STRATEGY AND BUSINESS MODEL

History of mBank Group

mBank Group’s business model in a snapshot

mBank Group is the fourth largest measured by total assets financial institution in Poland, providing retail, corporate and investment banking as well as other financial services, including leasing, factoring, commercial real estate financing, brokerage, wealth management, corporate finance and capital markets advisory as well as distribution of insurance.

Historically, mBank developed its operations from corporate banking, which has always been its strength. Since its establishment in 1986 the Bank has served some of Poland’s largest companies involved in foreign trade on export markets. A longstanding experience in corporate banking services set the stage for the Bank’s further expansion into the small and medium-sized corporate client segment.

In 2000, mBank started its retail operations by launching a fully Internet-based bank in Poland. It was a pioneering project in the local market, based on the Internet, direct service through call centre, and later on mobile banking and also other new technology-based solutions. In 2001, mBank also launched a high street brick-and-mortar bank, offering a broad range of products and services targeted at affluent customers and micro-businesses seeking an access to high quality, personalised service at branches.

mBank is the only Polish bank with a successful track record of rolling out its domestic business model into foreign markets. In 2007, mBank launched retail operations in the Czech Republic and Slovakia, focusing initially on transactional banking and deposit products and further expanding into mortgage and consumer loans as the bank has been able to establish and develop strong client relationships. The Bank also offers to its Czech and Slovak clients a convenient mobile application.

As a result, the Bank’s client base has grown almost entirely organically, reaching 4,947 thousand retail clients and 19,562 corporate customers at the end of 2015.

Over the past few years, mBank has strengthened its client-oriented approach and has been pursuing a stable, focused strategy as a modern and innovative transactional bank providing an integrated range of multiple products and services meeting the needs of its clients. In 2013, mBank launched a reinvented, modern, convenient, easily accessible and user-friendly Internet platform (New mBank) with more than 200 new features, which won global recognition for innovation in banking taking home many international awards. The bank has been also systematically expanding its mobile application to provide the customers with the ability to manage their finances wherever they are.

mBank’s widely recognised operational excellence is based on its state-of-the-art user interface for online banking, next-generation mobile applications, video banking and P2P payments via Facebook and text messaging, and real-time, event-driven customer relationship management (CRM) based on client behaviour patterns. The whole product offer is centred around the current account with a broad spectrum of financial services accessible in just “one click”, as the aim is to be the most convenient transactional bank on the market.

In the corporate and investment banking area, mBank’s offer for business clients include a range of fully integrated commercial banking products, services and solutions, with particular emphasis on the advanced transactional banking platform. This comprehensive product offering is complemented by investment banking services, such as ECM, DCM and M&A advisory services.

mBank’s distribution concept combines the most technologically advanced solutions adapted for the Polish banking market as well as current and future operating environment. It has been primarily based on Internet and mobile-based tools, tailored separately to the needs of both retail and corporate clients, and a mid-sized physical distribution network, offering premium service quality, located throughout Poland.

With its proven ability in achieving the communicated targets, mBank is well positioned to continue its successful business growth in selected client segments through exploiting attractive market opportunities. The IT platform architecture allows the Bank to develop and introduce new products, services and sales channels rapidly, efficiently and with a low operational risk. Thanks to such a flexible infrastructure, mBank is able to manage its business expansion strategy.

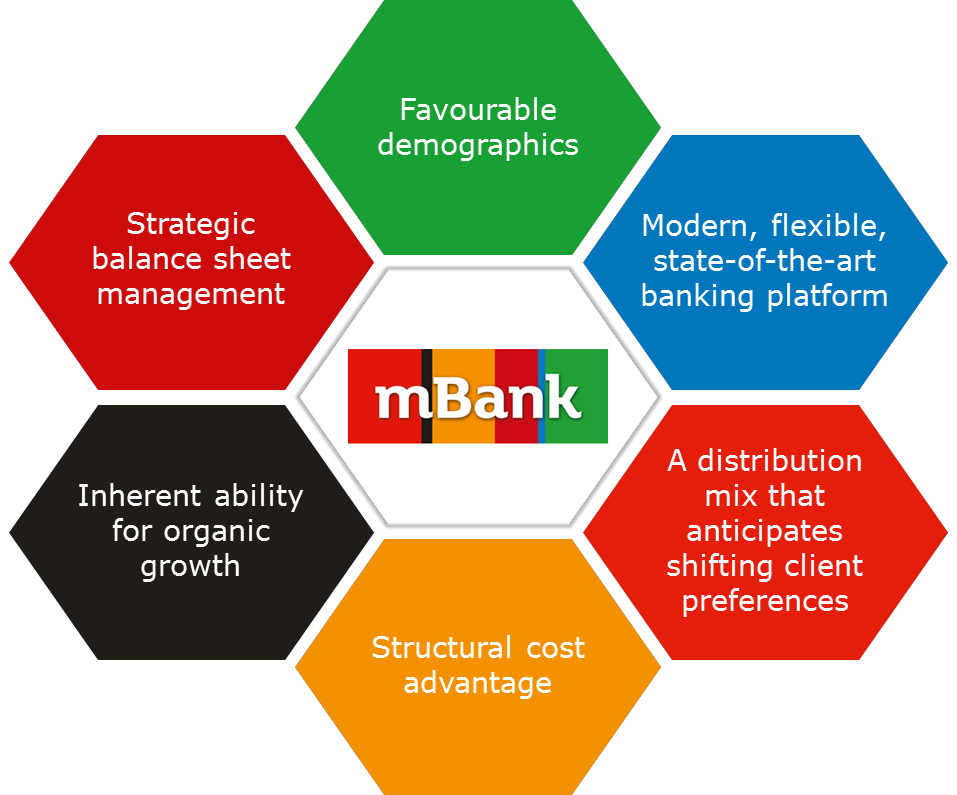

mBank Group’s strategic advantages

Over the past years mBank Group developed a range of competitive strengths, which enable the organisation to take advantage of growth opportunities and successfully achieve its strategic objectives. The key factors are illustrated and described below:

Favourable demographics

mBank’s unique value proposition in the retail banking segment, anchored in an attractive and forefront business model, has been developed to target young, aspiring and tech-savvy clients, who quickly adapt innovative solutions. Consequently, mBank’s customer base has an advantageous demographic profile as compared to the Polish market.

A half of the Bank’s retail clients are under the age of 35 and are expected to reach their highest personal income levels in the coming years, positioning mBank to reap the benefits from additional cross-selling opportunities of banking and insurance products. Maturing of the customer base provides a natural source for revenue growth as well as supports the asset quality of the Group and the responsiveness of its clients to cross-selling initiatives. More on the demographics of mBank Group customers in the chapter Demographic profile of mBank Group clients.

Modern, flexible, state-of-the-art banking platform

Anticipating the development and increasing accessibility of the Internet, already since 2001, mBank has applied and promoted a modern and highly convenient retail banking model based on the Internet and other new technologically advanced solutions. As a result, the Bank is uniquely positioned in the market to offer a wide range of innovative products and services, meeting the changing needs of its target clients.

mBank, as a global innovator in banking, has been constantly improving its Internet and mobile transaction systems. In 2013, a re-developed, modern, intuitive, easily accessible and user-friendly internet platform (New mBank) with more than 200 new features and improvements was launched. Implemented solutions have been delivering higher client acquisition and transactionality. A flexibility of the mBank’s platform to expand or roll-out new strategic ventures is an additional advantage (e.g. an offering for the customers of Orange Finanse). At the same time, the Bank has been continuously enhancing its mobile application, providing the customers with even more convenient way to manage their finances wherever they are.

