DANE FINANSOWE

mBank Group at a glance

Who we are

mBank Group is the fourth largest financial institution in Poland as measured by total assets. We are a truly digital bank focused on offering our clients the best mobile and transactional services backed by an agile bank infrastructure and award-winning traditional internet service and quick and reliable contact center. On the Corporate and Investment Banking side, we are a leader in providing advanced solutions in terms of transactional banking and successfully integrate our traditional lending business with investment banking and specialized services offered by Group subsidiaries. We are present in Poland, Czech Republic and Slovakia.

Our clients:

Retail customers: 5.3 million

Corporate clients: 20.9 thousand

Mobile application users: above 1.3 million

Our employees:

8.4 thousand (6.5 thousand of FTEs)

Key financial data (PLN M)

| 2012 | 2013 | 2014 | 2015 | 2016 | |

| Total assets | 102,145 | 104,283 | 117,986 | 123,523 | 133,744 |

| Net loans | 66,947 | 68,210 | 74,582 | 78,434 | 81,763 |

| Deposits | 57,984 | 61,674 | 72,422 | 81,141 | 91,418 |

| Equity | 9,619 | 10,256 | 11,073 | 12,275 | 13,051 |

| Net interest income | 2,280 | 2,226 | 2,491 | 2,511 | 2,833 |

| Net fees and commissions | 787 | 835 | 902 | 897 | 906 |

| Total income | 3,571 | 3,674 | 3,939 | 4,093 | 4,295 |

| Total costs | -1,661 | -1,678 | -1,771 | -2,053 | -1,963 |

| Loan loss provisions | -447 | -478 | -516 | -421 | -365 |

| Net profit | 1,197 | 1,206 | 1,287 | 1,301 | 1,219 |

| Net interest margin | 2.4% | 2.2% | 2.3% | 2.1% | 2.3% |

| Cost/Income ratio | 46.5% | 45.7% | 44.9% | 50.1% | 45.7% |

| Return on Equity (ROE) | 14.6% | 13.1% | 13.1% | 11.8% | 10.1% |

| Return on Assets (ROA) | 1.23% | 1.14% | 1.13% | 1.04% | 0.95% |

| CET 1 ratio* | 13.0% | 14.2% | 12.2% | 14.3% | 17.3% |

| Total Capital Ratio* | 18.7% | 19.4% | 14.7% | 17.3% | 20.3% |

| Loan/Deposit ratio | 115.5% | 110.6% | 103.0% | 96.7% | 89.4% |

| Employment (FTEs) | 6,138 | 6,073 | 6,318 | 6,540 | 6,528 |

* till March 2014 – Core Tier 1 and Capital Adequacy Ratio

mBank’s ratings

| Fitch | |

| Long-term rating | BBB |

| Short-term rating | F2 |

| Standard & Poor's | |

| Long-term credit rating | BBB |

| Short-term credit rating | A-2 |

Letter of the CEO of mBank

Letter of the President of the Management Board of mBank S.A. to the Shareholders

Dear Shareholders,

For the first time in history, we present the Report of the Management Board on the activity of mBank Group in a new format: as an integrated report. This is our first attempt to face the demanding task of outlining the process of value creation in our institution. The report covers both financial issues and non-financial areas of our activity. It reflects our conviction that the Bank’s success and its financial and business performance depend on the trust of and collaboration with a multitude of stakeholders, mainly including our customers. This thinking underlies our new strategy, which is customer-centric. All that we do is guided by the customers’ needs; customer satisfaction with our products and services is the main pillar of mBank’s further growth.

Despite many challenges in the external environment, 2016 was a very successful year for our Bank, not least in terms of operating results. Net profit attributable to the shareholders of mBank reached PLN 1,219.3 million, representing a decrease of 6.3% year on year; however, the operating profit adjusted for one-off events in 2016 and 2015 improved by 15.6% year on year. This satisfying result was generated under strong pressures exerted on the revenue of financial institutions. Since the Monetary Policy Council cut the reference rate to a historical low of 1.5% in March 2015, the Polish banking sector has taken steps to rebuild the interest margin. Repricing affected mainly the cost of financing while credit margins improved mainly thanks to a shift in the structure of the loan portfolio. It was not easy to improve the net fee and commission income, which was adversely impacted by reduced interchange fees on cashless transactions with payment cards, slowdown in new lending, Recommendation U, and weak capital markets. However, driven by a dynamic growth of business, customer acquisition, as well as steadily rising transactionality, mBank Group generated a historically high core income of PLN 3,793.3 million, with the net interest income growing by 12.8% and the net fee and commission income rising by 1.0%.

An important factor which partly offset the tax on certain financial institutions introduced in February 2016 was a one-off gain on the Visa transaction, which was PLN 251.7 million at mBank. As a result, mBank Group’s total income was close to PLN 4.3 billion, an increase of 4.9% year on year, despite the sale of BRE Ubezpieczenia TUiR to AXA Group and the sale of a stake in PZU in 2015, which translated into gains of PLN 319.3 million. Furthermore, it should be noted that the Polish banking sector paid significant one-off costs last year including an additional payment to the Banking Guarantee Fund at PLN 2.0 billion caused by the bankruptcy of Spółdzielczy Bank Rzemiosła i Rolnictwa w Wołominie, as required to cover guaranteed deposits, as well as a contribution to the Borrower Support Fund equal to PLN 600 million. The total contributions of mBank and mBank Hipoteczny to both funds were PLN 193.8 million. Another bankruptcy took place in the co-operative banking sector in Q4 2016, albeit on a smaller scale; mBank Group’s resulting expense was PLN 10.9 million.

According to reported results, the cost/income ratio was 45.7%; net of positive and negative one- offs, the normalised C/I was 48.2% v. 49.2% a year earlier. High efficiency is a key attribute of our operating model while a structural cost advantage continues to set us apart from other financial institutions in Poland. Recurrent administrative costs including amortisation rose by 5.1% in 2016 to PLN 1,952.3 million. This was mainly driven by continued investments in future growth, development of facilitations for customers, as well as improved security of the Bank’s systems; as a result, IT expenditures grew by close to 23% year on year. mBank Group’s average headcount increased by 78 FTEs in 2016, resulting in an increase of employee expenses by 2.6%.

Prudent risk management, a conservative credit policy, and in-depth sector expertise preventing excessive exposure to any sector in a weaker condition ensure a high quality of our loan portfolio. The cost of risk was 45 basis points in 2016 while net loan loss provisions decreased by 13.3% year on year to PLN 365.4 million. The provisions additionally improved with the sale of corporate and retail impaired receivables. As a result, mBank Group’s NPL ratio decreased to 5.4% at the end of 2016 while the coverage ratio was 57.1%. Furthermore, it should be noted that the strong Swiss franc prevailing since mid-January 2015 did not affect our retail customers’ capacity to pay loan instalments while the continued repayment of the portfolio at ca. 7% per year resulted in a nominal and relative decrease of its share in the balance sheet.

