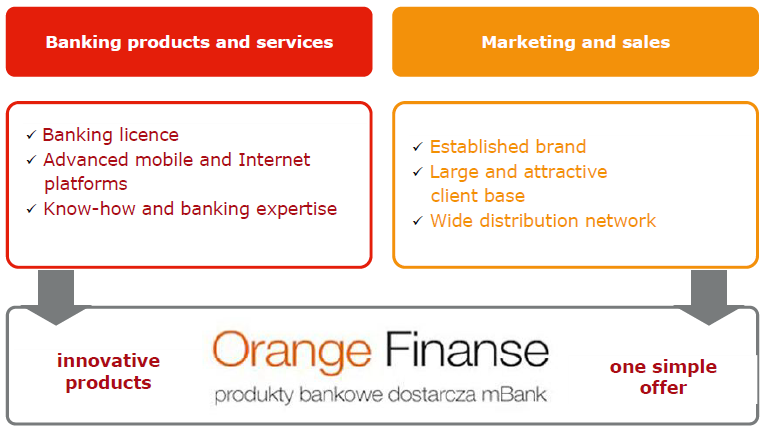

NFC service in Orange Finanse

The rapidly increasing importance of mobile payments is in line with one of the most substantial trends nowadays - smartphones taking over new areas of our life. It seems that within the coming months, contactless mobile payments will become a common payment method in Poland. Today, over 60% of Polish consumers are interested in paying at shops using their smartphones, and two thirds expect that in 5 years we will pay by phone at least once a week, according to the Mobile Money 2020 survey carried out by Visa Europe.

coming months, contactless mobile payments will become a common payment method in Poland. Today, over 60% of Polish consumers are interested in paying at shops using their smartphones, and two thirds expect that in 5 years we will pay by phone at least once a week, according to the Mobile Money 2020 survey carried out by Visa Europe.

Contactless payments with the use of a smartphone are becoming a part of our reality, thanks to an increasing popularity of NFC technology, which makes it possible to use a smartphone as a digital wallet.

Following this trend, in February 2015, Orange Finanse expanded its offer with NFC contactless payments dedicated to Android systems. The process is fully integrated with Orange Finanse mobile application. All the steps such as applying for an NFC card, its activation, card payments or cancellation are carried out from the level of the mobile application; there is no need to install more applications on a smartphone.

From the client's perspective, handling NFC cards is extremely easy; all that he needs to do is instal Orange Finanse mobile application, apply for the card in the application and activate the card through the assignment of PIN. Then, he may pay with the card at shops and other service outlets.

It takes less than 10 minutes to instal an NFC card in the mobile application. The simplicity of installation is crucial - the client is only 7 clicks and 2 screens away from getting the card.

For more information on cooperation with Orange, see chapter Strategic partnerships.

BLIK Service

In February, mBank activated in its mobile application the functionality for paying at traditional and online shops and withdrawing cash from ATMs by means of BLIK service. Thanks to this functionality, it is possible to make a payment just using a smartphone with the Bank's mobile application. BLIK service was activated at the same time by 6 member banks - shareholders of Polski Standard Płatności which operates the BLIK system. The innovativeness of mBank's solution was awarded at the annual Polish Card Gala in the Best Cashless Product of 2015 category. For more information on awards granted to mBank Group, see chapter Distinctions and awards.

mBank

mBank

In Q4 2015, the management boards of mBank and Dom Maklerski mBanku S.A. and mWealth Management S.A. signed the division plans marking the first stage of the planned integration of the companies within the Group’s structure. Brokerage services that so far have been rendered through Dom Maklerski mBanku and mBank will be carried out via single entity, i.e. mBank, with mWealth Management expected to join the process later on.

In Q4 2015, the management boards of mBank and Dom Maklerski mBanku S.A. and mWealth Management S.A. signed the division plans marking the first stage of the planned integration of the companies within the Group’s structure. Brokerage services that so far have been rendered through Dom Maklerski mBanku and mBank will be carried out via single entity, i.e. mBank, with mWealth Management expected to join the process later on.

coming months, contactless mobile payments will become a common payment method in Poland. Today, over 60% of Polish consumers are interested in paying at shops using their smartphones, and two thirds expect that in 5 years we will pay by phone at least once a week, according to the Mobile Money 2020 survey carried out by Visa Europe.

coming months, contactless mobile payments will become a common payment method in Poland. Today, over 60% of Polish consumers are interested in paying at shops using their smartphones, and two thirds expect that in 5 years we will pay by phone at least once a week, according to the Mobile Money 2020 survey carried out by Visa Europe.