A distribution mix that anticipates shifting client preferences

Given its multi-channel approach, which has been designed to anticipate and follow the changing needs of clients, mBank’s current sales mix is already ahead of what is expected to be the pattern of distribution prevailing in the banking sector in the coming years. Internet, mobile, video and call centre channels are rapidly gaining importance as demonstrated by the sales levels of various banking products generated by these channels as compared to traditional branches.

In particular, a half of current accounts and more than 2/3 of saving products are sold through mBank’s Internet platform. In addition, a dynamically growing number of banking activities has been performed through mBank’s mobile application, of which checking the balance of current account and making transfers are the most popular. Such a sales mix guarantees no need for painful structural adjustments in the near future. Moreover, as the Bank promotes a self-service model in which retail customers operate their accounts predominantly via remote channels, it gains an opportunity to proactively use modern real time marketing and cross-sell more products.

Structural cost advantage

Heavy investments in the Internet and mobile transaction platforms along with maintaining a light and efficient branch infrastructure result in a lower overall cost base and a high degree of operating flexibility for mBank. The Group’s competitive advantage stemming from its business model manifests itself in superior efficiency metrics compared to other Polish banks. Based on such ratios as cost to income, cost to average assets or gross loans to number of branches, mBank ranks among the top in all three categories when compared to the major Polish banks. mBank operates through the optimal number of branches, what implies no need to carry out a restructuring of its physical distribution network resulting in the branch closures.

Inherent ability for organic growth

mBank is the largest organically developed retail banking franchise in the CEE region. In contrast to most financial services groups in Poland, mBank has not grown through any significant mergers and acquisitions, proving its strong ability to constantly attract new customers in the three countries. The Group’s retail client base in Poland, the Czech Republic and Slovakia has grown solely organically by 322 thousand and 396 thousand in 2014 and 2015, respectively, reaching in total 4,947 thousand retail customers.

Strategic balance sheet management

Due to its continued focus on diversified, long-term and attractively priced funding, mBank Group managed to improve its liquidity profile, as demonstrated by gradually declining loan to deposit ratio, which reached 96.7% at the end of 2015.

On the asset side, development of balance sheet benefits from the phasing out of the legacy CHF-denominated mortgage loan portfolio and the intended expansion of higher margin lending products, such as retail consumer loans (predominantly cross-selling of non-mortgage loans to existing current account customers), PLN-denominated mortgage loans and SME loans. On the liabilities side, mBank is focused on ensuring a stable and adequate deposit base by leveraging the higher sight deposit volume as a primary banking relationship for majority of its retail clients.

Strengthening of balance sheet funding quality is also supported by issuances of senior unsecured and subordinated bonds in domestic and international markets. Moreover, mBank Hipoteczny maintains a leadership position on the Poland’s covered bond market, adding to the Group’s long-term financing sources. Issues of these instruments, performed both in EUR and PLN, not only help to cut the funding costs, but also better match the maturity of assets and liabilities as well as their currency structure.

Composition of mBank Group and main activities areas

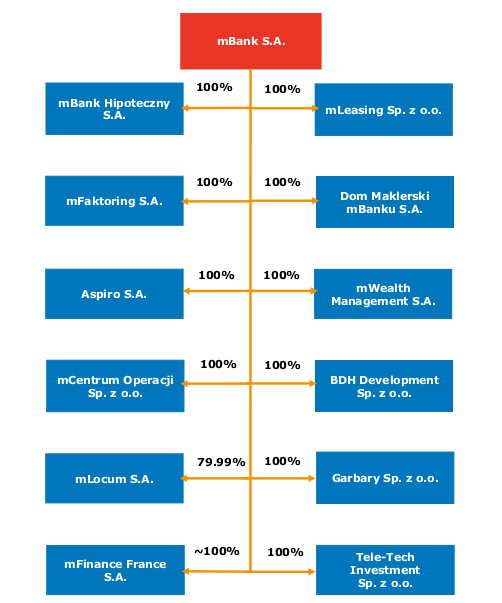

mBank Group is composed of: mBank S.A. – a parent company, and 12 subsidiaries, where mBank holds majority of shares. At 2015 mLeasing, mBank Hipoteczny, Dom Maklerski mBanku and mFaktoring were among most important subsidiaries at the Group.

The composition of mBank Group as at the end of 2015 was as follows:

In 2015, the Group aimed for adjusting its business model with regard to the sale of non-life and life insurance products, focusing on a future strategic partnership with AXA Group, the best in class international insurance group. On March 30, 2015, mBank Group finalized the transaction concerning the sale of 100% of shares in BRE Ubezpieczenia TUiR to AXA Group. For more on the transaction with AXA Group, see chapter Strategic partnerships.

In Q3 2015, in connection with the cessation of the activity of MLV 45 Sp. z o.o. spółka komandytowa, mBank S.A. has conducted reorganisation within mBank S.A. Group, which involved the transfer of shares held by the company MLV 45 Sp. z o.o. spółka komandytowa in companies mBank Hipoteczny S.A., mLeasing Sp. z o.o., mFaktoring S.A. and mLocum S.A. under the direct control of mBank S.A. On September 10, 2015, shareholders of MLV 45 Sp. z o.o. spółka komandytowa - mBank S.A. and MLV 45 Sp. z o.o. adopted a resolution on MLV 45 Sp. z o.o. spółka komandytowa liquidation, opening a liquidation procedure and appointing a liquidator. The application for the opening of the liquidation procedure was submitted to the District Court for the Capital City of Warsaw, 12th Division of the National Court Register on September 10, 2015 and the company was deleted from the register on December 22, 2015. The afore-mentioned reorganisation steps have had no impact on the continuing full control mBank S.A. exercises over the mentioned subsidiaries. As a result the Group ceased to consolidate MLV 45 Sp. z o.o. Sp.k. in Q3 2015.

In Q3 2015, the company Tele-Tech Investment Sp. z o. o. was consolidated. The company's business includes investing funds in securities, trading in receivables, proprietary trading in securities, managing controlled enterprises, business and management consultancy. The company has no employees.

In view of the above, at the end of 2015 the division of the operations of mBank Group into segments and business areas was the following:

| Segment |

Retail Banking |

Corporates and Financial Markets | |

| Corporate and Investment Banking | Financial Markets | ||

| Bank |

|

|

|

| Consolidated subsidiaries |

|

|

|

|

Other subsidiaries |

|

||

Under IFRS, all of the above subsidiaries are consolidated by way of acquisition accounting. The business of selected subsidiaries is briefly described in chapter Business activity of selected subsidiaries.

Changes in authorities of mBank

Supervisory Board of mBank S.A.

As of December 31, 2015, the Supervisory Board was composed of the following members:

1. Maciej Leśny – Chairman of the Supervisory Board

2. Martin Zielke – Deputy Chairman of the Supervisory Board

3. Martin Blessing – Member of the Supervisory Board

4. Andre Carls – Member of the Supervisory Board

5. Stephan Engels – Member of the Supervisory Board

6. Thorsten Kanzler – Member of the Supervisory Board

7. Teresa Mokrysz – Member of the Supervisory Board

8. Stefan Schmittmann – Member of the Supervisory Board

9. Agnieszka Słomka-Gołębiowska – Member of the Supervisory Board

10. Waldemar Stawski – Member of the Supervisory Board

11. Wiesław Thor – Member of the Supervisory Board

12. Marek Wierzbowski - Member of the Supervisory Board.

On November 24, 2015, Maciej Leśny, Chairman of the Bank's Supervisory Board, received a letter of resignation from Dr. Stefan Schmittmann, Member of the Bank's Supervisory Board and Chairman of the Risk Committee on resigning from the held functions as of December 31, 2015. Pursuant to a Resolution of the Supervisory Board of the Bank dated December 10, 2015, Dr. Marcus Chromik, replacing Stefan Schmittmann who resigned as of January 1, 2016, was appointed Member of the Supervisory Board of the Bank until the end of the term of office of the current Supervisory Board. He was also appointed Chairman of the Risk Committee of the Supervisory Board of mBank.