Last but not least, mBank Group’s profitability in 2016 was strongly affected by the tax on certain financial institutions, which reduced the profit by PLN 328.9 million, equivalent to 2.7 percentage points of return on equity. ROE fell to 10.1% versus 11.8% in 2015. However, the ratio should be considered from the perspective of continued improvement of the Bank’s capital base. This approach is grounded in measures taken by the regulator to reinforce the stability of the Polish banking sector and its resilience to shocks. The Polish Financial Supervision Authority (KNF) requires mBank to maintain the highest additional capital requirement for the risk related to FX retail mortgage loans. Following a revision in Autumn 2016, the consolidated additional capital requirement is 3.25 percentage points of TCR (total capital ratio) and 2.44 percentage points of Tier 1 capital ratio. Furthermore, an Other Systemically Important Institution (O-IIS) capital buffer of 0.5% of the total risk exposure was imposed on the Bank in early October 2016. As a result, mBank Group is required to maintain capital ratios of at least 13.19% (Tier 1) and 17.00% (TCR). Even in view of such high requirements imposed by KNF, our capital position is well above the regulatory minimum.

mBank Group’s balance sheet structure improved in 2016. The volume of gross loans, net of the FX effect and reverse repo transactions, increased by 3.1% year to year to PLN 84.6 billion at the end of 2016. New production of non-mortgage loans increased by 26% year on year to a record-high PLN 6.1 billion. Meanwhile, as margins were raised to maintain product profitability, the volume of new mortgage loans decreased by 36%. It should be noted that we completed the transition of mBank Group’s residential mortgages financing model. As of September 2016, after nearly three years of work, each new mortgage loan offered to mBank’s retail customers is booked on the balance sheet of mBank Hipoteczny to build up a pool of collateral for issues of covered bonds. Tranches of these instruments placed on the market in the past years have maturities up to 15 years, largely improving the maturity match of assets and liabilities. Due to a certain slowdown and in the absence of demand in the corporate segment, and in view of the Bank’s policy of non-engagement in unprofitable customer relations, we have partly moved from financing of large corporates to SMEs, where the volume of loans grew by 9.8%.

We continued to develop our deposit base, which stood at PLN 91.4 billion at the end of 2016, rising by 12.7% year on year. The balances of retail customers’ current accounts continued to grow dynamically; combined with balances in savings accounts, they expanded by 17.2% year on year. Importantly, the growth rate was superior to that of customer acquisition; this implies that it was driven by enhanced transactionality, which has always been our goal as we offer the most convenient online and mobile banking systems. These growth rates helped to lower the loan-to-deposit ratio, which stood at 89.4% at the end of 2016 versus 96.7% a year earlier. We have not seen an LtD ratio of this order at mBank for more than 10 years. Speaking of the sources of funding, it is important to mention the EMTN issue of September 2016. After a pause of more than two years, the prices on the international debt market became so attractive for mBank that we issued EUR 500 million of unsecured Eurobonds with a maturity of 4 years and an attractive coupon of 1.398% p.a. We repaid CHF 800 million of borrowings to Commerzbank in 2016.

One of the key features which distinguish mBank from the consolidating Polish market is the ability of organic growth, which we have turned into a major competitive advantage. Our customer acquisition in 2016 was once again more than satisfactory. We added 1,378 companies to our corporate customer database, which stood at 20,940 at the end of 2016. The number of mBank’s retail customers grew by 246 thousand in Poland and 73 thousand in the Czech Republic and Slovakia. We also added 81 thousand accounts to the Orange Finance database. mBank now serves 5,348 thousand customers in three markets. It should also be noted that we have the highest mobile customer penetration rate in the sector. The ratio of active mobile banking users to the number of personal accounts is now close to 40%. The campaign launched in early August targeting young clients (13-24 years) with an offering and communication style developed especially for the target group will certainly give a strong boost to the development of the channel.

On 10 June 2016, the Supervisory Board approved the new “mBank Group Strategy for 2016-2020” entitled “mobile Bank”. The approval of the strategy completed many months of preparatory work including the drafting of the mission, the selection of the pillars of mBank’s activity in the coming years, and the definition of the critical elements and resources necessary to attain the goals. By 2020, our business activity will focus on three strategic areas: empathy, mobility, efficiency. mBank wants to meet the authentic needs of clients in simple and user-friendly ways, generating positive emotions in line with the positioning of the brand. The aspiration is reflected in the new mission, which highlights the focus on providing customers with whatever they need at the right place and time: To help. Not to annoy. To delight... Anywhere.

In view of the dynamic evolution of the regulatory and operating environment of the banking sector, it is a great challenge to define reliable financial targets in a five-year time horizon. As we want to be responsible in defining our aspirations, while a precise indication of financial measures would, under the current circumstances, involve major risks of obsolescence in the coming years, mBank Group’s financial targets are defined in relative terms instead of rigid numbers. We believe that our strengths allow us to generate better financial results than our peers, and we defined out target position along five dimensions. In terms of cost efficiency (Cost/Income ratio) and return on equity (net ROE), we want to be one of top three listed banks in Poland every year. By 2020, we want to reach the podium in terms of return on assets (ROA net). We will maintain a CET1 ratio at least 1.5 percentage points above mBank’s capital requirement, as well as a capacity to pay out a dividend taking into account of the regulatory restrictions. Finally, our loan-to-deposit ratio may be only slightly more than 100%. The “mobile Bank” strategy outlines a vision of mBank Group’s business growth; it is not a closed-ended list of initiatives to take in the next five years as the current pace of change requires us to maintain strategic agility in our approach and action.

The issue of FX mortgage loans remains unresolved. Debates about potential assistance to bank customers who are CHF borrowers have continued for more than two years. We are ready to discuss the economic and social rationale of further assistance measures, which would not endanger the interests of our deposit holders but could support families which repay their own housing at a disproportionate cost. mBank was quick to implement just such solutions: our customers may have the crediting period extended, some of the instalments suspended, the FX spread reduced, the loan converted into PLN at NBP’s average exchange rate at no extra fee. I can assure you that the repayment rate of our FX loan portfolio remains very strong.

The composition of mBank Group changed in 2016. On 20 May 2016, we formally closed the integration of Dom Maklerski mBanku and mWealth Management into the organisation of mBank. The goal of the integration of the brokerage, private banking and wealth management services were to create a comprehensive investment offer under one brand, targeting the most demanding institutional and private clients, and to combine the competences and experience of our experts to better address customers’ needs. mLeasing closed its product gap by adding innovative solutions and developing competences in retail customer service; mKsięgowość – the accounting service for micro-firms was integrated with the bank account service; and SMEs were offered fixed-rate loans.

In the non-financial part of the report, we describe our achievements, goals, risks and opportunities in the CSR area with regard to the five key areas identified in the CSR Strategy of mBank for 2016- 2020. These are: building a stable and long-lasting relationships with clients, conducting socially responsible lending policies, creating a unique team, reducing the so-called environmental footprint of the bank and the improvement of the mechanisms of responsible management in the organization.