Management Board of mBank S.A.

As of December 31, 2015, the Management Board was composed of the following members:

1. Cezary Stypułkowski – President of the Management Board, Chief Executive Officer

2. Lidia Jabłonowska-Luba – Deputy President of the Management Board, Chief Risk Officer

3. Przemysław Gdański – Deputy President of the Management Board, Head of Corporate

and Investment Banking

4. Jörg Hessenmüller – Deputy President of the Management Board, Chief Financial Officer

5. Hans-Dieter Kemler – Deputy President of the Management Board, Head of Financial Markets

6. Cezary Kocik – Deputy President of the Management Board, Head of Retail Banking

7. Jarosław Mastalerz – Deputy President of the Management Board, Chief Operations Officer.

For more information on profiles of Members of the Supervisory Board and the Management Board of mBank, see chapter Statement of mBank on application of Corporate Governance principles in 2015.

mBank Group Strategy and plans for the coming years

Implementation of mBank Group Strategy for 2012-2016

The underlying principles of the Bank’s “One Bank” strategy, which was adopted in July 2012, are to improve the long-term profits and income generating capacity of the Group supported by a sound balance sheet and by providing clients with a high level of technological support.

The Bank has undertaken a number of initiatives in line with this strategy, including the following:

- The Bank has improved its balance sheet structure. In particular, it has reduced its loan to deposit ratio and diversified its funding, including through its EMTN programme and through the launch of a programme to finance retail mortgage loans by the issue of covered bonds.

- The Bank has provided all its customers in Poland, the Czech Republic and Slovakia with state-of-the-art, award-winning, innovative Internet banking platform. The Bank also offers its clients a best in class mobile application, and has positioned itself as the leader of mobile banking in Poland in terms of number of active users, and the "Mobility icon" in the context of the marketing communication. For more information on banking platform and mobile application, see chapter Innovations at mBank.

- The Bank has completed the migration of former Multibank clients to mBank transactional platform. As a result, the Bank is able to get a better insight into its clients requirements and to offer improved products. The Bank also believes that by unifying its retail client platform, the Bank will be able to increase efficiency and provide more dedicated marketing communications.

- The Bank has enhanced its position in transactional banking. The number and value of card transactions for retail clients increased dynamically between 2012 and 2015, and mBank’s market share currently totals 12%. The Bank has also maintained a strong position in corporate transactional banking.

- The Bank has implemented a new organisational structure for Corporate and Investment Banking which is integrated with K2 client requirements (K2 segment covers corporates with an annual turnover from PLN 30 million to PLN 500 million and medium enterprises of the public sector). This is an important aspect of mBank’s long-term focus on deepening relationships with corporate clients, in particular K2 clients, by offering a full range of corporate finance solutions within an integrated institution. The Bank has also strengthened its position in arranging debt and equity issues, as well as on the M&A market.

- In the area of the retail banking, the Bank has enhanced the development of its relationship with small and medium-sized enterprises (SME) by an integration of competences related to SME services, including sales management and business development using mBank's strengths, i.e. Internet banking, mobility, fast banking processes. In addition, the Bank is focusing on acquiring clients within the K3 client segment. The K3 client segment covers small and medium sized enterprises with an annual turnover up to PLN 30 million.

- The Bank has increased revenues generated by mBank's foreign branches in the Czech Republic and Slovakia through the dynamic development of the clients' base and focusing on the sale of high-margin products.

- The Bank has standardised its brand policy by offering services to all of mBank's Group clients under the mBank's brand.

- The Bank continues to reorganise its network of retail and corporate outlets by focusing on technology and clients' expectations arising from technological trends and developments. In particular, the Bank is seeking to standardise its sales network, integrate its products and services and enhance its retail and corporate customer service. In the largest Polish cities, the separate retail and corporate branches are being replaced by advisory competence centres (in office buildings) and the so-called “light” branches located in shopping malls. For more information on network of retail branches, see chapter Key projects of mBank in 2015.

- Commenced the re-design of the Group’s approach to the cooperation with the most affluent clients - the process of integration of services for the clients of private banking, wealth management, and brokerage services (Dom Maklerski mBanku) under the umbrella of mBank is underway.

From the point of view of financial goals, the Bank implemented the vast majority of its strategic assumptions. Confronted with the deteriorating banking environment exercising pressure on net income, as well as entailing higher fees and commissions in respect of costs, the C/I ratio increased from 44.9% in 2014 to 50.2% in 2015. Excluding one-off costs, such as payment of guaranteed funds to the deposit holders of SK Bank in Wołomin and payment related to contribution to the Borrowers Support Fundand, together with the gain from the sale of BRE Ubezpieczenia TUiR and PZU shares, the cost to income ratio as at the end of 2015 stood at 49.3%.

The table below presents financial objectives set under Strategy for 2012-2016:

| Strategy for 2012-2016 | ||

| Financial objectives | Target values |

As at the end of 2015 |

| Loan-to-deposit ratio | approx. 115% by 2016 |

96.7% |

| Net Stable Funding Ratio (NFSR) | min. 110% | 109% |

| Core Tier 1 ratio | approx. 11% | 14.3%* |

| Cost-to-income (C/I) ratio | max. 48% | 50.2% |

| Gross ROE | min. 15% | 14.7% |

| Net ROA | min. 1.4% | 1.0% |

* Common equity Tier 1 Capital ratio calculated in line with Basel III rules.

Strategy for 2016 - 2020

mBank is working on a Group's strategy for the years 2016 – 2020. The new strategy will address the most challenging factors faced by mBank. mBank's actions, as specified in the new strategy, will focus mainly on clients. The success on the banking market in the coming years will depend on the "client-centricity" skill - on the ability to identify and foresee client’s needs, and the introduction of simple and user-friendly solutions. In the context of changing behavioural patterns of clients and their expectations and preferences concerning cooperation with the Bank, mBank aspires to understand clients better, skilfully identify and precisely address their needs. The adoption of the new strategy is scheduled for H1 2016.