Among the CSR activities undertaken in 2016, I would like to pay special attention to the continuation of the first social campaign promoting online security, launched in 2015. We also conducted a process of simplifying credit agreements, and mBank Foundation carried out a number of educational activities. In addition, in 2016 we launched a deaf customer service, introducing into our transactional service an online video-chat with a bank expert who knows the Polish sign language or using translation services available in every bank’s outlet.

To summarise, despite many adverse developments in the external environment which financial institutions still face in 2017, including the banking tax, more restrictive capital requirements, the impact of recommendations published by the Financial Stability Committee in January, amended rules of calculation of BFG contributions, as well as further proposals intended to limit the space for banks to charge fees and commissions, I am certain that mBank Group’s business performance, which is a function of our relations with customers, will continue to improve. We have the qualities which ensure continued expansion in the strategic segments whatever the circumstances. Our competences, experience, professionalism, and state-of-the-art offer based on advanced technological solutions help us to efficiently acquire new customers and provide them with top quality service, resulting in a steady growth of revenue.

May I thank you, our Shareholders, for your unwavering trust, and assure you that we will continue to deliver satisfying returns based on the strong foundations of our business model.

I thank the Supervisory Board for their close co-operation and reliable support.

I also wish to thank our employees, whose continued engagement contributed to mBank Group’s success last year. I do believe that we are well prepared to leverage our competitive advantages and successfully meet the challenging market situation in 2017.

Yours faithfully,

Cezary Stypułkowski

Executive summary

2016 was marked by surprising political developments and a number of changes. These include: the result of the US election and the Brexit referendum, the alleviation of concerns about growing deflation trends in many economies and recovered hopes for quick growth in the global economy.

Poland’s economy reported a slowdown. According to the initial data, GDP rose by 2.8% in 2016, which is well below expectations from the beginning of the year. Private consumption replaced investment as the main driver of economic growth. Upswing in private consumption is attributable to surging real wages, 500+ programme benefits and further improvement in the household sentiment, which is currently at a record-high level. Investment expenditure plummeted as a result of a great many factors. These include exhaustion of funds from the EU’s previous budget and a delay in the preparation of new projects, which led to an investment gap, visible especially in the activity of local governments and railway companies. This also led to a drop in private investments, additionally stimulated by the growing uncertainty about the tax and regulatory environment and prospects for the global economy.

The unfavourable market environment caused by the economic slowdown, financial market turbulence, continued low interest rates as well as regulatory and tax changes (e.g. introduction of a new tax on assets of financial institutions) made 2016 a difficult period for Polish banks. Since the Polish Monetary Policy Council cut the reference rate to a historical low of 1.5% in March 2015, the Polish banking sector has taken steps to rebuild the interest margin. Repricing affected mainly the cost of financing while credit margins improved mainly thanks to a shift in the structure of the loan portfolio. The net fee and commission income continued to be adversely impacted by reduced interchange fees on cashless transactions with payment cards, slowdown in new lending, Recommendation U, and weak capital markets. An important factor that partly offset the tax on certain financial institutions introduced in February 2016 was a one-off gain on the Visa transaction, which pushed up banks’ income in June 2016. In the discussed period (PFSA data), the banking sector reported a 24.3% year-on-year increase in its total net profit.

For mBank Group, despite a challenging market environment, 2016 was another good year marked by business growth across segments. As a result of growing income, profit before tax went up compared with 2015. However, a higher tax rate led to a lower net profit.

The key events of 2016 include:

- Growth in the profit before tax of mBank Group by 1.2% to PLN 1,637.7 million compared with 2015. Drop in the net profit by 6.3% to PLN 1,219.3 million.

- Increase in income by 4.9% year on year, mainly thanks to the record-high core income and the posting of proceeds from the takeover of Visa Europe by Visa Inc.

- Drop in operating costs by 4.3%, which had a positive impact on the effectiveness measured with the cost / income ratio. It stood at 45.7% compared with 50.1% in 2015.

- Rising volumes:

- Increase in gross loans by 3.9% year on year. Net of reverse repo/buy sell back transactions and the FX effect, gross loans increased by 3.1% compared to 2015.

- Considerable rise in amounts due to customers (by 12.7% year on year), due to growth in the deposit base of both retail and corporate clients.

- Retail lending expansion reflected in record-high sale of non-mortgage loans – PLN 6.1 billion of new loans sold.

- As a result of rapid growth of deposits, record-breaking reduction of the loan to deposit ratio to 89.4%.

- Further improvement in the quality of assets, with a significantly lower cost of risk (46 bps) compared with 2015.

- High quality of capital base - capital ratios surpassing regulatory requirements: CET 1 ratio at 17.3%, Total Capital Ratio at 20.3%.

- Accelerating client acquisition – in 2016, 400.5 thousand retail and 1,378 corporate clients were acquired.

- Strengthening the position of a mobile and transactional bank with more than 1.3 million users of mBank’s mobile banking.