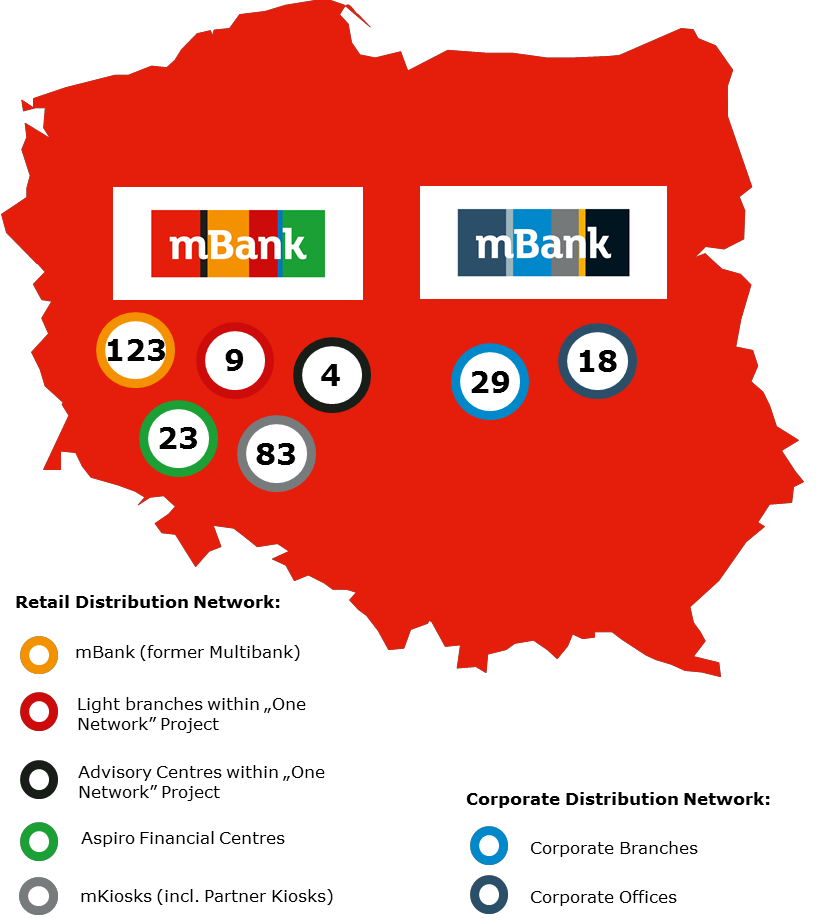

mBank Group geographical presence

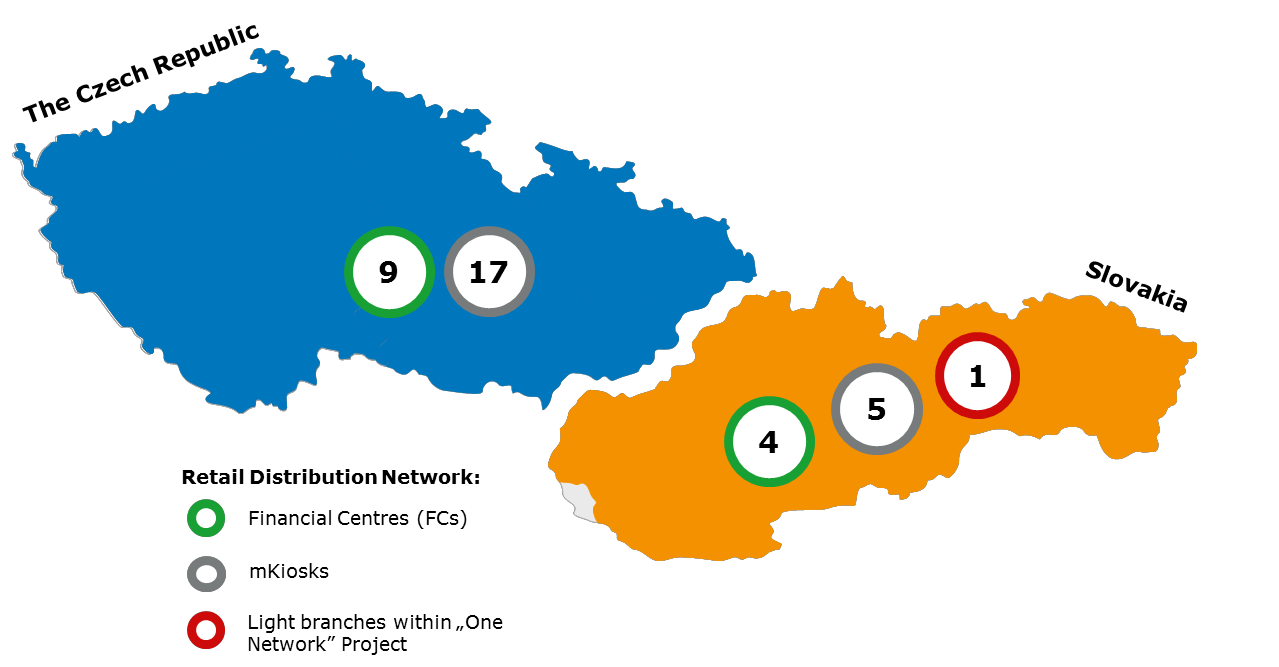

mBank Group operates successfully not only in Poland, but also in the Czech Republic and Slovakia.

In Poland, retail distribution network consists of 242 branches. Corporate distribution network amounts to 29 corporate branches and 18 corporate offices.

In the Czech Republic, retail distribution network consists of 9 financial centres and 17 mKiosks. In Slovakia there are 4 financial centres, 5 mKiosks and 1 light branch in Bratislava.

Headquarters of mBank in Poland, the Czech Republic and Slovakia

Four main premises of mBank are located in Warsaw, Łódź, Praha and Bratislava. The headquarters are located on Senatorska Street in Warsaw, including most of departments of Finance, Corporate and Financial Markets Divisions. Łódź is the traditional headquarter of mBank’s retail operations. Headquarters in the Czech Republic and Slovakia deal with day-to-day management of foreign operations.

HR development

Changes in employment

At the end of 2015, the total employment in mBank Group was 6,540 FTEs compared with 6,318 FTEs a year before (+3.5% or +222 FTEs). The increase took place mainly in the area of Retail Banking, due to the implementation of new strategy in foreign branches as well as in call center and IT area.

At the end of 2015, employment at mBank amounted to 5,151 FTEs and rose by 256 FTEs or 5.2% compared with 2014.

mBank's employees are relatively young: 49% are below the age of 35. They are also well-educated: nearly 83% are graduates of higher education institutions. Many employees undertake post-graduate and MBA studies, thus acquiring new professional qualifications.

At the end of 2015, employment in mBank Group subsidiaries amounted to 1,389 FTEs and decreased by 33 FTEs or 2.4% against 2014, due to the sale of BRE Ubezpieczenia TUiR.

The charts below illustrate the employment structure in mBank Group, by subsidiaries, and in mBank, by areas of operation:

Mission and values of mBank Group

mBank, the first fully Internet-based Bank in Poland, for years has been a synonym of innovative solutions in the banking sector. Today it sets standards in the development of mobile and online banking sector. mBank's mission focuses on clients, aspiring to be the Bank which accurately identifies and foresees the needs of its customers being able to meet them precisely.

As a result of unification of the brand policy, which started in 2013, currently all clients are serviced under one brand. At the same time, mBank's team internally developed the model of values and behaviour characterising employees of mBank and targeting the Group's actions at accomplishment of the mission to create a better Bank for its clients.

Specialised banking services dedicated to various groups of clients are constantly improved and adjusted to changing behavioural patterns of clients. Organising around common values shared by employees helps to effectively face market challenges and provide clients with satisfactory experience from cooperation with the Bank.

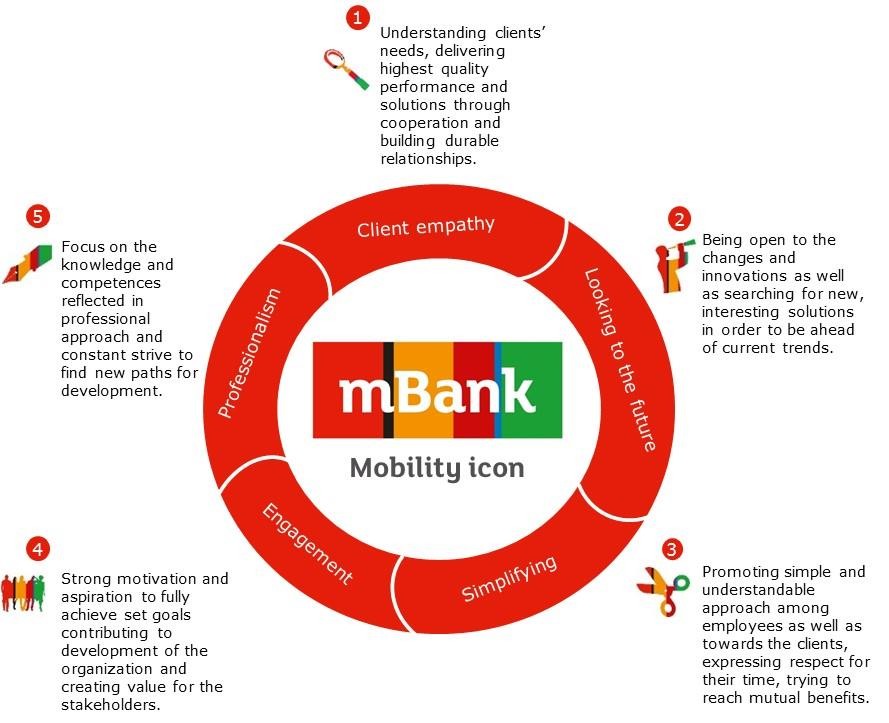

mBank values

mBank are mainly people who cooperate with the aim to understand and precisely meet the needs of clients and share the responsibility for their satisfaction. Common values form the basis for the development of organisation and trust in customer relations. A clearly specified model of values (the chart below) is an expression of the internal consistency of the organisation, focused on offering the highest standards of service, as well as setting the direction for actions in increasingly challenging market environment.

Training and development

Development activities

In 2015, development activities were determined by business priorities – they were used to develop skills and enhance knowledge the teams needed in order to effectively achieve their goals. Plans devised jointly by development specialists and managers responsible for particular teams representing all levels of management in the organisation (including the Members of the Management Board supervising the business lines) served as the basis for the activities. Special development programmes supported activities of project teams performing key business initiatives for mBank.

Apart from specialised tailor-made training programmes run by experienced Polish and foreign experts, 2015 was also marked by a number of in-house initiatives. They were a consistent continuation of activities started in previous years under mBank Group’s Strategy whose purpose is to fully use the knowledge and skills existing in the organisation.

A wide range of development programmes covering the entire organisation were run in mBank Group. They were characterised by a growing share of non-traditional activities, including on-the-job training and feedback from managers and colleagues. In 2015, all managers were trained in order to enhance their employee appraisal skills. The activities were coupled with major changes in employee appraisal process making the appraisal more useful in determining and planning the direction of development activities and making relevant decisions.

The following three programmes implemented in 2015 deserve special attention:

“3P” Project (from Polish: leadership-practice-professionalism)

Further implementation of the 3P programme (from Polish: leadership-practice-professionalism) set the framework for the development of managerial skills. The version addressed to experienced managers was a cafeteria-style solution enabling managers to freely choose the development path. The only exception was the special module called “Introduction to practice” being a kind of an “entrance ticket” needed to take part in the workshops addressed to experienced managers. The main assumption of the programme was to arouse interest in and desire for continuous enhancement of managerial skills, to help the participants to maintain Personal Mastery, consistently verify knowledge through experience, perseverance and readiness to learn from one’s own and other people’s mistakes, continuously test their skills in real-life leadership situations, to encourage people to look for inspirations in management, and to teach and help them understand systemic thinking.

The training courses had the form of workshops based on materials and situations the participants have faced before. The workshops were run by consultants and trainers representing a training consortium composed of three specialist training firms. A total of 431 people participating in 38 dedicated training courses were trained in 2015 as part of the 3P programme.

Host, Designer, Coach Project

Young managers taking their first steps in this function were offered a tailor-made programme called Host, Designer, Coach (Polish: GPC), designed to expand their knowledge and skills with regard to: setting employees high-quality goals, getting people involved, delegating tasks effectively, modern motivation and auto-motivation methods, navigation conversations, and coaching oriented at business effects. In addition, the training provided the young managers with information about themselves and their managerial potential; proven, simple and useful tools supporting managerial efforts; and a long list of practical non-financial incentives and best managerial practices from mBank and outside. The 2015 GPC programme encompassed 11 training sessions with 119 young managers trained.

Our people make the difference. Help us find the most outstanding ones.

Another edition of the development programme called “Our people make the difference. Help us find the most outstanding ones.” was organised in 2015. All the subsidiaries of mBank Group were invited to join the programme. We rewarded teams and people that are open to cooperation, knowledge sharing, team work, and helping others - people whose attitudes deserve recognition in the organisation. The programme was designed to support the integration of employees, increase their identification with the uniform brand, build team spirit and develop attitudes essential to achievement of business objectives. The programme is growing every year in terms of both its size and the number of employees reached.

The programme is not only about rewarding individual people. It is the promotion of appropriate behaviour, attitudes, cooperation and sharing of knowledge and experience that matters the most. The social dimension of the initiative is of key importance as well. Entering people for the competition, voting, choosing the winners, the final gala - all these elements bring people together. The programme unites mBank Group’s employees around the important objective of building an organisation based on its people in line with the statement “Our people make the difference”.

In search of young talents

Banking and Digital Finance - a course at the University of Łódź launched in cooperation with mBank

In October 2015, mBank and Accenture launched a new course at the University of Łódź (Banking and Digital Finance). The course stands for its unique interdisciplinary programme combining the competences from the finance area with digital skills. Among the lecturers are scientists and teachers from the University of Łódź and representatives of partner companies providing the students with an insider perspective. As part of this cooperation, mBank employees may hold some of the classes and lectures. As a result, mBank employees are not only offered a self-development and knowledge sharing opportunity, but are also able to test their knowledge in the university environment and have a real impact on how young people are being trained. The responsibility for the classes lies with the lecturers working at the University. mBank employees offer their know-how, which means that the number of classes/lectures they hold depends on their individual preferences and availability.

The course takes three years. Graduates will be awarded a bachelor’s degree. After a year and a half the students will be able to choose from two specialities: Banking 3.0 and IT in Finance. The course comprises such important subjects as: Banking, Company Finance, Financial Markets and Products, Accounting, Financial Analysis, Digital Economy, Information Techniques, Data Structures and Algorithms, and Media Workshops.

Out of 316 candidates, 100 were selected in the course of the recruitment process to start the studies in October.

The programme was developed in a way to provide future graduates with a solid background making them suitable for a wide range of positions in:

- banks and other financial institutions,

- consulting firms,

- entities cooperating with financial institutions.

The Young Talents Programme

The Young Talents Programme, launched 5 years ago, is mBank’s response to current and future needs of the organisation and expectations of candidates - students and graduates.

The programme is a part of mBank Group’s strategy of creating its image as an employer among students and graduates. It helps the organisation to acquire talented individuals entering the labour market and prepare them to take up independent tasks at the Bank. Consequently, it facilitates access to candidates for entry-level positions, thus optimising recruitment processes and increasing the importance of internal recruitment.

Composed of traineeships and internships, the Young Talent Programme is addressed to students and graduates who intend to work in the banking industry in the future. The programme participants acquire practical skills and knowledge and receive ongoing support from their supervisor. Moreover, interns and trainees work under an employment contract and have access to employee benefits.

The Young Talents Programme consists of the following two sub-programmes:

Traineeship programme, consisting of traineeships with flexible working hours, with trainee positions offered throughout the calendar year so that trainees may easily combine their work at mBank with studies and other obligations. The trainees become familiar with one area of the Bank’s operations. The traineeship contract is signed for three months with a prolongation option. There were approx. 80 trainees at mBank in 2015.