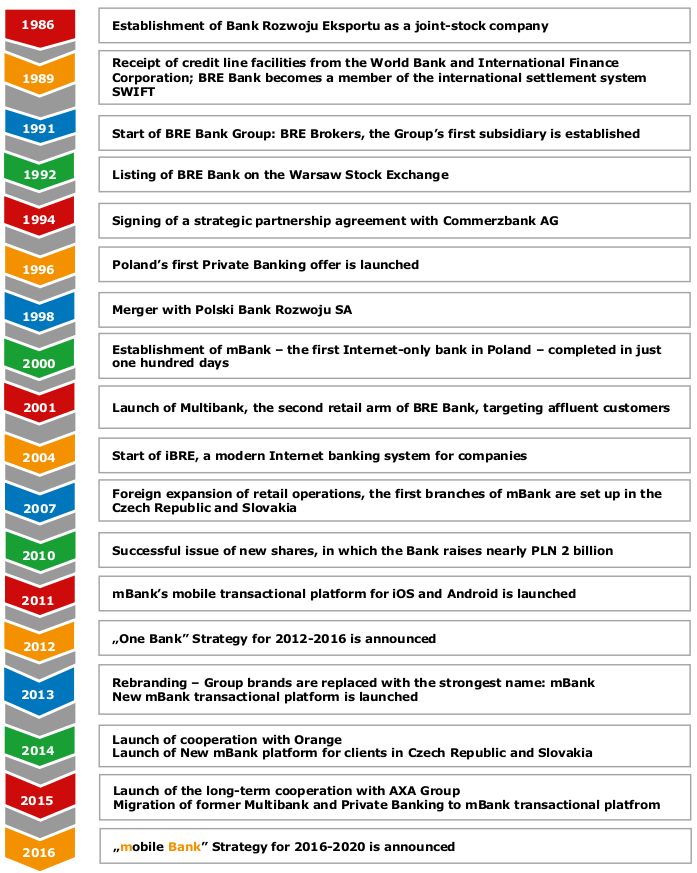

History of mBank Group

mBank Group’s business model in a snapshot

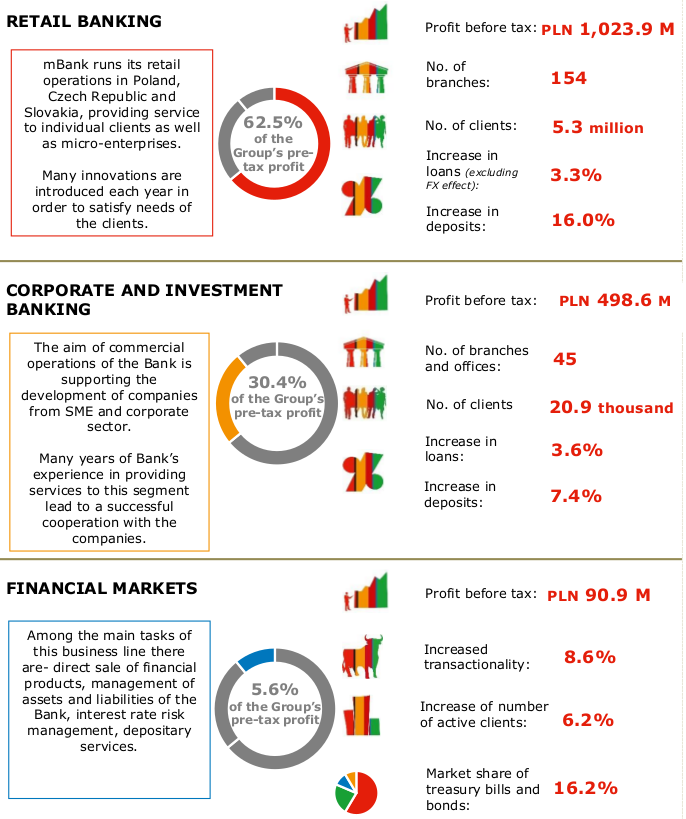

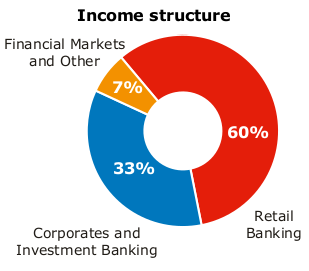

[G4-4, G4-6, G4-8] mBank Group is the fourth largest financial institution, measured by total assets, in Poland, providing retail, corporate and investment banking as well as other financial services, including leasing, factoring, commercial real estate financing, brokerage, wealth management, corporate finance and capital markets advisory.

Historically, mBank developed its operations from corporate banking, which has always been its strength. Since its establishment in 1986 the Bank has served some of Poland’s largest companies involved in foreign trade on export markets. A longstanding experience in corporate banking services set the stage for the Bank’s further expansion into the small and medium-sized corporate client segment.

In 2000, mBank started its retail operations by launching a fully Internet-based bank in Poland. It was a pioneering project in the local market, based on the Internet, direct service through call centre, and later on mobile banking and also other new technology-based solutions. In 2001, mBank also launched a high street brick-and-mortar bank, offering a broad range of products and services targeted at affluent customers and micro-businesses seeking an access to high quality, personalised service at branches.

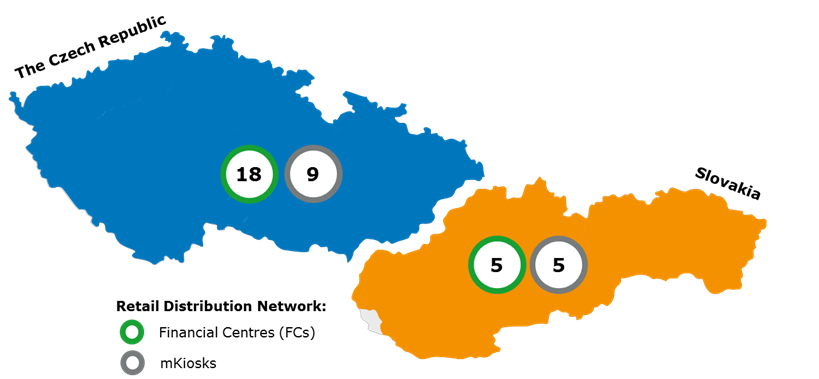

mBank is the only Polish bank with a successful track record of rolling out its domestic business model into foreign markets. In 2007, mBank launched retail operations in the Czech Republic and Slovakia, focusing initially on transactional banking and deposit products and further expanding into mortgage and consumer loans as the bank has been able to establish and develop strong client relationships. The Bank also offers to its Czech and Slovak clients a convenient mobile application.

As a result, the Bank’s client base has grown almost entirely organically, reaching 5,348 thousand retail clients and 20,940 corporate customers at the end of 2016.

Over the past few years, mBank has strengthened its client-oriented approach and has been pursuing a stable, focused strategy as a modern and innovative transactional bank providing an integrated range of multiple products and services meeting the needs of its clients. In 2013, mBank launched a reinvented, modern, convenient, easily accessible and user-friendly Internet platform (New mBank) with more than 200 new features, which won global recognition for innovation in banking taking home many international awards. The bank has been also systematically expanding its mobile application to provide the customers with the ability to manage their finances wherever they are.

mBank’s widely recognised operational excellence is based on its state-of-the-art user interface for online banking, next-generation mobile applications, video banking and P2P payments via Facebook and text messaging, and real-time, event-driven customer relationship management (CRM) based on client behaviour patterns. The whole product offer is centred around the current account with a broad spectrum of financial services accessible in just “one click”, as the aim is to be the most convenient transactional bank on the market.

In the corporate and investment banking area, mBank’s offer for business clients include a range of fully integrated commercial banking products, services and solutions, with particular emphasis on the advanced transactional banking platform. This comprehensive product offering is complemented by investment banking services, such as ECM, DCM and M&A advisory services.

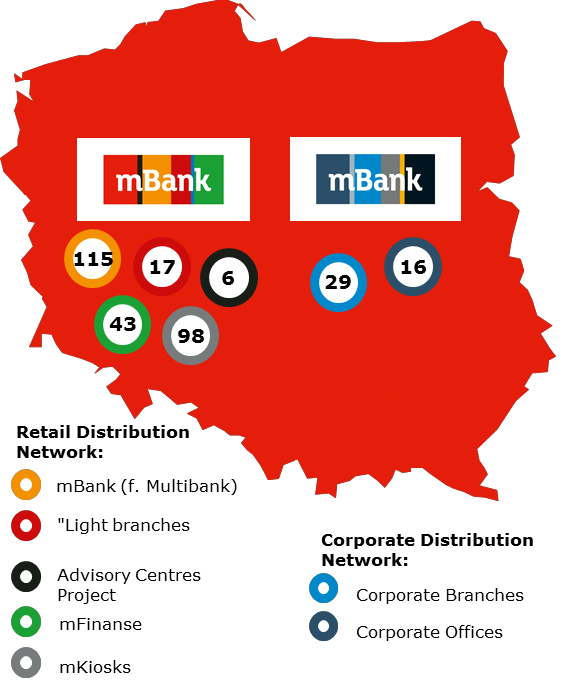

mBank’s distribution concept combines the most technologically advanced solutions adapted for the Polish banking market as well as current and future operating environment. It has been primarily based on Internet and mobile-based tools, tailored separately to the needs of both retail and corporate clients, and a mid-sized physical distribution network, offering premium service quality, located throughout Poland.