Internship programme of mBank is addressed to people who are open, committed and full of enthusiasm, who have already gained experience as trainees or as members of students’ science associations and student organisations. Internship contracts are signed for a term of 9 to 12 months. Interns work full time. The internships in Łódź and Warsaw are conducted on a rotational basis which makes it possible for an intern to become familiar with several areas of the Bank - interns have the opportunity to support three organisational units. Candidates applying for an internship choose one profile determining the leading competence during the internship. Analytical, business, legal, business and investment, business and marketing, corporate banking and risk management profiles were available in 2015 with 18 interns working at mBank.

mBank Group’s incentive system

he incentive system of mBank is based on the remuneration policy and intangible elements (e.g. possibility of career development). The incentive system plays a key role in developing corporate culture and builds a competitive advantage by acquiring and retaining competent employees.

The remuneration policy at mBank covers both the base salary (fixed component) as well as the variable part depending on the objectives achieved by the whole organisation and by individual employees.

In 2015, incentive programmes both for the Management Board Members and Key Managers were implemented at mBank Group.

2008 Incentive Programme for the Management Board Members of the Bank

On March 14, 2008 the Ordinary General Meeting of mBank, by adopting a relevant resolution, expressed consent to carry out an incentive programme for Members of the Bank's Management Board. Under the programme Members of the Bank's Management Board have the right to take up bonds with pre-emptive rights to acquire mBank shares or, as initially planned, shares of the ultimate parent entity, Commerzbank AG. In 2010, the programme was changed in the part concerning shares of Commerzbank, so that Members of the Management Board may obtain the right to receive cash equivalent corresponding to the value of the shares of Commerzbank calculated based on the average share price on the date when the right to receive the equivalent originated.

All the rights under payments settled in cash equivalent based on shares of Commerzbank and all the rights under payments settled in mBank S.A. shares within the framework of the programme have already been granted. Payments are settled in three equal deferred tranches: 12, 24 and 36 months from the date of acquiring the rights for a given year of the programme by the Management Board Member. The last settlements under this programme will take place in 2016.

Cash bonus paid under the programme for 2008-2011 was presented as an obligation to employees and referred to profit and loss account in a given year for which it was awarded.

The bonds may be acquired by the entitled persons over the years 2010 – 2021, provided that their employment continues. The right to take up shares under the conditional capital increase, resulting from the bonds, may be exercised by the entitled persons in the period from acquisition of bonds till 31 December 2021.

Share-Based Payments Settled in Cash

All rights under payments settled as a cash equivalent based on Commerzbank shares under the program have already been granted. Since payments are settled in three equal annual deferred tranches on the lapse of, respectively, 12, 24 and 36 months from the date of the right acquisition by the Management Board Members for a given year of the programme, the cost of Commerzbank share-based payments settled in cash were recognised in the income statement in correspondence with liabilities to employees. The last settlements under this programme are planned in 2016.

Share-Based Payments Settled in mBank S.A. Shares

All rights under payments settled in mBank S.A. shares under the programme have already been granted. Since payments are settled in three equal annual deferred tranches on the lapse of, respectively, 12, 24 and 36 months from the date of the right acquisition by the Management Board Members for a given year of the programme, the cost of share-based payments settled in shares are still recognised in the income statement in correspondence with other reserve capital. The last settlements under the programme are planned in 2016.

This is an equity-settled share-based program.

The table below presents the number and weighted average exercise prices of share options related to the 2008 incentive programme for Management Board Members of the Bank.

| 31.12.2015 | 31.12.2014 | |||

| Number of options | Weighted average exercise price (in PLN) | Number of options | Weighted average exercise price (in PLN) | |

| Outstanding at the beginning of the period | 3,650 | 4 | 10,293 | 4 |

| Granted during the period | - | - | - | - |

| Forfeited during the period | - | - | - | - |

| Exercised during the period | 3,469 | 4 | 6,643 | 4 |

| Expired during the period | 0 | - | - | - |

| Outstanding at the end of the period | 181 | 4 | 3,650 | 4 |

| Exercisable at the end of the period | - | - | - | - |

* In 2015, the weighted average price of the shares at the option exercise date was PLN 399.40 (in 2014 PLN 500.28).

2012 Incentive Programme for the Management Board Members of the Bank

On December 7, 2012, the Supervisory Board on the basis of recommendation of the Remuneration Committee, adopted Rules of the Incentive Programme at mBank S.A. which replaced the Rules of the Incentive Programme at mBank S.A. of March 14, 2008.

Under the programme, Members of the Bank's Management Board have the right to receive a bonus, including non-cash bonus paid in the Bank's shares, including phantom shares.

Cash bonus under the programme was paid for 2012-2013 and presented as an obligation to employees and referred to profit and loss account in a given year for which it was awarded.

Non-cash bonus, in which members of the Board have a right to take up bonds with pre-emptive rights to acquire shares, was granted under the programme for 2012-2013. The right to purchase the bonds will be realized in three equal annual deferred tranches, on the lapse of, respectively, 12, 24 and 36 months from the date of acquiring the right to non-cash bonus by the Management Board Memeber. Conditions of receiving as well as the amount of deferred tranche not paid out yet under non-cash bonus depend on the assessment of the financial position of the Bank by the Remuneration Committee and the performance evaluation of member of the Board for a period longer than one financial year.

The Supervisory Board on the basis of recommendations issued by the Remuneration Committee can make a decision on suspending in whole or limiting the right to acquire bonds with pre-emptive rights to take up the shares of the Bank relating to the deferred tranche in whole or partially due to the later assessment of the performance of the Member of the Management Board over a period of time longer than one financial year (i.e. for the period of at least 3 years), which takes into account the business cycle of the Bank as well as the risk related to the bank's operation, but only when the acts or omissions of the Member of the Management Board had a direct and adverse impact on the bank's financial result and market position within the assessment period. The Supervisory Board, on the basis of the recommendation of the Remuneration Committee of the Supervisory Board, can make a decision on suspending in whole or decreasing the bonus amount for a given financial year in relation to deferred tranche not paid out yet, in the situation referred to in Article 142 (1) of the Banking Law Act. Suspending in whole or decreasing any deferred tranche by the Remuneration Committee of the Supervisory Board can also apply to the deferred tranche not paid out yet to the Member of the Management Board after termination or expiry of the management contract.

Bonds may be acquired by eligible persons in the years 2014-2021.

The table below presents the number and weighted average exercise prices of share options related to the 2012 incentive programme for Management Board Members of the Bank.

| 31.12.2015 | 31.12.2014 | |||

| Number of options | Weighted average exercise price (in PLN) | Number of options | Weighted average exercise price (in PLN) | |

| Outstanding at the beginning of the period | 33,352 | - | 25,802 | - |

| Granted during the period | - | - | 16,153 | - |

| Forfeited during the period | - | - | - | - |

| Exercised during the period | 13,989 | 4 | 8,603 | 4 |

| Expired during the period | - | - | - | - |

| Outstanding at the end of the period | 19,363 | 4 | 33,352 | 4 |

| Exercisable at the end of the period | - | - | - | - |

* In 2015, the weighted average price of the shares at the option exercise date was PLN 399.40 (in 2014 PLN 500.28).

Cash Part of the Bonus

40% of the bonus base amount for the year is recognised as a liability to employees and charged to the income statement in the year for which it was granted.

Share-Based Payments Settled in mBank S.A. Shares

60% of the bonus base amount constitutes a payment settled in mBank S.A. shares.