With its proven ability in achieving the communicated targets, mBank is well positioned to continue its successful business growth in selected client segments through exploiting attractive market opportunities. The IT platform architecture allows the Bank to develop and introduce new products, services and sales channels rapidly, efficiently and with a low operational risk. Thanks to such a flexible infrastructure, mBank is able to manage its business expansion strategy.

[G4-15] Voluntarily endorsed external codes:

- Best Practice of GPW Listed Companies;

- Code of Banking Ethics (Principles of Good Banking Practice);

- UN Global Compact;

- Corporate Governance Principles for Supervised Institutions.

[G4-16] Organisations in whose operations mBank engaged:

- Dolnośląska Izba Gospodarcza;

- Francusko-Polska Izba Gospodarcza;

- ICC Polska;

- Izba Przemysłowo Handlowa w Toruniu;

- Izba Przemysłowo Handlowa Ziemi Radomskiej;

- Lubelski Klub Biznesu Stowarzyszenie;

- Lubelskie Towarzystwo Naukowe;

- Organizacja Pracodawców Ziemi Lubuskiej;

- Polski Komitet Użytkowników SWIFT;

- Polskie Stowarzyszenie Inwestorów Kapitałowych;

- Polsko-Niemiecka Izba Przemysłowo Handlowa;

- Polsko-Szwajcarska Izba Przemysłowo Handlowa;

- Północna Izba Gospodarcza;

- Regionalna Izba Przemysłowo Handlowa w Gliwicach;

- Sądecka Izba Gospodarcza;

- SEPA – ZBP;

- Starogardzko Klub Biznesu;

- Stowarzyszenie Polsko-Niemieckie Koło Gosp. w Poznaniu;

- Wielkopolska Izba Przemysłowo Handlowa;

- Wielkopolski Związek Pracodawców Prywatnych;

- Zachodnia Izba Gospodarcza;

- ZBP - Rada ds. Zarządzania Środkami Finansowymi;

- Związek Pracodawców Forum Okrętowe.

Every business model, also in banking, is based on engaging capital: financial, human, organisational, intellectual, social and natural. The business activity and day-to-day decisions transform them. It is easiest for us to describe and measure the financial capital as it is the foundation of the traditional reporting. However, we cannot forget about the fact that our activities transform the rest of capitals, causing their increase or decline.

The diagram below shows our most important capitals and the value creation process at mBank Group.

| Basing on our capitals... |

we develop our business... |

…creating value for all our stakeholders. |

||

|

|

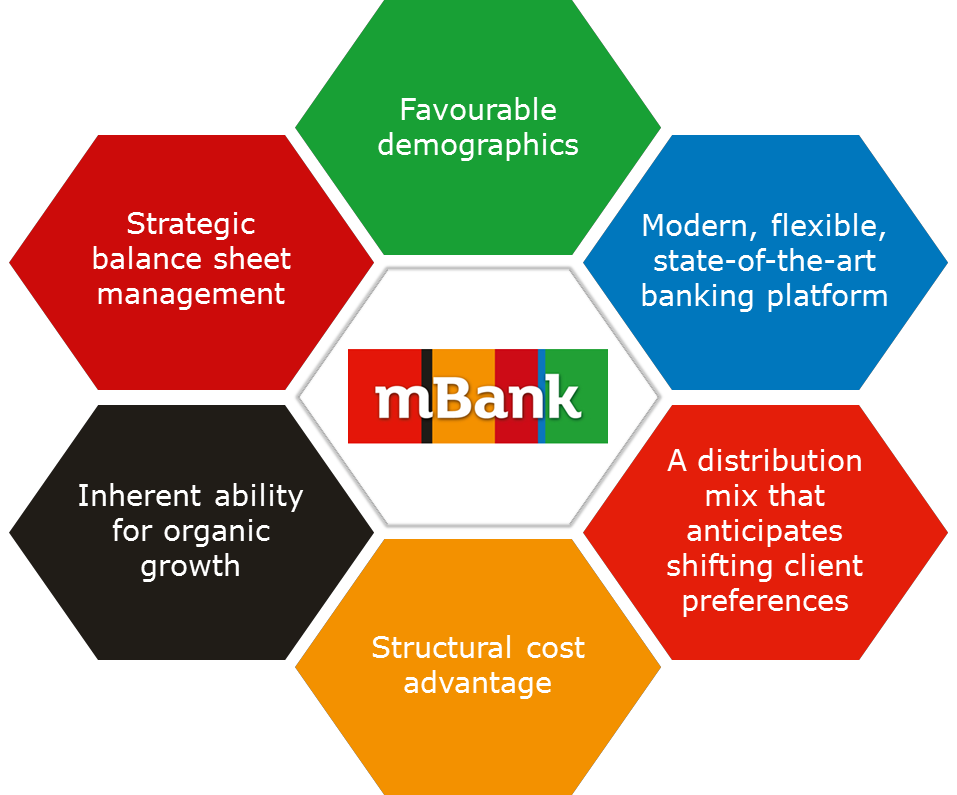

mBank Group’s strategic advantages

Over the past years we developed a range of competitive strengths, which enable our organisation to take advantage of growth opportunities and successfully achieve its strategic objectives. Our strengths include:

- favourable demographics,

- modern, flexible, state-of-the-art banking platform,

- a distribution mix that anticipates shifting client preferences,

- structural cost advantage,

- inherent ability for organic growth,

- strategic balance sheet management,

- strong, unified brand, associated with internet and mobile banking,

- technological and project agility, proved in fast implementation of complex business projects,

- strong market presence and trust of corporate clients, including leading position in transactional banking offer as well as successful integration of traditional corporate banking with the investment banking offering,

- engaged staff (engagement score above 50%),

- experience built on the strategic co-operation with the business partners outside of the banking sector (Orange, Axa).

The key factors are illustrated and described below:

Favourable demographics

mBank’s unique value proposition in the retail banking segment, anchored in an attractive and forefront business model, has been developed to target young, aspiring and tech-savvy clients, who quickly adapt innovative solutions. Consequently, mBank’s customer base has an advantageous demographic profile as compared to the Polish market.

A half of the Bank’s retail clients are under the age of 35 and are expected to reach their highest personal income levels in the coming years, positioning mBank to reap the benefits from additional cross-selling opportunities of banking and insurance products. Maturing of the customer base provides a natural source for revenue growth as well as supports the asset quality of the Group and the responsiveness of its clients to cross-selling initiatives.

Modern, flexible, state-of-the-art banking platform

Anticipating the development and increasing accessibility of the Internet, already since 2001, mBank has applied and promoted a modern and highly convenient retail banking model based on the Internet and other new technologically advanced solutions. As a result, the Bank is uniquely positioned in the market to offer a wide range of innovative products and services, meeting the changing needs of its target clients.

mBank, as a global innovator in banking, has been constantly improving its Internet and mobile transaction systems. In 2013, a re-developed, modern, intuitive, easily accessible and user-friendly Internet platform (New mBank) with more than 200 new features and improvements was launched. Implemented solutions have been delivering higher client acquisition and transactionality. A flexibility of the mBank’s platform to expand or roll-out new strategic ventures is an additional advantage (e.g. an offering for the customers of Orange Finanse). At the same time, the Bank has been continuously enhancing its mobile application, providing the customers with even more convenient way to manage their finances wherever they are.

A distribution mix that anticipates shifting client preferences

Given its multi-channel approach, which has been designed to anticipate and follow the changing needs of clients, mBank’s current sales mix is already ahead of what is expected to be the pattern of distribution prevailing in the banking sector in the coming years. Internet, mobile, video and call centre channels are rapidly gaining importance as demonstrated by the sales levels of various banking products generated by these channels as compared to traditional branches.

In particular, a half of current accounts and more than 2/3 of saving products are sold through mBank’s Internet platform. In addition, a dynamically growing number of banking activities has been performed through mBank’s mobile application, of which checking the balance of current account and making transfers are the most popular. Such a sales mix guarantees no need for painful structural adjustments in the near future. Moreover, as the Bank promotes a self-service model in which retail customers operate their accounts predominantly via remote channels, it gains an opportunity to proactively use modern real time marketing and cross-sell more products.

Structural cost advantage

Heavy investments in the Internet and mobile transaction platforms along with maintaining a light and efficient branch infrastructure result in a lower overall cost base and a high degree of operating flexibility for mBank. The Group’s competitive advantage stemming from its business model manifests itself in superior efficiency metrics compared to other Polish banks. Based on such ratios as cost to income, cost to average assets or gross loans to number of branches, mBank ranks among the top in all three categories when compared to the major Polish banks. mBank operates through the optimal number of branches, what implies no need to carry out a restructuring of its physical distribution network resulting in the branch closures.

Inherent ability for organic growth

mBank is the largest organically developed retail banking franchise in the CEE region. In contrast to most financial services groups in Poland, mBank has not grown through any significant mergers and acquisitions, proving its strong ability to constantly attract new customers in the three countries. The Group’s retail client base in Poland, the Czech Republic and Slovakia has grown solely organically by 395.9 thousand and 400.5 thousand in 2015 and 2016, respectively, reaching in total 5,348 thousand retail customers.

Strategic balance sheet management

Due to its continued focus on diversified, long-term and attractively priced funding, mBank Group managed to improve its liquidity profile, as demonstrated by gradually declining loan to deposit ratio, which reached 89.4% at the end of 2016.

On the asset side, development of balance sheet benefits from the phasing out of the legacy CHF- denominated mortgage loan portfolio and the intended expansion of higher margin lending products, such as retail consumer loans (predominantly cross-selling of non-mortgage loans to existing current account customers), PLN-denominated mortgage loans and SME loans. On the liabilities side, mBank is focused on ensuring a stable and adequate deposit base by leveraging the higher sight deposit volume as a primary banking relationship for majority of its retail clients.

Strengthening of balance sheet funding quality is also supported by issuances of senior unsecured and subordinated bonds in domestic and international markets. Moreover, mBank Hipoteczny maintains a leadership position on the Poland’s covered bond market, adding to the Group’s long-term financing sources. Issues of these instruments, performed both in EUR and PLN, not only help to cut the funding costs, but also better match the maturity of assets and liabilities as well as their currency structure.

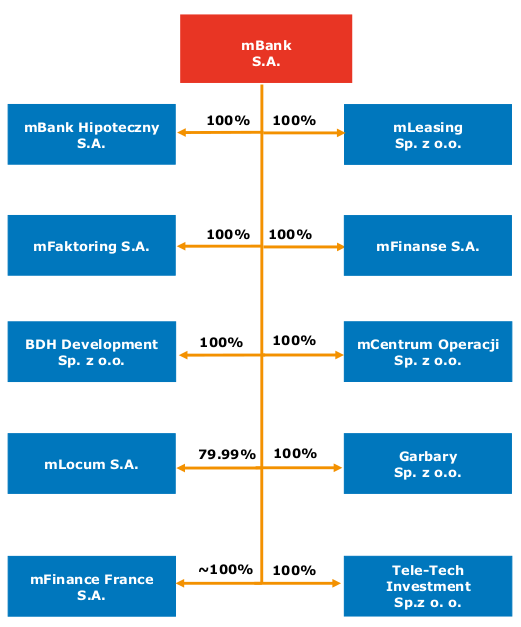

Composition of mBank Group

Composition of mBank Group and main activities areas

[G4-13] Year 2016 was marked by further changes in the structure of mBank Group. In May 2016 the integration of the brokerage operations of mBank, Dom Maklerski mBanku (mDM) and mWealth Management (mWm) into an expanded brokerage bureau of mBank was completed. The aim of the integration of all brokerage entities of mBank Group is to optimise the portfolio of brokerage services offered to all client groups, both individuals and institutions. Moreover, the integration will allow the Bank to better use its resources and potential, thus giving the brokerage services of mBank Group a greater competitive advantage. In order of integration, mDM and mWM were divided and on May 20, 2016, the companies were struck off the National Court Register.

Additionally, on September 30, 2016, Aspiro – a company providing financial services - changed its name to mFinanse. The change resulted from the Group’s strategy, according to which all subsidiaries within mBank Group use the prefix „m” in the name.

Consequently, mBank Group (consolidated subsidiaries) as at the end of 2016 was composed as presented on the diagram below.

[G4-8] In view of the above, at the end of 2016 the division of the operations of mBank Group into segments and business areas was the following:

Composition of mBank Group

| Segment | Retail Banking | Corporates and Financial Markets | |

| Corporate and Investment Banking | Financial Markets | ||

| Bank |

|

|

|

| Consolidated subsidiaries |

|

|

|

Other subsidiaries |

|

||

Subsidiaries of mBank Group

mBank Hipoteczny (mBH) is the largest mortgage bank in Poland by both the scale of financing of the real property market and covered bond issuance.

mBH finances commercial investments on the real property market, including office buildings, commercial centres and facilities, hotels, warehouses, logistics centres, housing estates. Another important area of mBH’s operation is lending to the public sector in the area of municipal investments and real properties of local government units.

At the beginning of September 2016 mBank Hipoteczny ultimately became the only provider of housing loans to individuals in Poland in mBank Group. This decision is an effect of the transformation of the Group’s approach to funding mortgage loans started in 2013. Lending in the retail area is now financed by the issuance of covered bonds, which increase the share of long-term liabilities in the balance sheet with every issued tranche.