As payments are settled in three equal annual deferred tranches on the lapse of, respectively, 12, 24 and 36 months from the date of acquisition by the member of the Board of the right for a given year of the programme, the cost of payments settled in shares is recognised in the income statement in the correspondence with other reserve capital. The last settlements of this program are planned in 2017.

This is equity-settled share-based program.

2014 Incentive Programme for the Management Board Members of the Bank

On March 31, 2014 the Supervisory Board in accordance with the recommendation of Remuneration Committee adopted a Regulation of the Incentive Programme in mBank S.A., which replaced the Regulation of the Incentive Programme in mBank S.A. dated at December 7, 2012.

Under the program the members of the Board have the right to bonus, including non-cash bonus paid in Bank’s shares, including phantom shares.

The net ROE of mBank S.A. Group and the monthly remuneration of the member of the Board as at December 31 form the basis for acquisition by Members of the Management Board of the right to bonus and for calculation of the amount of bonus for a given financial year. Equivalent of 50% of the base amount calculated based on ROE constitutes the so-called first part of the bonus. In regard to the remaining 50% of the base amount, the Remuneration Committee of the Supervisory Board can grant the second part of the bonus if it decides that a given Member of the Management Board achieved the annual/multi-year business and development objective. The decision of granting the second part of the bonus is the sole responsibility of Remuneration Committee of the Supervisory Board, which according to its own judgement and decision confirm MBO achievement taking into account the situation on financial markets in the last/previous financial period.

The sum of the first and the second part of bonus is the base bonus of the member of the Board for a given financial period. 40% of the base bonus constitutes non-deferred bonus and is paid in the year of determination of base bonus as follows: 50% in form of cash payment and 50% in Bank’s shares or bonds with pre-emptive rights to acquire shares or phantom shares.

60% of the base bonus is deferred bonus and is paid in three equal tranches in the next three following years after the year of determining the base bonus as follows: 50% of each of the deferred tranches in form of cash payment and 50% of each of the deferred tranches in form of non-cash payment in Bank’s shares or bonds with pre-emptive rights to acquire shares or phantom shares.

The Supervisory Board on the basis of recommendation of Remuneration Committee can make a decision to suspend in whole or reduce the amount of deferred tranche due to the later assessment of the performance of the Member of the Management Board over a period of time longer than one financial year (i.e. for the period of at least 3 years), which takes into account the business cycle of the Bank as well as the risk related to the bank's operations, but only when the acts or omissions of the Member of the Management Board had a direct and adverse impact on the Bank's financial result and market position within the assessment period and when at least one of the elements included in the assessment card is not fulfilled.

Remuneration Committee of the Supervisory Board can make a decision on suspending in whole or decreasing the non-deferred and deferred bonus amount for a given financial year, including deferred tranches not paid out yet, in the situation referred to in Article 142 (1) of the Banking Law Act. Suspending in whole or decreasing the non-deferred and deferred bonus, as well as any deferred tranche by the Remuneration Committee of the Supervisory Board can also apply to the non-deferred and deferred bonus, including deferred tranche not paid out yet after expiry or termination of the management contract.

The table below presents the number and weighted average exercise prices of share options related to the 2014 incentive programme for Management Board Members of the Bank.

| 31.12.2015 | 31.12.2014 | |||

| Number of options | Weighted average exercise price (in PLN) | Number of options | Weighted average exercise price (in PLN) | |

| Outstanding at the beginning of the period | - | - | - | - |

| Granted during the period | 16,295 | 4 | - | - |

| Forfeited during the period | - | - | - | - |

| Exercised during the period | 6,519 | 4 | - | - |

| Expired during the period | - | - | - | - |

| Outstanding at the end of the period | 9,776 | 4 | - | - |

| Exercisable at the end of the period | - | - | - | - |

* In 2015, the weighted average price of the shares at the option exercise date was PLN 399.40.

Cash Part of the Bonus

50% of the base amount constitutes bonus cash payment. It is recognised as a liability to employees and charged to the income statement in the correspondence to liability to employees.

Share-Based Payments Settled in mBank S.A. Shares

50% of the base amount constitutes bonus payment settled in mBank S.A. shares. The cost of payments settled in shares is recognised in the income statement in the correspondence with other reserve capital.

This is equity-settled share-based program.

On March 2, 2015 the Supervisory Board extended the duration of the program from December 31, 2018 until December 31, 2021 in accordance with the recommendation of the Remuneration Committee.

2008 Incentive Programme for Key Managers of mBank Group

On 27 October 2008 the Extraordinary General Meeting of the Bank adopted an incentive programme for the key management staff of mBank S.A. Group.

The programme participants include:

Bank Directors;

Representatives of key management.

They are responsible for taking decisions which have material impact on the implementation of a strategy specified by the Bank's Management Board, the Group's results, stability and security of business and development and creating added value of the organization.

In 2010, the Management Board of the Bank decided to launch the programme and approved the list of participants for Tranche III. Within Tranche III 13,000 options were granted. In 2011 within the Tranche IV and V programme 20,000 options and 19,990 options were granted. The rights started to be exercised in 2012 for Tranche III, in 2013 for Tranche IV and the process will last till December 31, 2019. The rights under Tranche V can be exercised after meeting specified conditions concerning acquisition of rights in the period from May 1, 2014 to December 31, 2019. The conditions for acquiring rights refer to being in an employment relationship throughout the term of the Tranche, obtaining an economic ratio for mBank S.A. Group specified by the Management Board and obtaining a specific appraisal by the programme participant in each year of the Tranche. In 2011 a decision was taken on suspension of the programme and not activating the remaining tranches.

Share-Based Payments Settled in mBank S.A. Shares

The cost of the programme for key managers is charged to the income statement and recognised in correspondence with other reserve capital.

The cost of payments settled in shares is recognised in the income statement as of the date of award of the program until the acquisition date of rights, i.e.:

- - from 23.08.2010 to 30.04.2012 for Tranche III;

- -from 1.02.2011 to 30.04.2013 for Tranche IV;

- - from 1.02.2011 to 30.04.2014 for Tranche V.

This is equity-settled share-based program.

The table below presents the number and weighted average exercise prices of share options related to the 2008 incentive programme for key managers of mBank Group.

| 31.12.2015 | 31.12.2014 | |||

| Number of options | Weighted average exercise price (in PLN) | Number of options | Weighted average exercise price (in PLN) | |

| Outstanding at the beginning of the period | 1,277 | 4 | 20,560 | 4 |

| Granted during the period | - | - | 2,460 | - |

| Forfeited during the period | - | - | 200 | - |

| Exercised during the period | 1,177 | 4 | 20,798 | 4 |

| Expired during the period | - | - | 745 | - |

| Outstanding at the end of the period | 100 | 4 | 1,277 | 4 |

| Exercisable at the end of the period | - | 4 | 1,277 | 4 |

* In 2015, the weighted average price of the shares at the option exercise date was PLN 399.40 (in 2014 PLN 500.28).

Options outstanding at the end of 2015 and 2014 expire on December 31, 2022.

Employee programme for key management staff of mBank Group of 2013

On April 11, 2013, the Extraordinary General Meeting of the Bank adopted a resolution amending the rules of the employee programme, which replaced the incentive programme for key management staff of mBank Group from 2008, whereas in regard to the persons who acquired bonds or were granted right to acquire bonds in Tranches III, IV and V the programme will be carried out under the previous principles.

The aim of the programme is to ensure growth in the value of the Company's shares by linking the interest of the key management staff of mBank S.A. Group with the interest of the Company and its shareholders and implementing in mBank S.A. Group variable components of remuneration of the persons holding managerial positions at mBank S.A. Group in accordance with the Resolution of the Polish Financial Supervision Authority.