The subsidiary is the largest issuer of covered bonds, which are its core source of funding. The covered bonds issued by mBH rank among the safest investment instruments on the Polish capital market. The value of outstanding covered bonds issued by mBH reached nearly PLN 4.6 billion, representing a market share of 50.2%.

In addition to its lending activity, mBH offers also market analyses and advisory services addressed to investors and entities active on the commercial real property market.

According to Fitch Ratings, mBH’s long-term and short-term ratings are “BBB” and “F2”, respectively. The mortgage covered bonds issued by mBH are rated “A”. For more information about mBH’s ratings, see later in the chapter.

Until September 30, 2016, the company operated under the name Aspiro. The change of its name resulted from the Group’s strategy, according to which all subsidiaries within mBank Group use the prefix “m” in the name.

mFinanse is a financial services intermediary operating as an open platform for selling financial products of various institutions including mBank. Its product offer includes loans, accounts, insurance as well as investment and savings products for both individuals and companies. The subsidiary offers the products of 19 financial entities, in more than 100 outlets across Poland with the participation of 600 customer advisors.

mLeasing is one of the largest leasing companies in Poland and ranks third on the real property leasing market and third on the leasing market.

The subsidiary offers lease financing, loans, and car fleet rental and management services addressed to both corporate and retail clients.

In the corporate segment mLeasing offers various types of leasing products, including lease of private and commercial cars and heavy transport vehicles, car fleet management, lease of machines and equipment, and real property lease.

In the retail segment the subsidiary operates the “Leasing in Retail” programme addressed to micro- enterprises and SMEs, which are offered lease contracts using dedicated lease processes.

mFaktoring is the eight largest player on the Polish factoring market among the members of the Polish Factors Association.

The services provided by mFaktoring are complementary to mBank’s corporate offer. mFaktoring offers the financing of ongoing business operations, receivables management, credit protection, maintenance of debtors’ settlement accounts and enforcement of receivables. In addition, the offer includes domestic and export factoring with recourse and credit protection, as well as import guarantees.

Products offered by mFaktoring are available in all mBank branches providing services to SMEs and corporations in Poland.

mCentrum Operacji (mCO) provides back-office support to the members of mBank Group.

In particular, the subsidiary handles the instructions and applications of retail and corporate clients of mBank Group. In addition, mCO supports the Group in terms of professional data archiving solutions, both electronic and paper-based.

The company’s services enable monitoring of data security and confidentiality, quick access to information, as well as support in planning, controlling and reducing costs. This ensures the timeliness and quality of services, which translates into an increase in the efficiency of customer service processes.

mLocum S.A. is an experienced and active real property developer that has been present on the real property market since 2000. It is one of the first real property developers in Poland having a presence on many local markets, including Kraków, Łódź, Wrocław, Warsaw, Poznań and Sopot.

The subsidiary organises and manages housing development projects. Other activities of the subsidiary include management of real properties, including condominiums.

So far, mLocum has built more than 4.3 thousand apartments in 34 projects. The company is an active member of the Polish Association of Developers for the largest estate companies advancing the Polish housing industry.

mBank’s Authorities

Supervisory Board of mBank

As of December 31, 2016, the Supervisory Board of mBank was composed as follows:

- Maciej Leśny – Chairman of the Supervisory Board

- Stephan Engels – Deputy Chairman of the Supervisory Board

- Andre Carls – Member of the Supervisory Board

- Marcus Chromik – Member of the Supervisory Board

- Jörg Hessenmüller – Member of the Supervisory Board

- Thorsten Kanzler – Member of the Supervisory Board

- Michael Mandel – Member of the Supervisory Board

- Teresa Mokrysz – Member of the Supervisory Board

- Agnieszka Słomka-Gołębiowska – Member of the Supervisory Board

- Waldemar Stawski – Member of the Supervisory Board

- Wiesław Thor – Member of the Supervisory Board

- Marek Wierzbowski – Member of the Supervisory Board

The five independent members of the Supervisory Board are: Maciej Leśny, Teresa Mokrysz, Agnieszka Słomka-Gołębiowska, Waldemar Stawski and Marek Wierzbowski.

Detailed résumés of all members of mBank authorities are available on https://www.mbank.pl/en/about-us/bank-authorities/.

Management Board of mBank

As of December 31, 2016, the Management Board of mBank was composed as follows:

- Cezary Stypułkowski – President of the Management Board, Chief Executive Officer

- Przemysław Gdański – Vice-President of the Management Board, Head of Corporate and Investment Banking

- Christoph Heins – Vice-President of the Management Board, Chief Financial Officer

- Lidia Jabłonowska-Luba – Vice-President of the Management Board, Chief Risk Officer

- Hans-Dieter Kemler – Vice-President of the Management Board, Head of Financial Markets

- Cezary Kocik – Vice-President of the Management Board, Head of Retail Banking

- Jarosław Mastalerz – Vice-President of the Management Board, Head of Operations and Information Technology.

Detailed résumés of all members of mBank authorities are available on https://www.mbank.pl/en/about-us/bank-authorities/.

For more information on changes in the Management Board and Supervisory Board of mBank, see chapter 8. Statement of mBank S.A. on application of Corporate Governance principles in 2016.

mBank Group geographical presence

[G4-6] mBank Group operates successfully not only in Poland, but also in the Czech Republic and Slovakia.

In Poland, retail distribution network consists of 279 branches. Corporate distribution network amounts to 29 corporate branches and 16 corporate offices.

In the Czech Republic, retail distribution network consists of 18 financial centres and 19 mKiosks. In Slovakia there are 4 financial centres, 5 mKiosks and 1 light branch in Bratislava.

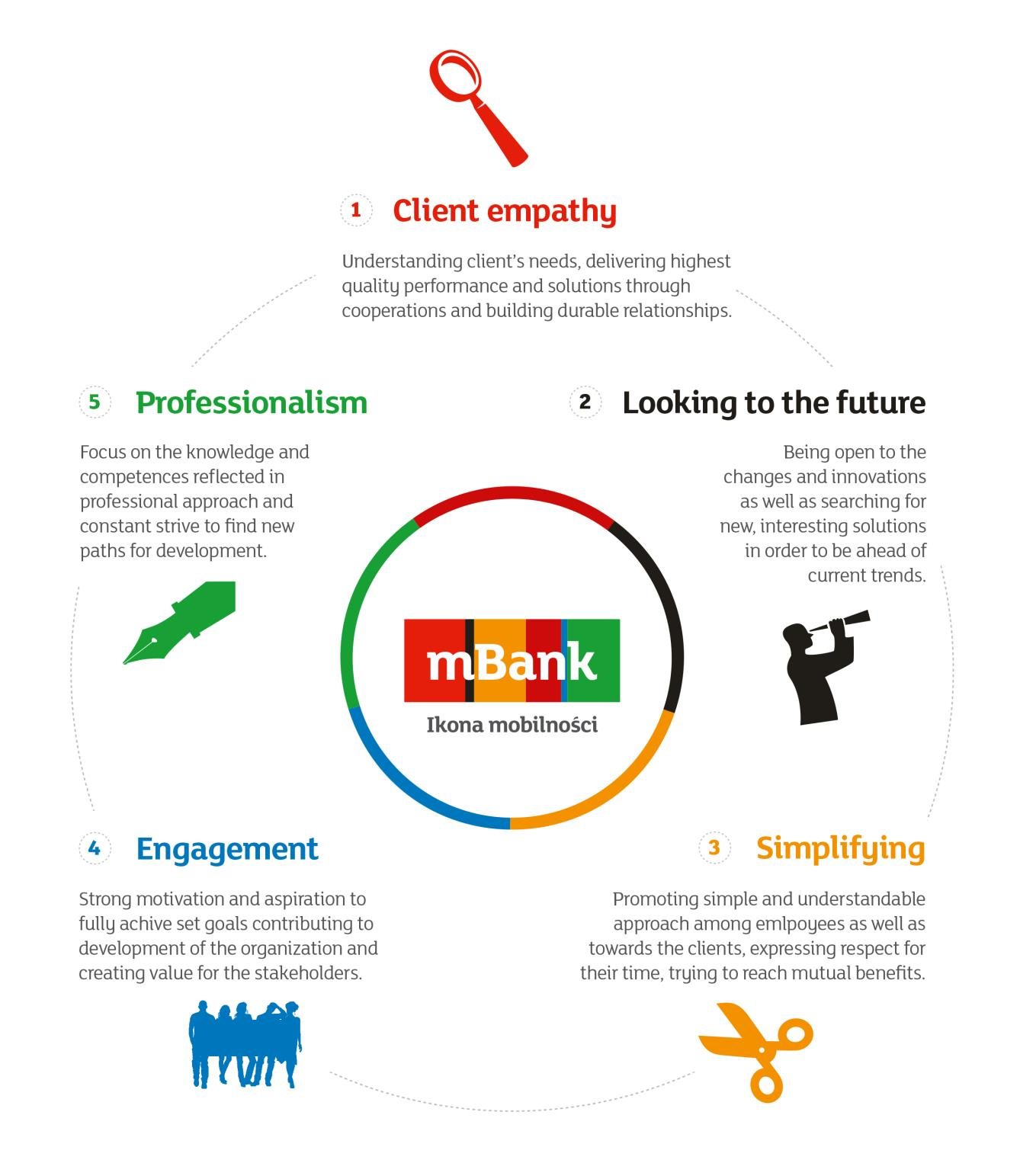

Model of values and behaviour

[G4-56] The model of behaviour provides answers to questions related to the practical significance of our values. What actions and attitudes does the management board expect from the employees and what do they expect from one another? We aim at making decisions which are consistent with our values. It is not only what we do that counts – how we do it is important too. In our daily work, the values are a compass indicating each and every one of us the direction in which we should be heading.

For more information on our model of values and behaviour see chapter 7. Responsible company.

Stakeholders

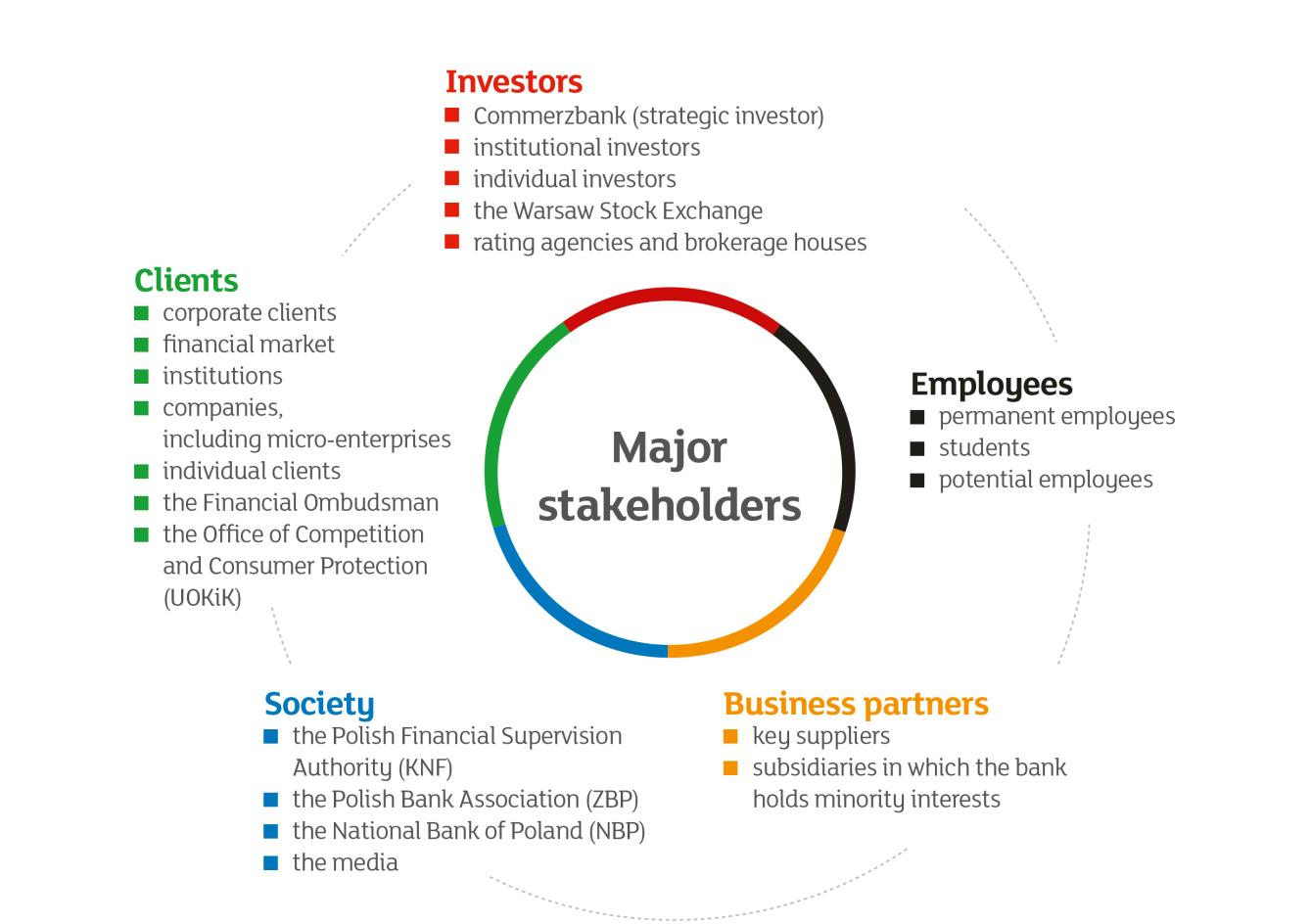

[G4-26] The identification and assessment of stakeholders conducted in mid-2015 revealed the major stakeholders in the largest categories. These are:

For more information on the stakeholders see chapter 9. About the report.

mBank

mBank