The programme applies to the employees having a material impact on the risk profile of mBank S.A. Group, in particular Members of the Management Board of strategic subsidiaries, Bank Directors and key staff of mBank, whose decisions have a significant impact on the implementation of the strategy specified by the Bank's Management Board, results of mBank S.A. Group, growth in the value of the Bank.

During the programme the rights to acquire bonds under Tranche VI have been granted, which may be exercised in three equal parts after 12, 24 and 36 months from the date of granting these rights, in accordance with the internal regulations adopted in mBank S.A. Group specifying rules of variable remuneration of the employees having a material impact on the risk profile at mBank S.A. Group.

The bonds may be acquired by the entitled persons during the programme term, but not later than by December 31, 2022.

The Bank's Management Board/Supervisory Board of the Company, where the Programme is carried out can take a decision on suspending the Programme in whole or decreasing the number of bonds or the number of bonds deferred in a given tranche for the entitled person in the case of occurrence of the situations referred to in Article 142 (1) of the Banking Law Act, occurrence of balance sheet loss or loss of liquidity, meeting the conditions set forth in the agreements with the program participants, forming the basis for provision of work or other services for the Bank and subsidiaries.

Cash Part of the Bonus

The bonus in the amount of 50% of the base amount for the year is recognised as a liability to employees and charged to the income statement in the year for which it was granted.

Share-Based Payments Settled in mBank S.A. Shares

As payments are settled in three equal annual deferred tranches on the lapse of, respectively, 12, 24 and 36 months from the date of acquisition by the programme participants of the right for a given year of the programme, the cost of this part of the programme is charged to the income statement and recognised in correspondence with other reserve capital.

This is equity-settled share-based program.

The table below presents the number and weighted average exercise prices of share options related to the 2013 incentive programme for key managers of mBank Group.

| 31.12.2015 | 31.12.2014 | |||

| Number of options | Weighted average exercise price (in PLN) | Number of options | Weighted average exercise price (in PLN) | |

| Outstanding at the beginning of the period | 2,233 | - | - | - |

| Granted during the period | 5,288 | - | 2,233 | - |

| Forfeited during the period | - | - | - | - |

| Exercised during the period | 3,713 | 4 | - | - |

| Expired during the period | - | - | - | - |

| Outstanding at the end of the period | 3,808 | - | 2,233 | - |

| Exercisable at the end of the period | - | - | - | - |

* In 2015, the weighted average price of the shares at the option exercise date was PLN 399.40.

Employee programme for key management staff of mBank Group of 2014

On March 31, 2014, the Supervisory Board of the Bank adopted on the basis of recommendation of Remuneration Committee a resolution amending the rules of the employee programme, which replaced the incentive programme for key management staff of mBank Group from 2013, whereas in regard to the persons who acquired bonds or were granted right to acquire bonds in Tranches III, IV, V and VI the programme will be carried out under the previous principles.

The aim of the programme is to ensure growth in the value of the Company's shares by linking the interest of the key management staff of mBank S.A. Group with the interest of the Company and its shareholders and implementing in mBank S.A. Group variable components of remuneration of the persons holding managerial positions at mBank S.A. Group.

Beginning with Tranche VII the right to purchase bonds granted to the entitled person will be divided into four parts, which may be realized respectively: I part – non-deferred bonds representing 50% of the 60% of the amount of discretionary bonus granted for a given financial year in the year of granting the right, and then another three equal parts – deferred bonds constituting 50% of the 40% of the amount of discretionary bonus granted for a given financial year on the lapse of 12, 24 and 36 months from the date of granting the rights, in accordance with the internal regulations adopted in mBank S.A. Group specifying rules of variable remuneration of the employees having a material impact on the risk profile at mBank S.A. Group.

The Bank's Management Board/Supervisory Board of the Company, where the Programme is carried out may take a decision on suspending the Programme in whole or decreasing the number of bonds or the number of bonds deferred in a given tranche for the entitled person in case of occurrence of the situations, referred to in Article 142 (1) of the Banking Law Act, occurrence of balance sheet loss or loss of liquidity, meeting the conditions set forth in the agreements with the program participants, forming the basis for provision of work or other services for the Bank and subsidiaries.

Cash Part of the Bonus

The bonus in the amount of 50% of the base amount for the year is cash payment. It is recognised as a liability to employees and charged to the income statement in the correspondence to the liability to employees.

Share-Based Payments Settled in mBank S.A. Shares

The bonus in the amount of 50% of the base amount constitutes a payment settled in mBank S.A. shares.

The cost of payments settled in shares is recognised in the income statement in the correspondence with other reserve capital.

This is equity-settled share-based program.

On March 2, 2015 the Supervisory Board extended the duration of the program from December 31, 2019 until December 31, 2022 in accordance with the recommendation of the Remuneration Committee.

Employee programmes of mBank Group subsidiaries

Starting from the second quarter of 2014 utill the sale of BRE Ubezpiczenie TUiR SA in the first quarter of 2015, the Group operated an incentive programme, under which the management and employees of BRE Ubezpieczenia TUiR SA were entitled to potential capital gains concerning 4.99% of the shares of this company. The programme met the definition of share-based payment settled in cash. The incentive programme functioning in mBank Hipoteczny is based on phantom shares of this bank and considered as incentive programme under IAS 19.

Summary of the impact of the Programmes on the Bank’s balance sheet and income statement

Share-Based Payments Settled in Shares

The table below presents changes in other reserve capital generated by the above mentioned incentive programmes for share-based payments settled in mBank S.A. shares.

Share-Based Payments Settled in Cash

The incentive programme for the Management Board of the Bank in the part relating to Commerzbank shares has no impact on other reserves as its cost is taken to the income statement in correspondence with liabilities.

The value of provided services associated with this part of the programme amounted to PLN 1,286 thousand in 2015 (December 31, 2014: PLN 3,370 thousand). The value of liabilities under this program amounted to PLN 0 on December 31, 2015 (December 31, 2014: PLN 1,995 thousand).

Cash Payments

On March 2, 2015 Supervisory Board according to the recommendation of the Remuneration Committee extended the duration of the programm from December 31, 2019 to December 31, 2022.

According to the opinion of the Management Board of the Bank, remuneration policy is in line with objectives set within the Group improving the stability of the company and long term growth.

MbO (Management by Objectives) - planning and appraisal system

In the current economic environment, one of the bases for a strong and stable growth as well as a competitive advantage is an effective and efficient Organisation Management System. In 2011, mBank implemented a fully developed, established and, additionally, very flexible System of Management by Objectives (MbO). For a few years now the MbO system has been covering not only mBank employees, but also all the employees of the key subsidiaries of mBank Group, thereby ensuring effective cooperation and communication within the entire mBank Group.

On the basis of more than 5 years of experience, at the end of 2015 the process of setting and cascading objectives for 2016, both in mBank and in selected Group subsidiaries was started — strong emphasis was placed on solidarity and integration objectives as well as those driving cooperation within not only mBank, but also the whole Group. It is a long-term process which will, in effect, provide mBank Group with a lasting competitive advantage and a tool which supports its long-term strategy on an ongoing basis.

The knowledge of strategic goals will allow mBank Group to focus employees' involvement on the most important issues, improving their effectiveness and saving time.

The MbO system has the following functions in the organisation:

- It translates directly into mBank's and mBank Group’s performance by imposing discipline and involving the entire organisation in the achievement of results.

- It forms a direct communication platform which enables sharing information on the role and involvement of an individual employee in developing the organisation and achieving the strategic goals of mBank.

mBank

mBank